The Economics of Coffee Price Stabilization Programs

Coffee is not just a beverage; it’s a lifeline for millions. Price volatility threatens the livelihoods of farmers, the affordability for consumers, and the stability of the coffee industry at large. Coffee price stabilization programs play a crucial role in mitigating these fluctuations, ensuring fair economic practices and sustainable growth. Explore how climate change and market demand influence prices, and understand how programs like crop insurance and buffer stock schemes can safeguard stakeholders. From successful models in Colombia and Brazil to lessons learned from failed initiatives, uncover the complex dynamics behind coffee economics. Arm yourself with insights from this essential guide to navigate the evolving coffee market landscape.

In the intricate world of global commodities, coffee stands as a titan, its aromatic beans fueling economies and energizing millions worldwide. Yet, beneath the surface of our daily brew lies a complex economic landscape, one where price volatility can send ripples through entire nations and impact livelihoods across continents. At the heart of this economic conundrum are coffee price stabilization programs, sophisticated mechanisms designed to bring order to the chaotic world of coffee pricing. These programs are not just economic tools; they are lifelines for farmers, safeguards for consumers, and stabilizing forces for the entire coffee industry.

The importance of coffee as a global commodity cannot be overstated. It's the second most traded commodity after oil, with millions of farmers depending on coffee production for their livelihoods. The coffee market is notoriously volatile, with prices subject to wild swings that can devastate farming communities or lead to windfall profits. This volatility doesn't just affect farmers; it ripples through the entire supply chain, impacting roasters, distributors, and ultimately, the price we pay for our daily cup. Coffee price stabilization programs aim to mitigate these fluctuations, providing a buffer against the harsh realities of an unpredictable market.

Understanding Coffee Price Volatility

To truly grasp the significance of price stabilization programs, we must first delve into the factors that contribute to coffee price volatility. The coffee market is a complex ecosystem, influenced by a myriad of interconnected factors that can send prices soaring or plummeting with little warning.

Factors Influencing Coffee Prices

Climate change stands as one of the most significant drivers of price volatility in the coffee market. Coffee plants are notoriously sensitive to environmental conditions, requiring specific temperature ranges and rainfall patterns to thrive. As global temperatures rise and weather patterns become increasingly erratic, coffee-growing regions face unprecedented challenges. Droughts can decimate crops, leading to supply shortages and price spikes. Conversely, excessive rainfall can lead to fungal diseases like coffee leaf rust, which can wipe out entire harvests. The unpredictability of these climatic events makes it difficult for farmers to plan and invest in their crops, contributing to long-term instability in the market.

Market demand is another crucial factor in coffee price volatility. Consumer preferences are constantly evolving, with trends like specialty coffee and sustainability-focused products reshaping the industry landscape. When demand for a particular type of coffee surges, prices can skyrocket as roasters compete for limited supplies. Conversely, shifts away from certain varieties or origins can leave farmers struggling to sell their crops at a profit. Global economic conditions also play a role, with recessions potentially dampening demand and expansions fueling increased consumption. The interplay between these demand-side factors and supply-side constraints creates a perfect storm for price volatility.

The Impact of Price Volatility on Stakeholders

For coffee farmers, price volatility can be the difference between prosperity and poverty. When prices are high, farmers may invest in their farms, improving infrastructure and planting new trees. However, the long maturation period of coffee plants (typically 3-5 years) means that by the time these new plants start producing, the market may have shifted dramatically. Low prices can force farmers to neglect their crops, leading to reduced quality and yield in subsequent years. This creates a vicious cycle of boom and bust that can trap farming communities in poverty. Moreover, price uncertainty makes it difficult for farmers to access credit, further limiting their ability to invest in their farms and improve their livelihoods.

Consumers feel the impact of price volatility at the cash register and in their cups. When coffee prices spike, roasters and retailers may be forced to raise prices, potentially leading to reduced consumption. However, the relationship between global coffee prices and retail prices is not always direct. Many large coffee companies use hedging strategies to buffer against short-term price fluctuations, meaning that retail prices may lag behind market movements. This can create confusion for consumers, who may not understand why prices remain high even as market reports show falling coffee prices.

Roasters and suppliers occupy a precarious middle ground in the coffee supply chain. They must balance the needs of farmers with the demands of consumers while navigating the unpredictable waters of the global coffee market. Price volatility can make it challenging to maintain consistent profit margins and plan for long-term growth. When prices spike, roasters may be forced to choose between absorbing the cost increase or passing it on to consumers, potentially risking market share. Conversely, when prices plummet, roasters may face pressure to lower their prices, even as they seek to maintain quality and support their farmer partners.

Overview of Coffee Price Stabilization Programs

Coffee price stabilization programs are complex economic interventions designed to bring stability to an inherently volatile market. At their core, these programs aim to reduce the amplitude of price swings, providing a more predictable economic environment for all stakeholders in the coffee industry.

What are Coffee Price Stabilization Programs?

Coffee price stabilization programs are systematic efforts to moderate the extreme highs and lows of coffee prices in the global market. These programs can take many forms, from government-led initiatives to industry-wide collaborations. The primary goal is to create a more stable and predictable pricing environment, which can benefit farmers, roasters, and consumers alike. By smoothing out the peaks and valleys of coffee prices, these programs aim to create a more sustainable and equitable coffee industry.

The mechanisms behind price stabilization programs can be complex, often involving a combination of market interventions, financial instruments, and policy measures. Some programs focus on establishing price floors to protect farmers from ruinously low prices, while others may involve buffer stock schemes to absorb excess supply during bumper crops. More sophisticated programs might incorporate futures contracts and other financial derivatives to help stakeholders manage price risk.

Historical Context and Development

The concept of price stabilization in commodity markets is not new, with roots tracing back to the early 20th century. In the coffee industry, one of the most significant early attempts at price stabilization was the International Coffee Agreement (ICA) of 1962. This agreement, which lasted until 1989, established a system of export quotas aimed at maintaining coffee prices within a predetermined range. While the ICA had some success in stabilizing prices, it ultimately collapsed due to changing market conditions and disagreements among member countries.

In the wake of the ICA's collapse, many coffee-producing countries developed their own national price stabilization programs. Colombia's National Federation of Coffee Growers (FNC) is often cited as a successful example of a national program. The FNC has operated a price guarantee system for decades, ensuring that Colombian farmers receive a minimum price for their coffee regardless of market conditions. This system has helped to maintain the quality and reputation of Colombian coffee while providing a measure of economic security for farmers.

Brazil, the world's largest coffee producer, has taken a different approach to price stabilization. The Brazilian government has historically intervened in the coffee market through a combination of stockpiling, export controls, and subsidies. While these measures have been controversial at times, they have played a significant role in shaping the global coffee market.

The legislative and policy frameworks governing coffee price stabilization programs vary widely depending on the country and the specific program. In some cases, these programs are enshrined in national law, with dedicated agencies responsible for their implementation. In others, they may be more informal arrangements between industry stakeholders. International organizations like the International Coffee Organization (ICO) play a crucial role in coordinating global efforts and providing a forum for dialogue between producing and consuming countries.

Mechanisms of Coffee Price Stabilization

The mechanisms employed in coffee price stabilization programs are diverse and often tailored to the specific needs and conditions of different coffee-producing regions. These mechanisms range from direct market interventions to sophisticated financial instruments, each with its own strengths and limitations.

Price Support Mechanisms

Minimum price guarantees are a cornerstone of many coffee price stabilization programs. These guarantees establish a price floor below which farmers are assured they will not have to sell their coffee. The implementation of minimum price guarantees can vary, but typically involves a government agency or industry organization agreeing to purchase coffee at the guaranteed price if market prices fall below this level. This provides a safety net for farmers, ensuring a basic level of income even in times of market downturns.

The effectiveness of minimum price guarantees depends on several factors, including the level at which the guarantee is set and the financial resources available to support the program. If set too low, the guarantee may not provide meaningful protection for farmers. If set too high, it may create market distortions and prove unsustainable in the long term. Successful programs often involve a delicate balancing act, with the guaranteed price adjusted periodically to reflect changing market conditions and production costs.

Buffer stock schemes represent another important tool in the price stabilization toolkit. These schemes involve the creation of a centralized stockpile of coffee that can be used to influence market supply and, by extension, prices. When prices are low, the buffer stock agency purchases coffee to reduce market supply and support prices. Conversely, when prices are high, coffee from the buffer stock can be released to increase supply and moderate price increases.

The operation of buffer stock schemes requires significant financial resources and careful management. The agency responsible for the buffer stock must have the expertise to accurately gauge market conditions and the timing of interventions. Moreover, the storage and maintenance of large coffee stockpiles present logistical challenges, as coffee is a perishable commodity with a limited shelf life. Despite these challenges, well-managed buffer stock schemes can play a crucial role in smoothing out short-term price fluctuations and providing a stabilizing influence on the market.

Insurance and Risk Management Tools

Crop insurance is an increasingly important component of coffee price stabilization efforts. While not directly influencing market prices, crop insurance helps to stabilize farmer incomes by providing protection against crop failures due to natural disasters, pests, or diseases. This financial safety net can encourage farmers to invest in their farms and adopt sustainable practices, knowing that they have some protection against catastrophic losses.

The development of effective crop insurance programs for coffee farmers faces several challenges. Coffee is often grown in remote, mountainous regions where assessing crop damage can be difficult. Moreover, the long production cycle of coffee plants means that insurance must cover potential losses over several years. Despite these challenges, innovative approaches, including index-based insurance that pays out based on predetermined triggers like rainfall levels, are making crop insurance more accessible to coffee farmers.

Futures contracts play a crucial role in modern coffee price stabilization efforts. These financial instruments allow coffee producers, roasters, and traders to lock in prices for future deliveries, providing a hedge against price volatility. By using futures contracts, stakeholders can gain more certainty about their future revenues or costs, allowing for better long-term planning and investment decisions.

The use of futures contracts in the coffee industry has become increasingly sophisticated, with a range of derivative products now available. While these instruments can provide valuable risk management tools, they also introduce new complexities and potential risks. Education and capacity building are crucial to ensure that all stakeholders, particularly smallholder farmers, can effectively utilize these financial tools to their advantage.

Case Studies of Successful Coffee Price Stabilization Programs

Examining real-world examples of coffee price stabilization programs provides valuable insights into their potential benefits and challenges. While no program is perfect, several countries have implemented strategies that have significantly improved the stability and sustainability of their coffee sectors.

Examples from Producing Countries

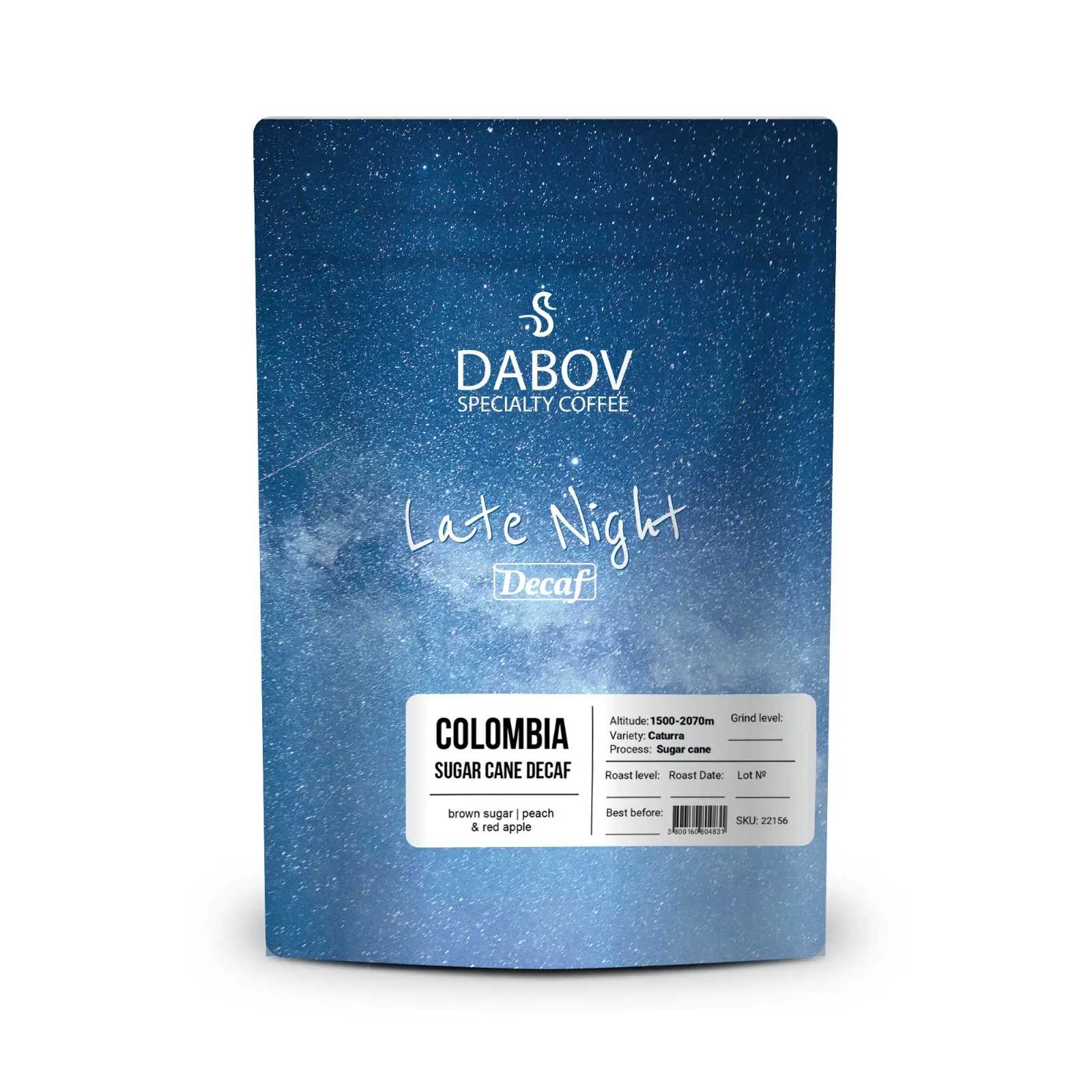

Colombia's National Federation of Coffee Growers (FNC) offers one of the most comprehensive and long-standing examples of a successful coffee price stabilization program. The FNC's price guarantee system, which has been in place for decades, ensures that Colombian coffee farmers receive a minimum price for their beans, regardless of market conditions. This system is funded through a combination of export taxes and government support, creating a self-sustaining mechanism that has helped maintain the quality and reputation of Colombian coffee.

The FNC's program goes beyond simple price guarantees. It includes extensive support services for farmers, including technical assistance, research and development, and marketing support. This holistic approach has helped Colombian coffee maintain its premium position in the global market, even in the face of increasing competition from other producing countries. The stability provided by the FNC's programs has allowed farmers to invest in quality improvements and sustainable practices, further enhancing the value of Colombian coffee.

Brazil, as the world's largest coffee producer, has taken a different approach to price stabilization. The Brazilian government has historically intervened in the coffee market through a combination of stockpiling, export controls, and subsidies. While these measures have been controversial at times, they have played a significant role in shaping the global coffee market and providing a measure of stability for Brazilian farmers.

One of Brazil's key strategies has been the use of buffer stocks to absorb excess supply during bumper crops and release coffee during times of scarcity. This approach has helped to moderate price swings and maintain Brazil's dominant position in the global coffee market. Additionally, Brazil has invested heavily in research and development, leading to significant improvements in productivity and resilience to climate change. These efforts have helped to stabilize production and reduce the impact of weather-related supply shocks on prices.

Lessons Learned from Failed Programs

While there have been many successes in coffee price stabilization, there have also been notable failures that provide important lessons. One of the most significant examples is the collapse of the International Coffee Agreement (ICA) in 1989. The ICA, which had been in place since 1962, used a system of export quotas to maintain coffee prices within a predetermined range. While initially successful, the system ultimately proved unsustainable due to changing market conditions and disagreements among member countries.

The failure of the ICA highlighted the dangers of overregulation in commodity markets. The rigid quota system created incentives for countries to circumvent the rules, leading to the growth of a parallel market for non-quota coffee. Moreover, the artificial price stability created by the ICA may have discouraged necessary adjustments in production and consumption patterns, ultimately contributing to the severe price crash that followed the agreement's collapse.

Another important lesson from failed programs is the need for flexibility and adaptability. Price stabilization mechanisms that are too rigid or fail to account for changing market conditions can quickly become ineffective or even counterproductive. Successful programs must be able to evolve in response to shifts in global supply and demand, changes in consumer preferences, and emerging challenges like climate change.

Economic Impacts of Price Stabilization Programs

The economic impacts of coffee price stabilization programs extend far beyond the immediate effect on market prices. These programs can have profound implications for the entire coffee value chain, from smallholder farmers to multinational corporations.

Effects on Coffee Producers

One of the most significant benefits of price stabilization programs for coffee producers is increased income stability. By reducing the amplitude of price swings, these programs provide farmers with a more predictable economic environment. This stability can have far-reaching effects on farming communities. With more reliable incomes, farmers are better able to plan for the future, invest in their farms, and improve their overall quality of life.

Income stability can lead to a virtuous cycle of investment and improvement in coffee quality. When farmers are confident that they will receive a fair price for their coffee, they are more likely to invest in better farming practices, new plant varieties, and post-harvest processing equipment. These investments can lead to higher quality coffee, which in turn commands higher prices in the market. This upward spiral can help lift entire communities out of poverty and create a more sustainable coffee industry.

Moreover, price stabilization programs can provide a buffer against external shocks, such as extreme weather events or global economic crises. By ensuring a minimum level of income even in difficult times, these programs can help prevent the mass exodus of farmers from coffee production during market downturns. This continuity is crucial for maintaining the long-term viability of coffee-growing regions and preserving valuable agricultural knowledge and traditions.

Impact on the Global Coffee Market

The effects of price stabilization programs extend beyond individual farmers to shape the dynamics of the global coffee market. By moderating price volatility, these programs can create a more stable and predictable environment for all stakeholders in the coffee industry. This stability can encourage long-term investment and planning throughout the supply chain, from farm to cup.

For consumers, price stabilization programs can lead to more consistent pricing and availability of coffee. While these programs may not completely eliminate price fluctuations at the retail level, they can help to smooth out the most extreme price spikes and dips. This can benefit both consumers, who are less likely to face sudden, dramatic price increases, and retailers, who can more accurately forecast their costs and pricing strategies.

However, it's important to note that price stabilization programs can also have unintended consequences on the global market. If not carefully designed and implemented, these programs can create market distortions, potentially leading to overproduction or underproduction of coffee. They may also impact the competitiveness of different coffee-producing regions, potentially altering global trade patterns. Balancing the need for stability with the importance of market signals is a key challenge in designing effective price stabilization programs.

Coffee Business Tips Related to Price Stabilization

For businesses operating in the coffee industry, understanding and adapting to price stabilization programs is crucial for long-term success. Here are some strategic considerations and tips for navigating this complex landscape.

Strategic Planning

Adapting business models to account for price stabilization programs requires a nuanced understanding of how these programs operate and their potential impacts on the market. One key strategy is to diversify sourcing relationships. By working with producers in different regions with varying price stabilization mechanisms, businesses can hedge against the risks associated with any single program or market.

Another important consideration is the use of financial instruments to manage price risk. Futures contracts, options, and other derivatives can be powerful tools for locking in prices and protecting against volatility. However, these instruments require expertise to use effectively. Investing in financial literacy and risk management capabilities can pay significant dividends for coffee businesses of all sizes.

Long-term relationship building with producers is another crucial strategy. By developing direct, sustainable relationships with coffee farmers, businesses can gain more control over their supply chain and potentially negotiate more stable pricing arrangements. These relationships can also provide valuable insights into local market conditions and the effectiveness of price stabilization programs on the ground.

Emphasizing Quality Over Quantity

In a market influenced by price stabilization programs, emphasizing quality can be a powerful differentiator. By focusing on premium, specialty coffees, businesses can potentially insulate themselves from some of the price pressures in the commodity market. This strategy aligns well with the goals of many price stabilization programs, which often aim to encourage quality improvements among producers.

Building a strong brand based on quality and sustainability can help businesses command premium prices and build customer loyalty. This approach requires a commitment to sourcing exceptional coffees and telling the stories behind them. Transparency about sourcing practices and the impact of price stabilization programs can be a powerful marketing tool, appealing to consumers who are increasingly interested in the ethics and sustainability of their coffee.

Investing in staff training and education is crucial for businesses pursuing a quality-focused strategy. Baristas, roasters, and other staff should be well-versed in the nuances of coffee quality and the factors that influence it, including the role of price stabilization programs in supporting sustainable production. This knowledge can be shared with customers, creating a more engaged and loyal customer base.

Future Trends and Challenges in Coffee Price Stabilization

As the coffee industry continues to evolve, so too must the approaches to price stabilization. Several key trends and challenges are likely to shape the future of these programs.

Climate Change and Economic Sustainability

Climate change represents one of the most significant challenges to the coffee industry and, by extension, to price stabilization efforts. Rising temperatures, changing rainfall patterns, and increased frequency of extreme weather events are already impacting coffee production in many regions. These changes can lead to reduced yields, lower quality, and increased susceptibility to pests and diseases, all of which can contribute to price volatility.

Future price stabilization programs will need to incorporate climate resilience as a core component. This may involve supporting farmers in transitioning to more resilient coffee varieties, implementing agroforestry systems, or even relocating production to more suitable areas. The costs associated with these adaptations will need to be factored into price stabilization mechanisms to ensure their long-term viability.

Transitioning to sustainable practices is not just an environmental imperative; it's increasingly becoming an economic necessity. Consumers are demanding more sustainable coffee, and this trend is likely to intensify in the coming years. Price stabilization programs of the future may need to incorporate sustainability criteria, potentially offering premium prices for coffees produced using environmentally friendly methods.

Innovations in Price Stabilization

Emerging technologies are opening up new possibilities for coffee price stabilization. Blockchain technology, for example, has the potential to create more transparent and efficient supply chains, potentially reducing some of the information asymmetries that contribute to price volatility. Smart contracts built on blockchain platforms could automate certain aspects of price stabilization programs, reducing administrative costs and improving responsiveness to market conditions.

Big data and artificial intelligence are other areas with significant potential. These technologies could be used to develop more sophisticated price forecasting models, allowing for more precise and timely interventions in the market. They could also help in assessing the effectiveness of different stabilization strategies, leading to continual improvement of these programs.

Mobile technology is already playing a crucial role in connecting smallholder farmers to market information and financial services. Future price stabilization programs are likely to leverage these technologies even further, potentially offering real-time price information, mobile-based insurance products, and direct payment systems that bypass traditional intermediaries.

Conclusion

Coffee price stabilization programs represent a complex and evolving approach to managing one of the world's most important agricultural commodities. These programs, when well-designed and implemented, have the potential to create a more stable and sustainable coffee industry, benefiting stakeholders throughout the value chain.

From the income stability they provide to farmers to the more predictable business environment they create for roasters and retailers, the impacts of these programs are far-reaching. However, they also face significant challenges, from the complexities of global market dynamics to the looming threat of climate change.

As we look to the future, it's clear that coffee price stabilization programs will need to continue evolving. They must balance the need for market stability with the importance of market signals, incorporate new technologies and data-driven approaches, and address the pressing issues of sustainability and climate resilience.

For everyone involved in the coffee industry, from farmers to consumers, understanding the economics of coffee price stabilization is crucial. These programs shape the market in profound ways, influencing everything from the price of our daily cup to the livelihoods of millions of coffee farmers around the world.

Call to Action

As consumers, industry professionals, or simply coffee enthusiasts, we all have a role to play in supporting a more stable and sustainable coffee industry. Here are some ways you can engage with this important topic:

- Educate yourself: Continue learning about coffee economics and the impact of price stabilization programs. Stay informed about developments in the coffee industry and how they might affect pricing and availability.

- Support sustainable practices: Choose coffees that are produced sustainably and ethically. Look for certifications that indicate fair prices for farmers and environmentally friendly production methods.

- Engage with coffee businesses: Ask your local coffee shops and roasters about their sourcing practices and how they navigate price volatility. Your interest can encourage businesses to be more transparent and considerate in their sourcing decisions.

- Advocate for fair policies: Support policies and initiatives that promote fair trade and sustainable production in the coffee industry. This could involve contacting your representatives or supporting organizations that advocate for coffee farmers.

- Share your knowledge: Spread awareness about the complexities of coffee pricing and the importance of stability for coffee-producing communities. Engage in discussions with friends, family, and on social media about these issues.

By taking these steps, we can all contribute to a more stable, sustainable, and equitable coffee industry. Remember, every cup of coffee connects us to a global network of farmers, traders, roasters, and fellow consumers. Let's make those connections count.