The Global Coffee Trade An Insider's Look

Coffee is more than just a morning ritual—it's a multi-billion dollar global industry that connects millions of producers, traders, and consumers. In this article, we delve into the intricacies of the global coffee trade, exploring its historical evolution, market dynamics, and the essential players involved. From understanding the coffee commodities to navigating the challenges and innovations that shape this market, we unveil the layers that underscore its significance. With insights into economic impacts and future trends, this guide will serve as a valuable resource for anyone interested in coffee trading. Join us in uncovering the rich tapestry of the coffee industry and its pivotal role in the global economy.

In the vast landscape of global commodities, few products hold as much significance and allure as coffee. This aromatic bean, cherished by millions worldwide, stands as one of the most traded commodities in the global market, weaving a complex tapestry of economic, social, and environmental threads across continents. The global coffee trade is not merely a transaction of goods; it's a intricate dance of culture, economics, and human connection that spans from the lush hillsides of Colombia to the bustling cafes of New York City. This article aims to provide a comprehensive insider's look into the fascinating world of the global coffee trade, unraveling its complexities and shedding light on the forces that shape this multi-billion dollar industry.

Understanding the Global Coffee Trade

What is the Global Coffee Trade?

The global coffee trade is a sophisticated network of interconnected activities that facilitate the journey of coffee from seed to cup. At its core, it encompasses the cultivation, processing, transportation, and sale of coffee beans across international borders. This intricate system links a diverse array of stakeholders, including small-scale farmers in remote tropical regions, large agricultural cooperatives, multinational corporations, and local roasters in consuming countries. The trade is characterized by its global reach, with coffee being produced in over 50 countries, primarily in the "Bean Belt" between the Tropics of Cancer and Capricorn, and consumed in virtually every corner of the world.

The complexity of the global coffee trade lies in its multifaceted nature. It involves not only the physical movement of coffee beans but also a sophisticated financial ecosystem of futures contracts, hedging strategies, and price speculation. The trade is influenced by a myriad of factors, including climate conditions, geopolitical events, currency fluctuations, and changing consumer preferences. Understanding the global coffee trade requires a holistic view that considers the interplay between agricultural practices, international trade policies, market dynamics, and socio-economic conditions in both producing and consuming countries.

One of the unique aspects of the coffee trade is its impact on local economies and communities. For many coffee-producing countries, particularly in Africa and Latin America, coffee exports represent a significant portion of their agricultural GDP and foreign exchange earnings. The trade has the power to uplift entire communities, providing livelihoods for millions of smallholder farmers. However, it also poses challenges, as the volatility of coffee prices on the global market can have profound effects on the economic stability of these regions.

History of Coffee Trading

The history of coffee trading is a fascinating journey that spans centuries and continents, marked by cultural exchange, colonial expansion, and economic transformation. Coffee's story begins in the highlands of Ethiopia, where legend has it that a goat herder named Kaldi discovered the energizing effects of coffee berries in the 9th century. From these humble origins, coffee began its global journey, first spreading to the Arabian Peninsula, where it became an integral part of social and religious life.

The commercialization of coffee on a global scale can be traced back to the 16th and 17th centuries. Arab traders initially held a monopoly on coffee cultivation and trade, carefully guarding the secret of coffee production. However, as European powers expanded their colonial reach, they sought to break this monopoly. The Dutch were among the first to successfully cultivate coffee outside of Arabia, establishing plantations in their colonies, particularly in Java, Indonesia. This marked the beginning of coffee's transformation from a luxury item to a global commodity.

The 18th and 19th centuries saw a dramatic expansion of coffee cultivation and trade. European colonial powers established vast coffee plantations in their territories across Africa, Asia, and the Americas. This period also witnessed the rise of Brazil as a coffee powerhouse, a position it continues to hold today. The industrialization of the 19th century further accelerated coffee's global spread, with improved transportation and communication networks facilitating more efficient trade.

The 20th century brought significant changes to the coffee trade landscape. The establishment of the International Coffee Agreement in 1962 marked an attempt to stabilize coffee prices and promote cooperation between producing and consuming countries. This agreement introduced a quota system and played a crucial role in shaping the modern coffee market. However, its collapse in 1989 led to a period of price volatility and market liberalization.

In recent decades, the coffee trade has been characterized by increasing complexity and specialization. The rise of specialty coffee markets, direct trade relationships, and sustainability certifications have added new dimensions to the traditional commodity-based trade model. Technological advancements have also played a role, with digital platforms facilitating more direct connections between producers and consumers.

Understanding the historical context of coffee trading provides valuable insights into the current state of the global coffee market. It reveals how geopolitical, economic, and social forces have shaped the industry over time, and offers clues to its potential future trajectories. As we delve deeper into the intricacies of today's coffee trade, this historical perspective serves as a crucial foundation for comprehending the complex dynamics at play in the modern global coffee market.

The Coffee Market Structure

Players in the Coffee Market

The global coffee market is a complex ecosystem comprising various interconnected players, each fulfilling crucial roles in the journey of coffee from farm to cup. At the foundation of this structure are the coffee farmers, who range from smallholders cultivating a few hectares to large-scale plantation owners. These producers are responsible for growing, harvesting, and often the initial processing of coffee cherries. In many regions, farmers organize into cooperatives, which can provide economies of scale, shared resources, and increased bargaining power in the market.

Next in the chain are local traders and exporters, who aggregate coffee from various producers and prepare it for international shipment. These entities play a critical role in quality control, packaging, and navigating the complexities of international trade regulations. They often have established relationships with importers in consuming countries and may engage in futures contracts to manage price risks.

Importers, typically based in consuming countries, purchase coffee from exporters and distribute it to roasters. They often specialize in sourcing specific types or origins of coffee and may provide warehousing and financing services. Large multinational trading companies also operate in this space, often vertically integrated to control multiple stages of the supply chain.

Roasters transform the green coffee beans into the aromatic product familiar to consumers. This segment includes everything from small artisanal roasters to large multinational corporations. Roasters are increasingly engaging directly with producers through direct trade relationships, bypassing traditional intermediaries.

Retailers, including cafes, supermarkets, and online platforms, represent the final link to consumers. The retail landscape has evolved significantly in recent years, with the rise of specialty coffee shops and direct-to-consumer online sales challenging traditional distribution channels.

Supporting this core structure are numerous ancillary players, including logistics providers, financial institutions, certification bodies, and industry associations. These entities provide crucial services that facilitate the smooth operation of the global coffee trade.

Understanding the roles and interactions of these various players is essential for anyone looking to navigate the coffee market effectively. Each entity faces unique challenges and opportunities, and the balance of power between these players can significantly impact market dynamics and price formation.

Major Coffee-Producing Countries

The global coffee production landscape is dominated by a handful of countries, each with its unique coffee-growing traditions, varietals, and market positioning. Brazil stands as the undisputed titan of coffee production, accounting for approximately one-third of the world's coffee supply. The country's vast coffee plantations, primarily located in the states of Minas Gerais, São Paulo, and Espírito Santo, produce both Arabica and Robusta varieties. Brazil's coffee sector is characterized by its high level of mechanization and efficiency, allowing for large-scale production that significantly influences global coffee prices.

Vietnam, the second-largest producer, has rapidly ascended in the coffee world over the past few decades. The country specializes in Robusta production, with the Central Highlands region being the epicenter of cultivation. Vietnam's emergence as a coffee powerhouse has dramatically altered the global supply dynamics, particularly in the Robusta market.

Colombia, renowned for its high-quality Arabica beans, holds a special place in the coffee world. The country's coffee, grown in the Andes Mountains, is prized for its balanced flavor profile and is often used in premium blends. The Colombian coffee industry is supported by a strong national brand identity and the influential Colombian Coffee Growers Federation (FNC), which plays a crucial role in marketing and quality control.

Other significant producers include Indonesia, Ethiopia (the birthplace of coffee), Honduras, and India. Each of these countries contributes unique flavor profiles and production methods to the global coffee tapestry. For instance, Ethiopia is known for its diverse heirloom varieties and traditional processing methods, while Indonesia is famous for its unique wet-hulled process that produces distinctive, full-bodied coffees.

Understanding the characteristics and market positions of these major producing countries is crucial for anyone involved in the coffee trade. Production levels, quality variations, and local policies in these countries can have far-reaching effects on global coffee supply and prices. Moreover, changing climate patterns and evolving agricultural practices in these regions are reshaping the future of coffee production, presenting both challenges and opportunities for the industry.

Demand and Supply Dynamics

The interplay between coffee demand and supply forms the backbone of the global coffee market, influencing prices, trade flows, and industry trends. On the demand side, coffee consumption has shown steady growth globally, driven by increasing per capita consumption in emerging markets and the expansion of coffee culture in traditional tea-drinking countries. The specialty coffee movement has also fueled demand for high-quality, single-origin coffees, creating new market segments and value propositions.

Consumer preferences play a significant role in shaping demand. There's a growing trend towards premium and specialty coffees, particularly among younger consumers in developed markets. This shift has led to increased demand for traceable, sustainably sourced beans and unique flavor profiles. Additionally, the rise of ready-to-drink and at-home brewing options, accelerated by the COVID-19 pandemic, has altered consumption patterns and distribution channels.

On the supply side, coffee production is subject to significant variability due to several factors. Climate conditions, including rainfall patterns, temperature, and extreme weather events, can dramatically affect crop yields. The biennial nature of coffee trees, which tend to have alternating high and low production years, also contributes to supply fluctuations.

Geopolitical factors and local policies in producing countries can significantly impact supply. For instance, government support programs, export regulations, and land use policies can influence production levels and export volumes. Currency fluctuations in producing countries can also affect the competitiveness of their coffee exports on the global market.

The long-term supply outlook is increasingly shaped by sustainability concerns. Climate change poses a significant threat to coffee production, with rising temperatures and changing precipitation patterns potentially reducing suitable growing areas. In response, there's a growing focus on developing climate-resilient coffee varieties and implementing sustainable farming practices.

The balance between demand and supply is reflected in global coffee prices, which can be highly volatile. Factors such as frost in Brazil or political instability in a major producing country can lead to supply shocks and price spikes. Conversely, bumper crops or weakening demand can result in price depressions, potentially impacting the livelihoods of millions of coffee farmers.

Understanding these complex demand and supply dynamics is crucial for all stakeholders in the coffee industry. It requires a holistic view that considers not only market forces but also environmental, social, and technological factors that shape the global coffee landscape. As the industry continues to evolve, staying attuned to these dynamics will be key to navigating the challenges and opportunities in the global coffee trade.

Coffee Trade Guide: Navigating the Market

Coffee Trading Basics

Navigating the coffee trading market requires a solid understanding of its fundamental components and mechanisms. At its core, coffee trading involves the buying and selling of coffee as a commodity, but the intricacies of this process are far more complex than a simple exchange of goods.

Coffee is primarily traded in two forms: physical (or cash) markets and futures markets. In the physical market, actual coffee beans are bought and sold for immediate or near-future delivery. This market is where roasters, importers, and exporters operate to secure their coffee supplies. Transactions in the physical market can be based on spot prices (for immediate delivery) or forward contracts (for future delivery at a predetermined price).

The futures market, on the other hand, deals with standardized contracts for coffee delivery at a future date. The two primary futures exchanges for coffee are the Intercontinental Exchange (ICE) in New York, which trades Arabica futures, and the London International Financial Futures and Options Exchange (LIFFE), which trades Robusta futures. These futures contracts serve as important price discovery mechanisms and risk management tools for the industry.

Quality grading plays a crucial role in coffee trading. The Specialty Coffee Association (SCA) has established a standardized 100-point cupping scale, which is widely used to evaluate coffee quality. Factors such as aroma, flavor, acidity, body, and aftertaste are assessed by trained Q Graders. In the commodity market, coffee is often graded based on the number of defects in a sample, with grades like NY 2/3, which allows for a certain number of full defects per 300-gram sample.

Pricing in the coffee market is influenced by a multitude of factors. The C-Price, which is the benchmark price for washed Arabica coffee traded on the ICE, serves as a reference point for much of the global coffee trade. However, premiums or discounts are applied based on factors such as origin, quality, and certifications. For example, Colombian Milds typically command a premium over the C-Price, while lower-grade coffees might trade at a discount.

Contract terms in coffee trading can be complex, covering aspects such as quantity, quality specifications, delivery terms, and payment conditions. The International Coffee Organization (ICO) provides standard forms of contract to facilitate international coffee trades, though many companies also use their own customized contracts.

Risk management is a critical aspect of coffee trading. Price volatility in the coffee market can be extreme, influenced by factors ranging from weather conditions to currency fluctuations. Traders and roasters often use hedging strategies, such as futures contracts or options, to protect against adverse price movements.

Understanding these basics is essential for anyone looking to engage in coffee trading. However, it's important to note that the coffee market is constantly evolving, with new trading platforms, sustainability certifications, and direct trade models emerging. Staying informed about these developments and their implications is crucial for success in the dynamic world of coffee trading.

Types of Coffee Commodities

The global coffee market primarily trades in two main species of coffee: Arabica and Robusta. However, within these broad categories, there exists a wide variety of coffee types, each with its unique characteristics and market positioning.

Arabica coffee, scientifically known as Coffea arabica, accounts for about 60-70% of global coffee production. It's generally considered to produce a higher quality cup, with complex flavor profiles and higher acidity. Arabica is grown at higher altitudes, typically between 600-2000 meters above sea level, and is more susceptible to diseases and pests. Key Arabica varieties include:

- Typica: One of the oldest Arabica varieties, known for its excellent cup quality but low yield.

- Bourbon: A natural mutation of Typica, offering good cup quality and slightly higher yields.

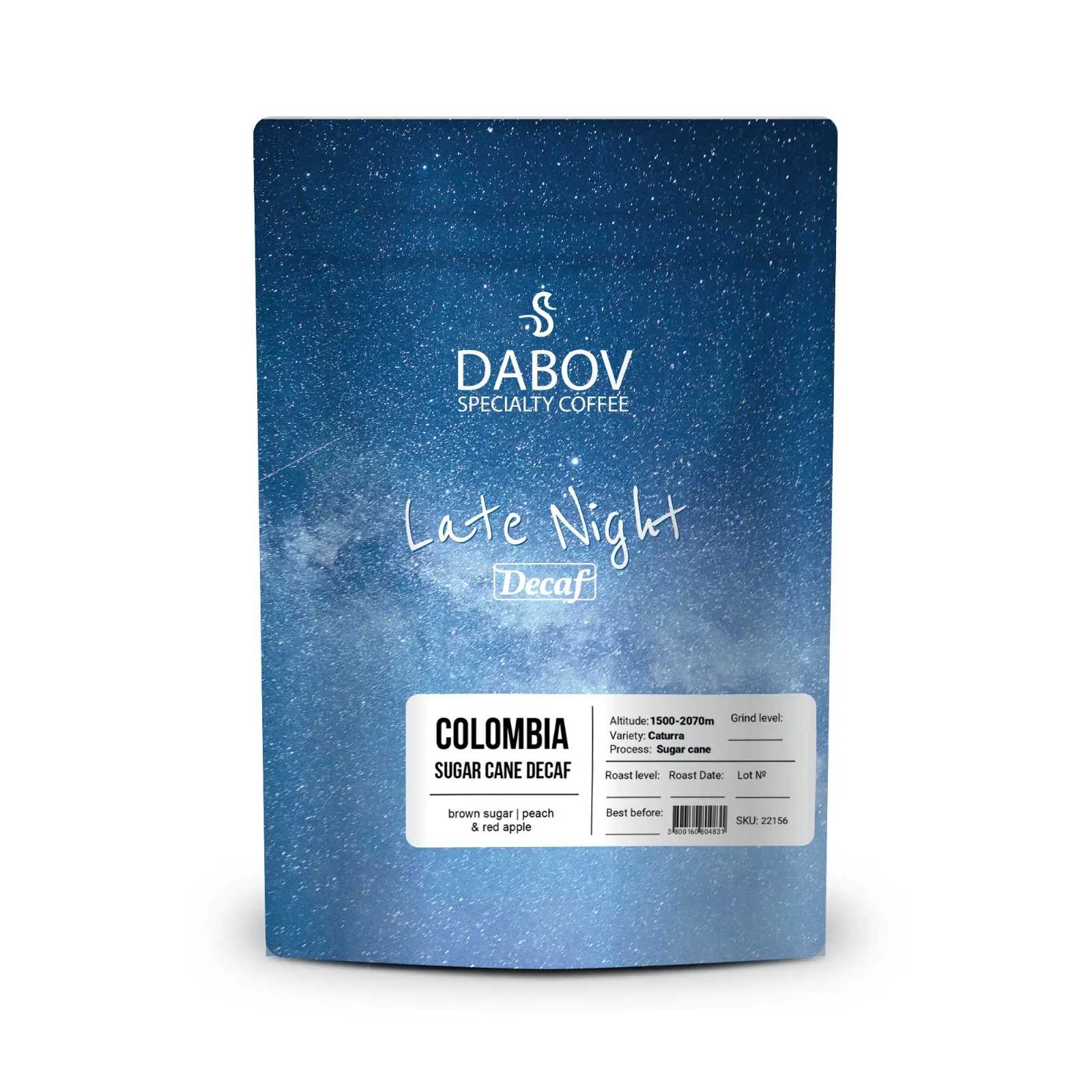

- Caturra: A dwarf mutation of Bourbon, popular for its higher yield and good cup quality.

- Gesha/Geisha: A highly prized variety known for its exceptional flavor profile and high market value.

Robusta coffee, or Coffea canephora, makes up the remaining 30-40% of global production. It's hardier than Arabica, resistant to diseases, and can grow at lower altitudes. Robusta has a stronger, more bitter taste and contains about twice the caffeine of Arabica. It's often used in espresso blends and instant coffee production.

Beyond these main types, the coffee market also recognizes various classifications based on processing methods, origin, and certifications:

- Washed/Wet Processed: Coffee cherries are depulped and fermented before drying, resulting in a clean, bright flavor profile.

- Natural/Dry Processed: Whole coffee cherries are dried with the fruit intact, producing a sweeter, more complex flavor.

- Honey/Pulped Natural: A method between washed and natural, where some mucilage is left on the bean during drying.

Origin-specific coffees, such as Colombian Supremo, Kenya AA, or Ethiopian Yirgacheffe, command their own market segments and often trade at premiums due to their distinctive flavor profiles and reputations.

Certified coffees represent another important category in the market. These include:

- Organic: Certified to be grown without synthetic pesticides or fertilizers.

- Fair Trade: Produced by farmers who are guaranteed a minimum price and adhere to certain social and environmental standards.

- Rainforest Alliance: Meets criteria for environmental and social sustainability.

- Bird Friendly: Certified by the Smithsonian Migratory Bird Center to provide good bird habitats.

The specialty coffee market has also given rise to micro-lot and single-origin coffees, which are highly prized for their unique flavor profiles and traceability. These coffees often bypass traditional commodity markets and are traded directly between roasters and producers.

Understanding the characteristics and market dynamics of these various coffee types is crucial for anyone involved in coffee trading. Each type has its own supply and demand patterns, price premiums, and target markets. As consumer preferences continue to evolve, particularly with the growth of the specialty coffee sector, staying informed about emerging coffee varieties and processing methods is essential for success in the coffee trade.

How to Get Started in Coffee Trading

Entering the world of coffee trading can be an exciting yet challenging endeavor. Whether you're a budding entrepreneur looking to start a coffee import business or an established company seeking to diversify into coffee trading, there are several key steps and considerations to keep in mind.

- Educate Yourself: Before diving in, it's crucial to gain a comprehensive understanding of the coffee industry. This includes learning about coffee varieties, processing methods, quality grading, and market dynamics. Consider taking courses offered by organizations like the Specialty Coffee Association (SCA) or attending industry conferences and trade shows.

- Identify Your Niche: The coffee market is diverse, ranging from bulk commodity trading to specialty micro-lots. Determine where you want to position yourself. Are you interested in high-volume, lower-margin commodity trading, or do you want to focus on specialty coffee with higher margins but lower volumes?

- Develop Industry Connections: Networking is crucial in the coffee industry. Attend coffee events, join industry associations, and connect with potential suppliers and customers. Building relationships with producers, exporters, and other traders can provide valuable insights and opportunities.

- Understand Regulations and Compliance: Coffee trading involves navigating complex international trade regulations. Familiarize yourself with import/export laws, customs procedures, and food safety regulations in both producing and consuming countries. Consider consulting with a trade lawyer or customs broker.

- Secure Financing: Coffee trading often requires significant capital, both for purchasing coffee and managing cash flow during shipping and storage. Explore financing options, including trade finance from banks or alternative lenders specializing in commodity trading.

- Establish Quality Control Processes: Quality is paramount in coffee trading. Develop relationships with certified Q Graders for cupping and grading. Consider investing in sample roasting equipment to assess coffee quality in-house.

- Manage Risk: Coffee prices can be highly volatile. Learn about risk management strategies, including hedging using futures contracts. Consider working with a commodities broker to develop appropriate risk management strategies.

- Develop a Sourcing Strategy: Building reliable sourcing channels is crucial. This might involve direct relationships with producers, working with trusted exporters, or partnering with origin-based trading companies. Consider visiting coffee-producing regions to build direct relationships and understand local conditions.

- Establish a Distribution Network: On the selling side, identify your target customers and develop strategies to reach them. This could include selling to roasters, retailers, or other traders.

- Invest in Technology: Utilize trading platforms and software to manage inventory, track shipments, and analyze market data. Consider blockchain solutions for supply chain traceability, which is increasingly important in the specialty coffee sector.

- Focus on Sustainability: With growing consumer awareness, consider how you can incorporate sustainability into your trading practices. This might include sourcing certified coffees or developing direct trade relationships that prioritize farmer welfare and environmental stewardship.

- Start Small and Scale: Consider starting with smaller volumes to learn the ropes before scaling up. This allows you to understand the practical aspects of coffee trading and build credibility in the industry.

- Continuous Learning: The coffee industry is constantly evolving. Stay informed about market trends, new origins, processing methods, and changing consumer preferences. Continuous education and adaptation are key to long-term success in coffee trading.

Remember, success in coffee trading often comes from a combination of market knowledge, quality relationships, and a passion for the product. It's a complex field that requires patience, perseverance, and a willingness to continually learn and adapt. By following these steps and maintaining a commitment to quality and ethical practices, you can build a strong foundation for a successful career in coffee trading.

Coffee Economics

Economic Importance of Coffee

Coffee's economic significance extends far beyond its role as a beloved beverage. As one of the world's most traded commodities, coffee plays a crucial role in the global economy, particularly for developing countries where it is a primary export crop. Understanding the economic importance of coffee requires examining its impact at various levels, from individual farmers to national economies and global trade dynamics.

At the micro-level, coffee cultivation provides livelihoods for an estimated 25 million farmers worldwide, predominantly smallholders in developing countries. For these farmers, coffee often represents their primary source of cash income, crucial for accessing education, healthcare, and other essential services. The coffee value chain also creates employment opportunities in processing, transportation, and marketing, contributing to rural development and poverty alleviation in producing regions.

On a national scale, coffee exports are a significant source of foreign exchange earnings for many producing countries. For instance, in countries like Ethiopia, Uganda, and Honduras, coffee exports can account for a substantial portion of total export revenues. This foreign exchange is crucial for these nations to finance imports, service external debt, and fund development projects. The coffee sector also contributes significantly to GDP in many producing countries, with its economic impact extending to related industries such as agriculture, logistics, and financial services.

The global coffee industry, encompassing production, processing, trading, and retail, is estimated to be worth over $200 billion annually. This vast economic activity generates employment and business opportunities across the entire value chain, from farm laborers to baristas in consuming countries. The industry's economic footprint extends to ancillary sectors such as packaging, machinery manufacturing, and marketing services.

Coffee's economic importance is also evident in its role in international trade. As a major commodity in global markets, coffee trading influences currency markets, particularly for major producing countries. The performance of coffee futures can impact broader commodity indices, affecting investment flows and economic sentiment.

Moreover, the coffee industry has been at the forefront of discussions on sustainable trade and ethical consumption. Initiatives like Fair Trade and direct trade models have sought to address economic inequalities in the coffee value chain, aiming to ensure more equitable distribution of profits and promote sustainable development in producing regions.

The specialty coffee movement has added another dimension to coffee's economic importance. By emphasizing quality and origin, this sector has created new value propositions and price premiums, potentially offering higher returns to producers. It has also spawned a vibrant ecosystem of specialty cafes, roasters, and related businesses in consuming countries, contributing to urban economies and cultural landscapes.

However, the coffee economy also faces significant challenges. Price volatility in the global coffee market can have severe impacts on producing countries and farmers. When prices fall below production costs, it can lead to economic hardship, migration, and even shifts to alternative crops, including illicit ones. Climate change poses another major threat, with changing weather patterns potentially altering the geography of coffee production and disrupting established economic patterns.

In response to these challenges, there's growing recognition of the need for a more sustainable and equitable coffee economy. This includes efforts to increase farmer resilience through diversification, improve access to finance and technology, and develop more direct and transparent supply chains. Innovations in areas like blockchain technology for traceability and climate-smart agriculture are being explored to address economic and environmental sustainability in the coffee sector.

Understanding the multifaceted economic importance of coffee is crucial for anyone involved in the industry, from traders and roasters to policymakers and consumers. It underscores the need for responsible practices that consider the broader economic impacts of coffee trade decisions. As the industry continues to evolve, balancing economic growth with sustainability and equity will be key to ensuring the long-term viability and positive impact of the global coffee economy.

Price Volatility in the Coffee Market

Price volatility is a defining characteristic of the global coffee market, presenting both opportunities and challenges for stakeholders across the value chain. Understanding the causes and implications of this volatility is crucial for anyone involved in coffee trading or production.

The coffee market is subject to significant price fluctuations, often more extreme than those seen in other agricultural commodities. These price swings can occur over various time frames, from daily movements to long-term trends spanning years. The primary benchmark for Arabica coffee prices is the "C" price, traded on the Intercontinental Exchange (ICE), while Robusta prices are referenced to the London International Financial Futures and Options Exchange (LIFFE).

Several factors contribute to coffee price volatility:

- Weather Conditions: Coffee is highly sensitive to weather patterns. Frost, drought, or excessive rainfall in major producing regions can significantly impact crop yields and, consequently, prices. For instance, a severe frost in Brazil, the world's largest coffee producer, can lead to global price spikes.

- Production Cycles: Coffee trees have a biennial bearing pattern, alternating between high and low yield years. This natural cycle contributes to supply fluctuations and price volatility.

- Currency Fluctuations: As coffee is typically traded in US dollars, exchange rate movements in producing countries can affect the local value of coffee exports and influence production decisions.

- Speculative Trading: Coffee futures are subject to speculative trading by non-commercial traders, which can amplify price movements beyond fundamental supply and demand factors.

- Geopolitical Events: Political instability, changes in trade policies, or economic crises in major producing or consuming countries can impact coffee prices.

- Changes in Consumption Patterns: Shifts in consumer preferences or economic conditions in major consuming markets can affect demand and prices.

- Stock Levels: The amount of coffee held in certified warehouses and by roasters can influence market sentiment and prices.

The implications of price volatility are far-reaching:

For Producers: Price volatility creates significant income uncertainty for coffee farmers. When prices fall below production costs, it can lead to financial hardship, reduced investment in farms, and even abandonment of coffee cultivation. Conversely, price spikes can incentivize increased production, potentially leading to oversupply and subsequent price crashes.

For Traders and Roasters: Volatility complicates inventory management and pricing strategies. It necessitates sophisticated risk management approaches, including the use of futures contracts and options for hedging.

For Consumers: While retail coffee prices tend to be less volatile than commodity prices, significant and prolonged price movements can eventually impact consumer prices and consumption patterns.

For Producing Countries: Coffee price volatility can affect foreign exchange earnings, fiscal revenues, and overall economic stability in countries heavily dependent on coffee exports.

Managing coffee price volatility involves various strategies:

- Hedging: Using futures and options contracts to lock in prices and manage risk.

- Diversification: For producers, this might involve cultivating other crops alongside coffee. For traders and roasters, it could mean sourcing from multiple origins.

- Long-term Contracts: Some buyers engage in long-term purchasing agreements with fixed or minimum prices to provide stability for producers.

- Price Risk Management Programs: Some producing countries have implemented national programs to help farmers manage price risks.

- Value Addition: Focusing on quality improvements, certifications, or processing to command price premiums and reduce exposure to commodity price fluctuations.

- Market Information Systems: Improving access to market information for producers to make more informed decisions.

- Financial Instruments: Development of innovative financial products like weather index insurance for farmers.

The specialty coffee sector has emerged partly as a response to commodity price volatility, emphasizing quality and direct relationships to decouple prices from the commodity market. However, even this segment is not immune to broader market forces.

Understanding and managing price volatility is a critical skill for anyone involved in the coffee industry. It requires a combination of market knowledge, risk management expertise, and adaptability. As the coffee market continues to evolve, developing effective strategies to navigate price volatility will remain a key challenge and opportunity for industry stakeholders.

Fair Trade and Sustainability in Coffee Economics

Fair Trade and sustainability have become increasingly prominent concepts in coffee economics, reshaping trade practices and consumer expectations across the industry. These movements aim to address long-standing issues of economic inequality and environmental degradation in the coffee supply chain, offering alternative models that prioritize social and ecological sustainability alongside economic viability.

Fair Trade in coffee emerged as a response to the persistent poverty and economic vulnerability faced by many coffee farmers, particularly smallholders in developing countries. The core principle of Fair Trade is to ensure a minimum price for coffee that covers the cost of sustainable production. This minimum price acts as a safety net when market prices fall below sustainable levels. Additionally, Fair Trade includes a premium paid on top of the market or minimum price, which is invested in community development projects chosen by producer organizations.

Key aspects of Fair Trade in coffee include:

- Guaranteed Minimum Price: This provides a degree of income stability for farmers, helping to mitigate the impacts of market volatility.

- Social Premium: The additional premium funds community projects such as education, healthcare, and infrastructure improvements.

- Pre-financing: Fair Trade standards require buyers to provide pre-financing to producers if requested, helping to alleviate cash flow challenges.

- Long-term Relationships: Fair Trade encourages longer-term trading partnerships, providing more stability for producers.

- Environmental Standards: Fair Trade certification includes criteria for environmental protection and sustainable farming practices.

The impact of Fair Trade on coffee economics is multifaceted. For producers, it can provide higher and more stable incomes, improved access to credit, and stronger producer organizations. For consumers, it offers a way to make more ethical purchasing decisions. However, critics argue that the impact is limited due to oversupply of Fair Trade certified coffee and that the system may not always reach the most marginalized farmers.

Sustainability in coffee economics extends beyond Fair Trade, encompassing a broader range of environmental, social, and economic considerations. Key aspects include:

- Environmental Sustainability: This involves practices such as shade-grown coffee cultivation, water conservation, and reduction of chemical inputs. Certifications like Rainforest Alliance and Bird Friendly focus on these aspects.

- Climate Resilience: With climate change threatening coffee production in many regions, there's increasing focus on developing climate-resilient coffee varieties and farming practices.

- Economic Viability: Ensuring that coffee farming remains a viable livelihood option, which includes addressing issues of productivity, quality improvement, and market access.

- Social Sustainability: This encompasses fair labor practices, gender equity, and community development in coffee-producing regions.

- Supply Chain Transparency: Increasing traceability and transparency in the coffee supply chain to support sustainability claims and build consumer trust.

The economics of sustainability in coffee are complex. While sustainable and certified coffees often command price premiums, the costs of certification and compliance can be significant. There's ongoing debate about how to fairly distribute the costs and benefits of sustainability initiatives across the supply chain.

The rise of direct trade models represents another evolution in sustainable coffee economics. These models often involve direct relationships between roasters and producers, bypassing traditional supply chain intermediaries. While not always formally certified, direct trade often emphasizes quality, sustainability, and fair pricing.

The impact of these sustainability initiatives on coffee economics is significant:

- Price Differentiation: Sustainable and certified coffees often achieve higher prices, potentially offering better returns to producers.

- Market Access: Sustainability certifications can provide access to niche markets and premium buyers.

- Risk Mitigation: Sustainable farming practices can help mitigate environmental risks and improve long-term farm viability.

- Consumer Behavior: Growing consumer awareness of sustainability issues is shaping purchasing decisions and brand loyalty.

- Investment Flows: Sustainability considerations are increasingly influencing investment decisions in the coffee sector, from farm-level financing to corporate acquisitions.

Looking ahead, the integration of sustainability into coffee economics faces several challenges and opportunities:

- Scaling Impact: Finding ways to extend the benefits of sustainable practices to a larger proportion of coffee farmers, particularly the most marginalized.

- Measuring Outcomes: Developing better metrics and transparency to demonstrate the real-world impacts of sustainability initiatives.

- Climate Adaptation: Addressing the growing threat of climate change to coffee production through research, innovation, and support for farmer adaptation.

- Technology Integration: Leveraging digital technologies for improved traceability, market access, and sustainability monitoring.

- Aligning Incentives: Creating economic models that better align the interests of all stakeholders in the coffee value chain around sustainability goals.

As the coffee industry continues to evolve, the principles of Fair Trade and sustainability are likely to play an increasingly central role in shaping coffee economics. Success will depend on finding models that can deliver meaningful social and environmental benefits while ensuring economic viability for all stakeholders in the coffee value chain.

Challenges in International Coffee Trading

Environmental Challenges

The international coffee trade faces significant environmental challenges that threaten the long-term sustainability of coffee production and the livelihoods of millions who depend on it. These challenges are multifaceted, ranging from the immediate impacts of climate change to broader issues of biodiversity loss and resource depletion.

Climate Change:Climate change stands as the most pressing environmental challenge facing the coffee industry. Coffee plants, particularly Arabica, are highly sensitive to temperature changes and altered precipitation patterns. The impacts of climate change on coffee production are already evident and are expected to intensify:

- Shifting Growing Regions: Rising temperatures are forcing coffee cultivation to move to higher altitudes or more temperate latitudes. This shift can lead to deforestation as farmers seek new suitable land.

- Increased Pest and Disease Pressure: Warmer temperatures and changing humidity levels create favorable conditions for coffee pests and diseases like coffee berry borer and coffee leaf rust.

- Erratic Weather Patterns: More frequent extreme weather events, such as droughts, floods, and frosts, can devastate coffee crops and increase yield volatility.

- Quality Issues: Climate stress can affect coffee bean development, potentially impacting flavor profiles and overall quality.

- Reduced Suitable Land: Some studies predict that the area suitable for coffee cultivation could decrease by up to 50% by 2050 due to climate change.

Deforestation:Coffee cultivation has been a significant driver of deforestation in many tropical regions. The expansion of coffee farms, particularly sun-grown coffee plantations, has led to the clearing of forests, resulting in:

- Biodiversity Loss: Many coffee-growing regions are biodiversity hotspots. Deforestation threatens countless plant and animal species.

- Soil Degradation: Forest clearing can lead to soil erosion and loss of soil fertility, impacting long-term agricultural productivity.

- Carbon Emissions: Deforestation contributes significantly to greenhouse gas emissions, exacerbating climate change.

Water Issues:Coffee production can have significant impacts on water resources:

- Water Pollution: Wet processing of coffee cherries can lead to water pollution if wastewater is not properly managed.

- Water Scarcity: In some regions, irrigation for coffee competes with other water needs, potentially leading to conflicts over water resources.

- Altered Hydrological Cycles: Deforestation and land-use changes for coffee cultivation can affect local water cycles.

Soil Degradation:Intensive coffee farming practices can lead to soil degradation:

- Erosion: Especially in areas where coffee is grown on steep slopes without proper soil conservation measures.

- Loss of Soil Fertility: Monoculture coffee farming and overuse of chemical inputs can deplete soil nutrients and harm soil microbiomes.

- Soil Pollution: Overuse of agrochemicals can lead to soil contamination.

Addressing these environmental challenges requires a multifaceted approach:

- Sustainable Farming Practices: Promoting agroforestry systems, organic farming, and other sustainable agricultural practices that protect biodiversity and soil health.