Understanding the Cost Structure of Coffee Production

Dive into the intricate landscape of coffee production costs, understanding why knowing the coffee cost structure is vital for farmers and investors alike. This article demystifies the economic factors that shape coffee pricing while providing practical insights into managing costs effectively. Learn about the fixed and variable expenses that significantly impact profitability and discover essential tools for market analysis. With a focus on sustainability and future trends empowered by technology, this guide is perfect for new farmers eager to make their mark in the coffee industry. Join us as we explore the economic underpinnings of this global commodity, arming you with knowledge to thrive in the coffee business.

Introduction

Coffee, the aromatic elixir that fuels millions of people worldwide, is more than just a beloved beverage; it's a global economic powerhouse. As the second most traded commodity after oil, coffee plays a pivotal role in the economies of numerous countries, particularly in developing regions. The coffee industry's intricate supply chain, from seed to cup, involves a complex web of farmers, processors, exporters, roasters, and retailers, each contributing to the final product that graces our mugs every morning.

The purpose of this article is to delve deep into the cost structure of coffee production, providing a comprehensive understanding of the economic factors that shape this industry. By exploring the various components that contribute to the cost of producing coffee, we aim to equip farmers, investors, and consumers with valuable insights into the challenges and opportunities within this dynamic sector. Understanding these costs is crucial for making informed decisions, whether you're a small-scale farmer looking to optimize your operations, an investor considering entering the coffee market, or a conscious consumer interested in the journey of your daily brew.

Section 1: The Basics of Coffee Production

1.1 What is Coffee Production?

Coffee production is a meticulous process that transforms a humble cherry into the beans we know and love. It begins with the cultivation of coffee plants, typically Coffea arabica or Coffea canephora (robusta), in suitable climates around the world's "Coffee Belt" – regions between the Tropics of Cancer and Capricorn. These plants require specific conditions to thrive, including appropriate altitude, temperature, rainfall, and soil composition.

The journey from seed to harvest is a labor-intensive process that spans several years. Coffee seedlings are nurtured in nurseries for several months before being transplanted to fields. It takes approximately three to four years for a coffee plant to bear fruit, known as coffee cherries. Once the cherries ripen to a vibrant red (or yellow for some varieties), they are ready for harvest.

Harvesting methods vary, with some regions employing selective picking – where only ripe cherries are handpicked – while others use strip picking or mechanical harvesting for efficiency. After harvesting, the cherries undergo processing to extract the beans. This can be done through the dry method (natural processing) where cherries are dried in the sun, or the wet method (washed processing) which involves removing the pulp before drying.

The dried beans, now called green coffee, are then sorted, graded, and prepared for export. This entire process, from planting to export-ready beans, typically spans 5-7 years for new farms, highlighting the significant time investment required in coffee production.

1.2 Importance of Understanding Cost Structure

Grasping the intricacies of the cost structure in coffee production is not just an academic exercise; it's a critical component for the success and sustainability of coffee farming operations. For farmers, a thorough understanding of costs allows for more effective budgeting, resource allocation, and strategic planning. It enables them to identify areas where efficiency can be improved, costs can be reduced, and profitability can be enhanced.

Moreover, in an industry subject to significant price volatility, understanding cost structures helps farmers make informed decisions about when to invest in expansion, when to hold back, and how to price their product competitively while maintaining profitability. This knowledge is particularly crucial in times of market downturns, helping farmers weather economic storms by adjusting their operations based on a clear understanding of their cost base.

For investors and industry stakeholders, comprehending the cost structure provides insights into the overall health and potential of the coffee sector. It aids in assessing the viability of coffee farming projects, understanding the challenges faced by producers, and identifying opportunities for innovation and support within the industry.

Consumers, too, benefit from this knowledge. As the demand for transparency in supply chains grows, understanding production costs helps consumers appreciate the true value of their coffee and make more informed purchasing decisions, potentially supporting fair prices for producers.

In essence, the cost structure of coffee production is the backbone of the industry's economics. It influences everything from farm-level decisions to global market trends, making its understanding indispensable for anyone involved in or interested in the coffee sector.

Section 2: The Cost Structure of Coffee Production

2.1 Fixed and Variable Costs

2.1.1 Definition and Examples

In coffee production, as in any agricultural endeavor, costs are typically categorized into fixed and variable expenses. This distinction is crucial for understanding the economic dynamics of coffee farming and for making informed financial decisions.

Fixed costs are expenses that remain constant regardless of the production volume. In coffee farming, these include:

- Land acquisition or lease: The cost of purchasing or renting the land for coffee cultivation.

- Infrastructure: Initial investments in buildings, processing facilities, and storage units.

- Equipment: Large machinery such as tractors, processing equipment, and irrigation systems.

- Permanent plantings: The initial cost of establishing coffee trees, which is amortized over their productive lifespan.

- Certifications: Costs associated with obtaining and maintaining organic, fair trade, or other certifications.

These fixed costs represent significant upfront investments and ongoing expenses that coffee farmers must bear regardless of their annual yield or market conditions.

Variable costs, on the other hand, fluctuate with production levels. In coffee farming, these include:

- Labor: Wages for seasonal workers during planting, maintenance, and harvesting periods.

- Inputs: Fertilizers, pesticides, and other agrochemicals used in cultivation.

- Fuel and energy: Costs associated with operating machinery and processing equipment.

- Packaging materials: Bags and containers for storing and transporting harvested coffee.

- Transportation: Expenses related to moving coffee from the farm to processing facilities or markets.

Variable costs provide more flexibility for farmers to adjust their expenses based on production needs and market conditions.

2.1.2 Impact on Overall Expenses

The interplay between fixed and variable costs significantly impacts overall expenses and, consequently, the profitability of coffee farms. Fixed costs create a financial baseline that farmers must meet regardless of their production output or market prices. This can be particularly challenging for small-scale farmers who may struggle to absorb these costs during years of low yield or depressed coffee prices.

The ratio of fixed to variable costs can vary widely depending on the size and type of coffee operation. Large, mechanized farms may have higher fixed costs due to significant investments in land and equipment but potentially lower variable costs per unit of production due to economies of scale. Smaller, traditional farms might have lower fixed costs but higher variable costs, particularly in labor-intensive operations.

Understanding this cost structure is crucial for pricing strategies. In times of high coffee prices, farms with higher fixed costs may see greater profit margins as their baseline expenses are covered more easily. Conversely, during market downturns, these same farms might struggle more than those with a higher proportion of variable costs, which can be more readily adjusted.

For farm management, the balance between fixed and variable costs influences decisions on investment, expansion, and risk management. Farms with high fixed costs might focus on maximizing production to spread these costs over a larger output. Those with higher variable costs might have more flexibility to scale production up or down based on market conditions.

In the long term, the trend in many coffee-producing regions has been towards increasing fixed costs, driven by investments in technology and infrastructure to improve quality and efficiency. This shift can lead to improved productivity and quality but also increases the financial risks for farmers, especially in a volatile market.

Understanding and managing this cost structure is therefore not just about controlling expenses; it's about creating a resilient and adaptable coffee farming operation that can thrive in various market conditions.

2.2 Key Components of Cost Structure

2.2.1 Labor Costs

Labor costs often represent the largest single expense in coffee production, particularly for farms employing traditional harvesting methods. The labor-intensive nature of coffee farming, especially during the harvest season, makes this a critical component of the cost structure to understand and manage effectively.

In many coffee-producing regions, labor costs are influenced by several factors:

- Seasonal demand: The need for workers peaks during harvest time, which can last several months. This seasonal spike in demand can drive up wages and create competition for skilled pickers.

- Skill level required: Selective picking, where only ripe cherries are harvested, requires more skilled labor and commands higher wages compared to strip picking or mechanical harvesting.

- Local labor laws and regulations: Minimum wage requirements, overtime rules, and social security contributions vary by country and can significantly impact overall labor costs.

- Migration patterns: In some regions, coffee harvesting relies heavily on migrant workers, which can introduce additional costs related to transportation and housing.

- Productivity rates: The efficiency of workers, often measured in kilograms of cherries picked per day, directly affects labor costs per unit of production.

Labor efficiency is a key focus for many coffee farms looking to optimize their cost structure. Strategies to improve labor efficiency include:

- Training programs to enhance picker skills and speed

- Implementing incentive systems based on quality and quantity of cherries picked

- Investing in semi-mechanized harvesting tools to boost individual worker productivity

- Improving farm layout and logistics to reduce time spent on non-picking activities

The seasonal nature of coffee labor presents unique challenges. Farms must balance the need for a flexible workforce during peak periods with the desire to maintain a skilled, reliable labor pool. Some larger operations address this by diversifying their crops or processing activities to provide year-round employment, thus retaining skilled workers.

Labor costs also intersect with quality considerations. While mechanization can reduce labor costs, it may not be suitable for high-quality, specialty coffee production where selective picking is crucial. This creates a delicate balance between cost management and quality maintenance that coffee producers must navigate.

2.2.2 Input Costs

Input costs form a significant portion of the variable expenses in coffee production and can have a substantial impact on overall profitability. These costs encompass a range of materials and substances used throughout the coffee growing cycle, each playing a crucial role in yield and quality.

Key inputs in coffee production include:

- Seeds or seedlings: The initial investment in plant material sets the foundation for the entire operation. High-quality, disease-resistant varieties may cost more upfront but can lead to better yields and reduced pest management costs over time.

- Fertilizers: Both organic and synthetic fertilizers are essential for maintaining soil fertility and supporting healthy plant growth. The cost and type of fertilizer used can vary widely based on soil conditions, farming practices (conventional vs. organic), and local availability.

- Pest and disease management: This category includes insecticides, fungicides, and herbicides. The cost can fluctuate based on pest pressures, which may vary year to year and can be influenced by climate change.

- Water: In regions where irrigation is necessary, water can be a significant input cost. This includes not just the water itself but also the energy costs associated with pumping and distribution.

- Soil amendments: Materials like lime or gypsum used to adjust soil pH or improve soil structure.

The impact of input costs on overall expenses can be substantial and is often subject to factors beyond the farmer's control. For instance:

- Global commodity prices affect the cost of synthetic fertilizers, which are often petroleum-based.

- Currency fluctuations can impact the price of imported inputs.

- Environmental regulations may restrict the use of certain chemicals, necessitating more expensive alternatives.

Effective management of input costs requires a delicate balance. Skimping on essential inputs like fertilizer can lead to reduced yields or quality, potentially resulting in lower revenues that outweigh the initial savings. Conversely, overuse of inputs not only increases costs but can also have negative environmental impacts.

Strategies for optimizing input costs include:

- Soil testing and precision agriculture techniques to apply inputs only where and when needed.

- Integrated pest management (IPM) to reduce reliance on chemical pesticides.

- Investing in cover crops and composting to improve soil health naturally.

- Bulk purchasing or cooperative buying to secure better prices on inputs.

The trend towards sustainable and organic coffee production has significant implications for input costs. While organic inputs may be more expensive, they can command premium prices in the market. Additionally, practices like agroforestry and the use of shade trees can reduce the need for certain inputs by naturally enhancing soil fertility and pest resistance.

Understanding and managing input costs is crucial for coffee farmers to maintain profitability while also adhering to sustainable farming practices. It requires ongoing education, careful planning, and often a willingness to invest in long-term soil health and ecosystem balance.

2.2.3 Infrastructure and Equipment

Infrastructure and equipment represent significant fixed costs in coffee production, forming the backbone of a farm's operational capacity. These investments are crucial for efficiency, quality control, and often determine a farm's ability to compete in the global coffee market.

Key infrastructure and equipment in coffee production include:

- Land preparation and management: Terracing equipment for hillside farms, drainage systems, and erosion control structures.

- Irrigation systems: Ranging from basic drip irrigation to sophisticated computer-controlled systems, crucial in areas with unreliable rainfall.

- Processing facilities: Wet mills for washed coffee processing, drying patios or mechanical dryers, fermentation tanks, and sorting equipment.

- Storage facilities: Warehouses with controlled environments to maintain coffee quality post-processing.

- Transportation equipment: Vehicles for moving coffee cherries from field to processing area and processed coffee to market.

- Quality control equipment: Moisture meters, sample roasters, and cupping labs for larger operations.

- Farm management technology: Software and hardware for record-keeping, inventory management, and precision agriculture.

The investment in infrastructure and equipment can vary widely based on the scale and focus of the operation. Small-holder farmers might rely on shared community processing facilities, while large estates may invest millions in state-of-the-art equipment.

These investments impact coffee production in several ways:

- Efficiency: Modern equipment can significantly reduce labor costs and improve processing speed.

- Quality: Proper infrastructure ensures consistent processing, which is crucial for maintaining coffee quality.

- Market access: Certain equipment (like wet mills) can allow farmers to move up the value chain, selling parchment instead of cherry coffee.

- Sustainability: Investments in water-efficient processing equipment or solar drying technology can reduce environmental impact and operational costs.

The decision to invest in infrastructure and equipment must be carefully weighed against potential returns. Factors to consider include:

- Scale of operation: Ensuring the equipment capacity matches current and projected production volumes.

- Financial capacity: Balancing the need for modernization with the ability to finance large investments.

- Market demands: Investing in equipment that aligns with target market quality requirements.

- Maintenance and operational costs: Considering not just the initial investment but ongoing expenses.

For many small-holder farmers, access to finance for these investments is a significant challenge. Cooperative models, where farmers pool resources to invest in shared facilities, have proven successful in many regions. Additionally, partnerships with coffee buyers or development organizations sometimes provide avenues for financing infrastructure improvements.

The trend towards specialty and micro-lot coffees has implications for infrastructure investments. Farms may need to invest in equipment that allows for small-batch processing and meticulous quality control to meet the demands of this high-value market segment.

As climate change impacts coffee-growing regions, investments in resilient infrastructure become increasingly important. This might include more robust water management systems, shade structures, or processing equipment designed to handle varying cherry ripeness due to erratic weather patterns.

In conclusion, while infrastructure and equipment represent significant upfront costs, they are often essential for long-term viability in the competitive coffee market. Careful planning, phased investments, and leveraging collaborative models can help farmers balance the need for modern infrastructure with financial constraints.

Section 3: Coffee Production Economics

3.1 Economic Factors Influencing Coffee Costs

The economics of coffee production is a complex interplay of various factors, many of which are beyond the direct control of individual farmers. Understanding these economic influences is crucial for anyone involved in the coffee industry, from small-scale growers to large agricultural corporations.

- Global Coffee Prices: The most significant economic factor affecting coffee production costs is the global price of coffee. Coffee is traded as a commodity on international markets, with prices set by supply and demand dynamics. The volatility of coffee prices can have dramatic effects on farm profitability. When prices are high, farmers may invest more in inputs and infrastructure, potentially increasing their costs. Conversely, prolonged periods of low prices can force farmers to cut costs, sometimes at the expense of quality or long-term sustainability.

- Currency Exchange Rates: For coffee-producing countries, fluctuations in currency exchange rates can significantly impact production costs and profitability. A stronger local currency can make exports less competitive and reduce income for farmers selling to international markets. Conversely, a weaker currency can increase the cost of imported inputs like fertilizers and machinery.

- Inflation: Rising inflation in coffee-producing countries can lead to increased costs for labor, inputs, and services. This is particularly challenging when global coffee prices don't keep pace with local inflation rates, squeezing profit margins for producers.

- Labor Market Dynamics: The availability and cost of labor can vary significantly based on local economic conditions. In some regions, competition from other industries or urban migration can drive up agricultural wages. Conversely, economic downturns might increase the labor pool but potentially at the cost of social stability.

- Energy Costs: The price of oil and other energy sources directly impacts the cost of inputs like fertilizers and the operational costs of machinery. It also affects transportation costs throughout the supply chain.

- Government Policies: National and local government policies can have profound effects on coffee production economics. These may include:

- Agricultural subsidies or support programs

- Export taxes or quotas

- Land use regulations

- Environmental policies affecting farming practices

- Trade agreements influencing market access

- Climate Change: While not a traditional economic factor, the increasing impact of climate change on coffee-growing regions has significant economic implications. Changing weather patterns can affect yields, quality, and the prevalence of pests and diseases, all of which have direct economic consequences.

- Market Demand Shifts: Changes in consumer preferences, such as the growing demand for specialty and sustainably produced coffees, can influence production decisions and costs. Meeting certification requirements or investing in quality improvement measures may increase costs but can also open access to premium markets.

- Technological Advancements: The adoption of new technologies in coffee farming and processing can have mixed effects on costs. While initial investments may be high, they can lead to increased efficiency and reduced labor costs over time.

- Access to Credit: The availability and terms of financing for coffee farmers can significantly impact their ability to invest in their farms or weather market downturns. High interest rates or limited access to credit can constrain farmers' options and increase the overall cost of production.

- Supply Chain Dynamics: The structure and efficiency of the coffee supply chain in different regions can affect the share of the final price that reaches farmers. More direct trade relationships or shorter supply chains can potentially improve farmer incomes but may also require additional investments in quality control and marketing.

These economic factors do not operate in isolation but interact in complex ways. For instance, a combination of low global prices, high inflation, and unfavorable exchange rates can create particularly challenging conditions for coffee producers.

Understanding these economic influences is crucial for developing strategies to mitigate risks and capitalize on opportunities. This might involve diversifying income sources, investing in value-added processing, or participating in cooperative structures to gain economies of scale.

For policymakers and industry stakeholders, recognizing these economic factors is essential for developing supportive policies and initiatives that can help ensure the long-term sustainability of coffee production in the face of economic challenges.

3.2 Supply and Demand Dynamics

The interplay between supply and demand in the coffee market is a fundamental force shaping the industry's economics, influencing everything from farm-level decisions to global trade patterns. Understanding these dynamics is crucial for all stakeholders in the coffee value chain.

Supply Factors:

- Production Cycles: Coffee plants have a biennial bearing pattern, with alternating years of high and low yields. This natural cycle contributes to supply fluctuations.

- Weather and Climate: Coffee is highly sensitive to weather conditions. Frost, drought, or excessive rainfall can significantly impact yields. Climate change is increasingly disrupting traditional growing patterns.

- Pest and Disease Outbreaks: Events like the coffee leaf rust epidemic in Central America can dramatically reduce supply from affected regions.

- Planting Decisions: Farmers' decisions to expand or reduce coffee acreage based on market prices can impact supply, though with a lag of several years due to the time it takes for new plants to mature.

- Government Policies: Export quotas, stockpiling programs, or incentives for crop diversification can influence the amount of coffee entering the global market.

- Processing Capacity: Limited processing infrastructure in some regions can create bottlenecks in the supply chain, affecting the amount of coffee that reaches the market.

Demand Factors:

- Consumer Trends: Changing consumption patterns, such as the rise of specialty coffee or the growth of coffee culture in traditionally tea-drinking countries, significantly impact demand.

- Economic Conditions: Global economic health affects consumer spending on coffee, particularly in the foodservice sector.

- Health Perceptions: Research on the health benefits or risks of coffee consumption can influence consumer behavior.

- Competition from Other Beverages: The popularity of alternative caffeinated drinks or health beverages can affect coffee demand.

- Population Growth: Increasing populations in both traditional and emerging coffee markets contribute to long-term demand growth.

- Marketing and Branding: Effective marketing campaigns by coffee companies can stimulate demand for specific types or origins of coffee.

The Interaction of Supply and Demand:

The coffee market is known for its price volatility, largely due to the complex interaction of these supply and demand factors. Some key dynamics include:

- Price Elasticity: Coffee demand is relatively inelastic in the short term, meaning consumption doesn't change dramatically with price fluctuations. However, prolonged high prices can lead to changes in consumer behavior.

- Lag in Supply Response: Due to the perennial nature of coffee plants, supply cannot quickly adjust to changes in demand. This lag can lead to periods of oversupply or shortage.

- Speculative Activity: Coffee futures markets can amplify price movements as traders react to or anticipate changes in supply and demand.

- Quality Segmentation: The market for specialty coffee often operates somewhat independently from the commodity market, with its own supply and demand dynamics.

- Geographic Shifts: Changes in production capabilities or consumption patterns in different regions can reshape global trade flows.

Impact on Production Decisions:

Understanding these dynamics is crucial for coffee producers in making informed decisions:

- Crop Management: Farmers may adjust their farming practices (e.g., intensifying cultivation or investing in irrigation) based on market signals.

- Diversification: Price volatility may encourage farmers to diversify into other crops or seek off-farm income sources.

- Quality Focus: Producers may invest in quality improvements to access more stable specialty markets.

- Cooperative Formation: Farmers might join cooperatives to gain better market access and bargaining power.

- Long-term Planning: Understanding market cycles can inform decisions about farm expansion or renovation.

For the broader industry, these supply and demand dynamics influence strategies around sourcing, inventory management, and product development. Roasters and retailers must navigate these fluctuations to ensure consistent supply and manage costs.

Policymakers in coffee-producing countries often grapple with how to support their coffee sectors in the face of these market forces. This might involve programs to improve productivity, promote quality, or facilitate access to alternative markets.

In conclusion, the complex dance of supply and demand in the coffee market creates both challenges and opportunities throughout the value chain. Stakeholders who can effectively analyze and respond to these dynamics are better positioned to thrive in this volatile but vibrant industry.

Section 4: The Role of Market Analysis in Coffee Pricing

4.1 Understanding Coffee Pricing

Coffee pricing is a complex and dynamic process influenced by a myriad of factors across the global supply chain. Understanding how coffee is priced is crucial for all stakeholders in the industry, from farmers to traders to roasters and retailers.

The Basics of Coffee Pricing:

- Commodity Market: The baseline for coffee pricing is set in the commodity futures markets, primarily the New York Coffee Exchange for Arabica and the London International Financial Futures and Options Exchange for Robusta. These markets establish the "C Price," which serves as a global benchmark.

- Differentials: The actual price paid for coffee often includes a differential above or below the C Price, based on factors like origin, quality, and certification status.

- Local Market Dynamics: In producing countries, local market conditions, including supply and demand, currency exchange rates, and government policies, can influence the farm-gate price.

- Quality Premiums: Specialty coffees often command significant premiums above the commodity price, based on cupping scores, unique characteristics, or specific certifications.

Factors Influencing Coffee Prices:

- Supply and Demand: Global production levels and consumption trends are primary drivers of price movements.

- Weather Events: Frost in Brazil or drought in Vietnam can cause significant price spikes due to anticipated supply shortages.

- Currency Fluctuations: As coffee is typically traded in US dollars, changes in exchange rates can impact prices in local currencies.

- Speculative Activity: Large-scale buying or selling by investment funds can amplify price movements in the futures markets.

- Geopolitical Events: Political instability in producing countries or changes in trade policies can affect coffee prices.

- Long-term Climate Trends: Concerns about the impact of climate change on coffee-growing regions can influence long-term price outlooks.

Fair Trade and Direct Trade Pricing:

Fair Trade certification sets a minimum price for coffee, aiming to provide a safety net for farmers. This model includes:

- A Minimum Price: Currently set at $1.40 per pound for washed Arabica coffee.

- Social Premium: An additional amount (currently $0.20 per pound) paid to cooperatives for community development projects.

- Organic Premium: An extra premium for certified organic coffee.

Direct Trade models, often used in the specialty coffee sector, typically involve:

- Prices negotiated directly between roasters and producers.

- Premiums based on quality and long-term relationship building.

- Often higher prices than Fair Trade minimums, but without the formal certification structure.

Specialty Coffee Pricing:

The specialty coffee market operates somewhat independently from the commodity market:

- Prices are often decoupled from the C Price, based instead on cup quality, rarity, and story.

- Quality is typically assessed using the Specialty Coffee Association's 100-point scale, with coffees scoring 80+ considered specialty grade.

- Unique processing methods, varietals, or micro-lot designations can command significant premiums.

Challenges in Coffee Pricing:

- Price Volatility: Rapid fluctuations in the C Price can create significant challenges for both producers and buyers in planning and risk management.

- Transparency: There's often a lack of clarity about how prices are set at various stages of the supply chain.

- Cost of Production: Farm-gate prices don't always reflect the actual cost of production, leading to sustainability concerns.

- Market Access: Small-scale farmers may struggle to access markets that offer better prices for their coffee.

Strategies for Stakeholders:

- Producers: Focusing on quality improvement, seeking certifications, and exploring direct trade relationships can help secure better prices.

- Traders and Roasters: Developing long-term relationships with producers and implementing price risk management strategies can help navigate market volatility.

- Consumers: Understanding the factors behind coffee pricing can inform purchasing decisions that support sustainable production.

The Future of Coffee Pricing:

The coffee industry is exploring new models to address pricing challenges:

- Price-to-be-Fixed Contracts: Allowing producers to fix their price at a later date based on market conditions.

- Income Driver Approach: Calculating prices based on desired farmer income rather than market dynamics.

- Blockchain and Traceability: Technologies that could increase transparency in pricing throughout the supply chain.

Understanding coffee pricing is essential for making informed decisions at all levels of the industry. As the market continues to evolve, staying informed about pricing mechanisms and trends will be crucial for all stakeholders in the coffee value chain.

4.2 Tools for Market Analysis

Effective market analysis is crucial for all participants in the coffee industry, from producers to traders, roasters, and retailers. Understanding and utilizing the right tools can provide valuable insights for decision-making, risk management, and strategic planning. Here's an overview of key tools and resources for coffee market analysis:

- Price Information Services:

- International Coffee Organization (ICO) Reports: Provides comprehensive data on global coffee production, consumption, and prices.

- Intercontinental Exchange (ICE): Offers real-time and historical data on coffee futures prices.

- Thomson Reuters Eikon: A comprehensive platform for financial market data, including coffee futures and spot prices.

- Production and Weather Forecasting:

- USDA Foreign Agricultural Service (FAS) Reports: Offers detailed analysis of coffee production in major growing countries.

- National Oceanic and Atmospheric Administration (NOAA): Provides climate data and forecasts that can impact coffee-growing regions.

- Specialty coffee associations often provide crop reports for specific origins.

- Technical Analysis Tools:

- Charting Software: Platforms like TradingView or MetaTrader offer advanced charting capabilities for analyzing price trends and patterns.

- Indicators: Tools like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands help in identifying trends and potential price reversals.

- Fundamental Analysis Resources:

- Economic Calendars: Tracking key economic releases that might impact currency values in coffee-producing countries.

- Geopolitical News Sources: Staying informed about political developments in major coffee-producing regions.

- Supply Chain Analysis:

- GeoTraceability: Offers tools for mapping and analyzing coffee supply chains.

- Cropster: Provides software for managing coffee quality throughout the supply chain.

- Market Reports and Subscriptions:

- CoffeeNetwork: Offers daily market reports and analysis.

- Perfect Daily Grind: Provides industry news and trend analysis.

- Specialty Coffee Transaction Guide: Offers data on specialty coffee pricing.

- Social Media and Online Communities:

- Twitter: Following key industry figures and organizations for real-time updates.

- LinkedIn Groups: Networking and sharing insights with industry professionals.

- Machine Learning and AI Tools:

- Predictive Analytics: Advanced tools using AI to forecast market trends based on historical data and current conditions.

- Sentiment Analysis: Analyzing social media and news sources to gauge market sentiment.

- Risk Management Tools:

- Hedging Platforms: Software for managing price risk through futures and options contracts.

- Currency Exchange Forecasting Tools: Important for international traders dealing with multiple currencies.

- Quality Assessment Tools:

- Coffee Quality Institute (CQI) Resources: Provides standards and training for coffee quality assessment.

- Specialty Coffee Association (SCA) Cupping Protocols: Standardized methods for evaluating coffee quality.

- Sustainability and Certification Tracking:

- Rainforest Alliance Certification Database: Tracks certified farms and supply chains.

- Fair Trade Certification Resources: Provides information on Fair Trade practices and certified producers.

- Mobile Apps:

- Coffee Trading Apps: Offer real-time price information and basic charting on mobile devices.

- Farm Management Apps: Help producers track inputs, yields, and costs.

Effective Use of Market Analysis Tools:

- Integrate Multiple Sources: No single tool provides a complete picture. Combining insights from various sources leads to more robust analysis.

- Contextualize Data: Understanding the broader context of market data is crucial. For example, a price spike might be due to a temporary supply disruption rather than a long-term trend.

- Develop a Systematic Approach: Establish a routine for market analysis, regularly reviewing key indicators and reports.

- Customize to Your Needs: Focus on tools and data most relevant to your position in the supply chain and geographic area of interest.

- Stay Updated: The coffee market is dynamic. Regularly update your toolkit and stay informed about new analysis methods and resources.

- Network and Collaborate: Engage with industry peers to share insights and learn about new analysis techniques.

- Invest in Training: Many of these tools require specific skills to use effectively. Investing in training can significantly enhance your analytical capabilities.

- Balance Short-term and Long-term Analysis: While daily price movements are important, also focus on long-term trends that may impact the industry over years.

By leveraging these tools and approaches, stakeholders in the coffee industry can make more informed decisions, better manage risks, and identify opportunities in this complex and dynamic market. Remember, the most powerful tool is the ability to interpret and act on the information these resources provide.

Section 5: Case Study: Analyzing Coffee Farms

5.1 Example of a Coffee Farm's Cost Structure

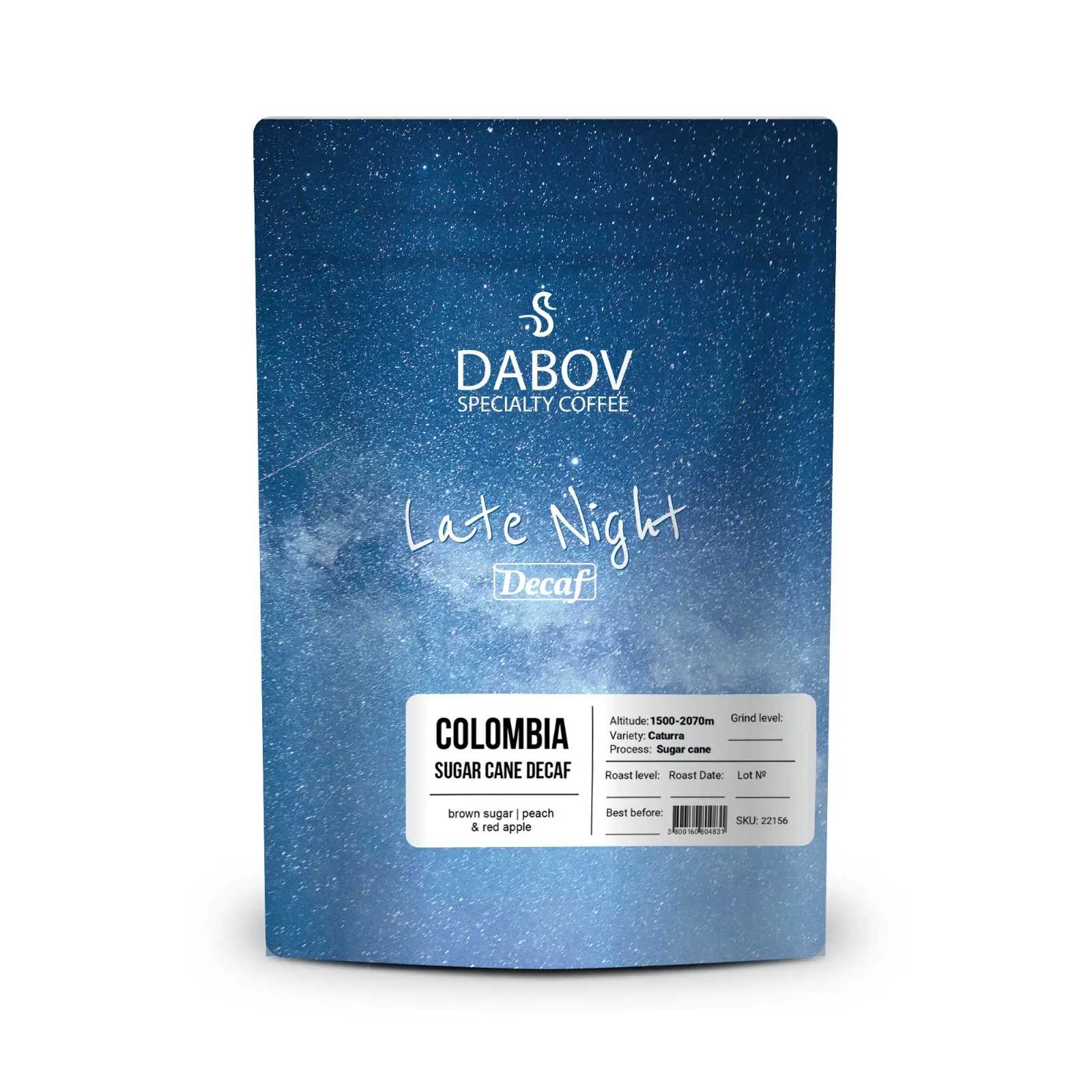

To illustrate the practical application of cost structure analysis in coffee production, let's examine a hypothetical case study of a medium-sized coffee farm in Colombia. This example will provide a detailed breakdown of costs and revenue, offering insights into the economic realities of coffee farming.

Farm Profile:

- Location: Huila region, Colombia

- Size: 15 hectares

- Production: Specialty Arabica coffee

- Annual Output: Approximately 22,500 kg of green coffee (1,500 kg/hectare)

- Farming Practices: Shade-grown, organic certified

Cost Breakdown (Annual):

- Fixed Costs:a. Land Lease: $4,500b. Equipment Depreciation: $3,000c. Certification Fees (Organic): $1,500d. Farm Management Software: $600Total Fixed Costs: $9,600

- Variable Costs:a. Labor:

- Pruning and Maintenance: $7,500

- Harvesting: $15,000

- Processing: $5,000b. Inputs:

- Organic Fertilizer: $4,500

- Pest Management: $2,000c. Processing:

- Energy Costs: $1,800

- Water: $900d. Packaging and Transportation: $3,000e. Miscellaneous (tools, minor repairs): $1,500Total Variable Costs: $41,200

Total Annual Costs: $50,800

Revenue Calculation:

- Production: 22,500 kg of green coffee

- Average Selling Price: $3.50 per kg (premium for organic, specialty grade)Total Revenue: $78,750

Gross Profit: $27,950Profit Margin: 35.5%

Analysis:

- Cost Structure:

- Fixed Costs represent 18.9% of total costs

- Variable Costs account for 81.1% of total costs

- Labor is the largest expense, constituting 54.1% of total costs

- Break-even Analysis:

- Break-even Point: 14,514 kg of green coffee

- The farm needs to sell 64.5% of its production to cover costs

- Sensitivity to Price Changes:

- A $0.50 decrease in price per kg would reduce profit by $11,250, cutting the profit margin to 21.2%

- A $0.50 increase would boost profit by $11,250, increasing the margin to 49.8%

- Impact of Yield Variations:

- A 10% decrease in yield (to 20,250 kg) would reduce profit to $20,075, assuming costs remain constant

- A 10% increase (to 24,750 kg) would increase profit to $35,825, again assuming constant costs

- Return on Investment (ROI):

- Assuming initial investment of $200,000 (land, equipment, etc.)

- Annual ROI: 14% (Profit / Investment)

Key Observations:

- Labor Intensity: The high proportion of labor costs highlights the labor-intensive nature of specialty