Navigating the Complex World of Coffee Trade

Delve into the intriguing world of coffee trade, a vital component of the global economy. This guide offers insight into the complexities that surround coffee trading, from understanding its historical context to navigating the current market landscape. Discover the key players involved, from growers to roasters, and explore the intricate supply chain that brings coffee from farm to cup. Learn about significant coffee-producing countries and the varieties that shape market dynamics. With practical tips for newcomers, this article also highlights essential research methods, relationship building, and risk management strategies crucial for thriving in coffee trade. Embark on your coffee trading journey and equip yourself with the knowledge needed to succeed in this multifaceted market.

Coffee, a beverage that has captivated the world for centuries, is not just a simple cup of morning joy but a complex commodity that drives a significant portion of the global economy. The coffee trade, a intricate web of relationships, transactions, and processes, connects millions of farmers, traders, roasters, and consumers across the globe. This article aims to demystify the complexities of the coffee trade and provide a comprehensive guide for both seasoned professionals and newcomers looking to navigate this fascinating market.

Introduction

The coffee trade is a vital component of the global economy, with an estimated market value of over $465 billion as of 2022. This staggering figure underscores the significance of coffee not just as a beloved beverage, but as a crucial economic driver for many countries and communities worldwide. From the small-scale farmers in the highlands of Ethiopia to the bustling coffee shops in metropolitan cities, the coffee trade impacts lives and livelihoods on an unprecedented scale.

This guide is designed to simplify the intricacies of the coffee trade, offering insights into its historical context, current market dynamics, and strategies for effective navigation. Whether you're a curious consumer, an aspiring trader, or a seasoned professional looking to deepen your understanding, this comprehensive exploration of the coffee trade will equip you with the knowledge to appreciate and engage with this complex world.

1. Understanding Coffee Trade

1.1 Definition of Coffee Trade

The coffee trade encompasses all activities involved in the production, distribution, and sale of coffee, from the moment a coffee cherry is picked to when a brewed cup reaches the consumer. This expansive industry involves a diverse cast of players, each with a crucial role in bringing coffee from farm to cup.

At the foundation of the coffee trade are the growers, often small-scale farmers in tropical and subtropical regions. These farmers cultivate coffee plants, harvest the cherries, and perform initial processing. Next in the chain are exporters, who purchase coffee from farmers or cooperatives and prepare it for international shipment. Importers then buy this coffee and sell it to roasters in consuming countries. Roasters, the alchemists of the coffee world, transform the green coffee beans into the aromatic brown beans we recognize. Finally, retailers and cafes bring the finished product to consumers.

This simplified overview belies the complexity of the trade, which also includes quality control specialists, logistics providers, financial institutions, and regulatory bodies, all working in concert to keep the global coffee trade flowing smoothly.

1.2 Historical Context

The history of coffee trade is as rich and complex as the beverage itself. Coffee's journey from its origins in Ethiopia to its current status as a global commodity is a tale of exploration, colonialism, and economic transformation.

Legend has it that coffee was discovered in the 9th century when an Ethiopian goatherd noticed his goats becoming unusually energetic after eating berries from a certain tree. By the 15th century, coffee had spread to the Arabian Peninsula, where it was first cultivated for trade. The port of Mocha in Yemen became the world's first coffee trade hub, giving rise to the term "Mocha" in coffee parlance.

European traders introduced coffee to their continent in the 17th century, leading to the establishment of coffeehouses that became centers of social and intellectual life. As demand grew, European powers established coffee plantations in their colonies, dramatically altering the economies and landscapes of regions in Latin America, Africa, and Asia.

The 19th and 20th centuries saw the coffee trade evolve into a global industry. The creation of instant coffee in the 1900s, the rise of multinational coffee companies, and the establishment of coffee futures trading on commodity exchanges all contributed to the complex, interconnected coffee market we see today.

In recent decades, the coffee trade has been marked by increased focus on sustainability, fair trade practices, and specialty coffee. These trends have reshaped relationships between producers and consumers, adding new layers of complexity to an already intricate trade.

1.3 The Importance of Coffee Trade

The significance of the coffee trade extends far beyond providing the world's most popular beverage. Economically, coffee is a crucial export for many developing countries. For nations like Ethiopia, Colombia, and Vietnam, coffee exports represent a substantial portion of their GDP and foreign exchange earnings. The industry provides livelihoods for an estimated 25 million farmers worldwide, not to mention the millions more employed in related sectors such as processing, transportation, and retail.

Culturally, coffee has become deeply ingrained in societies around the world. From the traditional Ethiopian coffee ceremony to the Italian espresso culture, coffee rituals form an important part of daily life and social interaction in many countries. The global spread of coffee shop chains has further cemented coffee's role in modern urban culture.

Socially, the coffee trade has been both a source of development and a focal point for addressing global inequalities. Fair trade and direct trade movements have sought to ensure better compensation and working conditions for coffee farmers. Meanwhile, the growth of specialty coffee has created new opportunities for farmers to differentiate their products and capture more value.

Environmentally, coffee cultivation has significant impacts. While traditional shade-grown coffee can support biodiversity, intensive sun-grown cultivation can lead to deforestation and soil degradation. As such, the coffee trade has become an important arena for promoting sustainable agricultural practices and addressing climate change concerns.

The coffee trade, therefore, is not just about beans and profits, but a complex system that touches on issues of economic development, cultural exchange, social justice, and environmental sustainability. Understanding these multifaceted impacts is crucial for anyone looking to navigate the world of coffee trade effectively.

2. The Global Coffee Market

2.1 Market Overview

The global coffee market is a behemoth, with an intricate network of producers, traders, roasters, and consumers spanning every continent. As of 2022, the global coffee market was valued at approximately $465 billion, with projections suggesting it could reach $645 billion by 2028. This growth is driven by increasing coffee consumption worldwide, particularly in emerging markets, and the rising popularity of specialty and premium coffee products.

In terms of volume, global coffee production in the 2021/2022 crop year was estimated at 167.2 million 60-kg bags, according to the International Coffee Organization (ICO). Consumption for the same period was estimated at 170.3 million bags, indicating a slight deficit in supply versus demand.

The coffee market is traditionally divided into two main segments: Arabica and Robusta. Arabica, known for its smoother, sweeter taste, accounts for about 60-70% of global production. Robusta, with its stronger, more bitter flavor and higher caffeine content, makes up the remaining 30-40%. However, this simple division belies the incredible diversity within these categories, with factors such as origin, processing method, and roast level creating a vast array of flavor profiles.

The market is further segmented by product type (whole bean, ground coffee, instant coffee, and coffee pods), distribution channel (supermarkets/hypermarkets, specialty stores, online retail, and others), and end-use (household and commercial). Each of these segments has its own dynamics and trends, adding layers of complexity to the overall market.

2.2 Major Coffee Producing Countries

Coffee production is concentrated in the "Bean Belt," a region between the Tropics of Cancer and Capricorn where climate conditions are ideal for coffee cultivation. The top producing countries each bring unique characteristics to the global market, influenced by their geography, climate, and coffee-growing traditions.

- Brazil: The world's largest coffee producer, accounting for about one-third of global production. Brazil is known for its large-scale, mechanized production of both Arabica and Robusta coffees. Brazilian coffees often have a nutty, chocolatey flavor profile and are frequently used in espresso blends.

- Vietnam: The second-largest producer globally and the leading Robusta producer. Vietnam's coffee industry developed rapidly in the late 20th century, focusing on high-yield Robusta production. Vietnamese coffee is known for its strong, bold flavor and is often used in instant coffee and espresso blends.

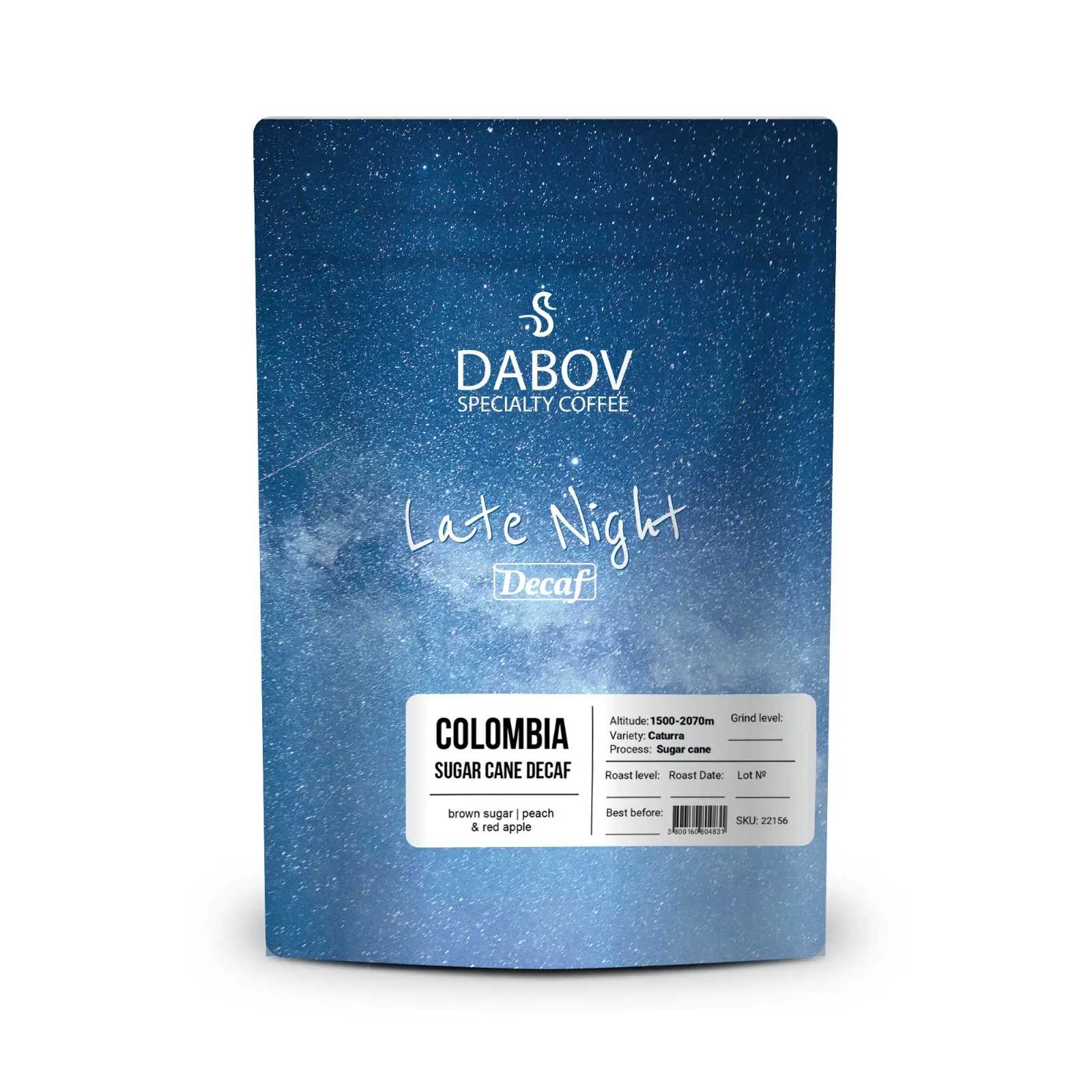

- Colombia: The third-largest producer and the largest producer of washed Arabica. Colombian coffee is renowned for its well-balanced flavor with notes of caramel and nuts. The country's diverse microclimates allow for year-round harvesting in different regions.

- Indonesia: The fourth-largest producer globally, known for both Arabica and Robusta production. Indonesian coffees, particularly those from Sumatra, are famous for their full body and earthy, spicy flavors. The unique "wet hulling" process used in parts of Indonesia contributes to these distinctive characteristics.

- Ethiopia: The birthplace of coffee and Africa's top producer. Ethiopian coffees are prized for their complex, floral, and fruity flavors. The country produces exclusively Arabica coffee, with many heirloom varieties not found elsewhere.

Other significant producers include Honduras, India, Uganda, Mexico, and Guatemala, each contributing unique flavors and characteristics to the global coffee market. The diversity of producing countries ensures a wide range of flavor profiles and qualities, catering to various consumer preferences and market segments.

2.3 Coffee Varieties and Their Impact on Trade

The two main species of coffee cultivated for commercial production are Coffea arabica (Arabica) and Coffea canephora (Robusta). However, within these species, there are numerous varieties and cultivars, each with distinct characteristics that influence their market value and trading patterns.

Arabica coffee, which accounts for about 60-70% of global production, is generally considered superior in quality due to its complex flavor profile and lower caffeine content. It's more challenging to grow, requiring specific altitude and climate conditions, making it more susceptible to diseases and pests. This vulnerability translates to higher production costs and greater price volatility in the market.

Key Arabica varieties include:

- Typica: One of the oldest Arabica varieties, known for excellent cup quality but low yield.

- Bourbon: A natural mutation of Typica, with higher yield and good cup quality.

- Caturra: A dwarf mutation of Bourbon, with high yield but requiring more care.

- Gesha/Geisha: A variety that has gained fame for its exceptional floral and tea-like qualities, commanding premium prices.

Robusta coffee, making up 30-40% of global production, is hardier and more disease-resistant than Arabica. It grows at lower altitudes, produces higher yields, and contains more caffeine. Robusta is often used in espresso blends and instant coffee due to its strong flavor and ability to produce a rich crema.

The choice of variety significantly impacts trading dynamics. Arabica coffees, especially specialty grade beans from renowned origins or rare varieties like Gesha, often trade at a premium. These coffees are typically sold through direct trade relationships or specialty importers, bypassing traditional commodity markets.

Robusta, while generally cheaper, plays a crucial role in the coffee industry. Its price movements can significantly affect large-scale commercial roasters who use it in blends or instant coffee production. The spread between Arabica and Robusta prices is a key indicator watched by traders and roasters alike.

In recent years, there's been growing interest in hybrid varieties that combine the quality of Arabica with the resilience of Robusta. These hybrids, such as Castillo in Colombia or Catimor in Central America, are changing the landscape of coffee production and trade, offering new options for farmers facing climate change challenges.

The diversity of coffee varieties contributes to the complexity of the coffee trade, requiring traders and buyers to have in-depth knowledge of the characteristics, growing conditions, and market dynamics associated with each variety. This diversity also provides opportunities for differentiation and value addition in an increasingly competitive global market.

3. The Complexity of Coffee Trade

3.1 Supply Chain Dynamics

The coffee supply chain is a complex, global network that connects millions of farmers to billions of consumers. Understanding this chain is crucial for anyone looking to navigate the coffee trade effectively. Let's break down the journey of coffee from seed to cup:

- Farmers: At the base of the supply chain are an estimated 25 million coffee farmers worldwide, most of whom are smallholders. These farmers cultivate coffee plants, often alongside other crops, and are responsible for harvesting the coffee cherries when ripe.

- Processing: After harvest, coffee cherries undergo initial processing, either on the farm or at a local processing facility. This can involve wet processing (washed coffee), dry processing (natural coffee), or various hybrid methods. The choice of processing method significantly impacts the final flavor profile and value of the coffee.

- Cooperatives/Collectors: In many regions, smallholder farmers sell their coffee to local cooperatives or collectors. These entities aggregate coffee from multiple farmers, allowing for economies of scale in further processing and transportation.

- Exporters: Exporters buy coffee from cooperatives or large farms and prepare it for international shipment. This involves activities such as grading, sorting, and packaging. Exporters also handle the complex logistics and paperwork involved in international trade.

- Importers: Coffee importers buy large quantities of green coffee from exporters and sell it to roasters in consuming countries. They play a crucial role in quality control, financing, and risk management within the supply chain.

- Roasters: Roasters transform the green coffee beans into the aromatic brown beans we recognize. They may range from small artisanal operations to large multinational companies. Roasters often create blends to achieve consistent flavor profiles and manage cost fluctuations.

- Retailers: This includes supermarkets, specialty coffee shops, and online retailers who sell roasted coffee to consumers. Some larger chains may also function as roasters.

- Consumers: The end users of the product, whose preferences and purchasing decisions ultimately drive the entire supply chain.

Throughout this chain, there are additional actors such as brokers, warehousing providers, shipping companies, and financial institutions that facilitate the movement of coffee and capital. Each link in this chain adds value but also complexity, with various potential bottlenecks and risks.

In recent years, there's been a trend towards shorter supply chains, with some roasters engaging in direct trade relationships with farmers or cooperatives. While this can lead to better compensation for farmers and more control over quality for roasters, it also requires participants to take on roles traditionally filled by other supply chain actors.

The length and complexity of the coffee supply chain contribute to price volatility and can make it challenging to ensure transparency and traceability. However, it also provides numerous entry points for those looking to participate in the coffee trade, each with its own set of challenges and opportunities.

3.2 Economic Factors Influencing Coffee Trade

The coffee trade is influenced by a myriad of economic factors, making it one of the most volatile commodity markets. Understanding these factors is crucial for anyone involved in coffee trading. Let's explore some of the key economic elements that drive complexity in the coffee market:

- Supply and Demand: Like any commodity, coffee prices are fundamentally driven by supply and demand. However, coffee's supply is uniquely challenging to manage due to the long lead time between planting and harvesting (3-4 years for a new coffee plant to produce cherries) and the impact of weather conditions on yield. On the demand side, while overall coffee consumption tends to be relatively stable, shifts in preferences (e.g., towards specialty coffee) can cause significant market changes.

- Currency Exchange Rates: Coffee is typically priced in US dollars, but produced in countries with different currencies. Fluctuations in exchange rates can significantly impact the profitability of coffee exports for producing countries and the purchasing power of importers.

- Production Costs: The costs of labor, fertilizers, and other inputs can vary greatly between and within producing countries. Changes in these costs affect farmers' profitability and can influence supply levels.

- Weather and Climate Change: Coffee plants are sensitive to temperature and rainfall. Extreme weather events or long-term climate changes can significantly impact yield and quality, leading to supply shortages and price spikes. The increasing frequency of such events due to climate change adds another layer of unpredictability to the market.

- Geopolitical Events: Political instability, changes in trade policies, or conflicts in major producing or consuming countries can disrupt coffee trade flows and impact prices.

- Speculation: Coffee futures are traded on commodity exchanges, allowing for speculation by traders who may never intend to take physical delivery of coffee. While this provides liquidity to the market, it can also lead to price volatility disconnected from fundamental supply and demand factors.

- Government Policies: Producing countries may implement policies such as export quotas, minimum price guarantees, or stockpiling programs that can influence global supply and prices. Similarly, consuming countries' trade policies, such as tariffs or import regulations, can impact demand and trade flows.

- Transportation Costs: Changes in fuel prices or shipping capacity can significantly affect the cost of moving coffee from producing to consuming countries, impacting the final price of coffee.

- Substitution Effects: While coffee has a relatively inelastic demand, significant price increases can lead some consumers to switch to substitutes like tea or energy drinks, potentially impacting long-term demand trends.

- Market Concentration: The coffee industry has seen significant consolidation, particularly among roasters and retailers. The purchasing decisions of a few large players can have outsized impacts on the market.

These factors interact in complex ways, often with feedback loops that can amplify price movements. For example, high prices might encourage farmers to plant more coffee, leading to oversupply and price crashes a few years later. Conversely, prolonged low prices might cause farmers to abandon coffee cultivation, potentially leading to future supply shortages.

The complexity arising from these economic factors necessitates sophisticated risk management strategies for all participants in the coffee trade. It also creates opportunities for those who can accurately analyze and predict market movements. Understanding these dynamics is crucial for anyone looking to navigate the coffee market successfully.

3.3 Social and Ethical Considerations

In recent decades, the coffee trade has become a focal point for discussions about social responsibility, ethical business practices, and sustainable development. These considerations have added new layers of complexity to the coffee trade, influencing consumer preferences, business practices, and even government policies. Let's explore some of the key social and ethical issues in the coffee trade:

- Fair Trade: The Fair Trade movement emerged in response to the often exploitative conditions faced by coffee farmers. Fair Trade certification aims to ensure farmers receive a fair price for their coffee, above the market minimum. It also promotes community development, prohibits child labor, and encourages environmentally friendly farming practices. While Fair Trade has made significant strides in raising awareness and improving conditions for some farmers, it has also been criticized for not going far enough and for the costs of certification being prohibitive for some small farmers.

- Direct Trade: Building on the principles of Fair Trade, some roasters have adopted a Direct Trade model, establishing direct relationships with farmers or cooperatives. This approach aims to ensure higher prices for quality coffee and foster long-term relationships. However, it requires significant investment from roasters and can be challenging to scale.

- Sustainability: Coffee cultivation can have significant environmental impacts, including deforestation, water pollution, and loss of biodiversity. Many consumers and companies are now prioritizing coffee that is grown using sustainable methods. Certifications like Rainforest Alliance and Bird Friendly aim to promote environmentally friendly cultivation practices. However, the proliferation of certifications can be confusing for consumers and burdensome for producers.

- Labor Rights: Coffee harvesting is labor-intensive, and there have been persistent issues with worker exploitation, including low wages, poor working conditions, and even forced labor in some regions. Ensuring fair labor practices throughout the supply chain remains a challenge.

- Gender Equity: Women play a crucial role in coffee production but often face discrimination and lack of access to resources. There's growing recognition of the need to promote gender equity in the coffee sector, with some initiatives specifically focused on supporting women coffee farmers.

- Climate Change Adaptation: Climate change poses an existential threat to many coffee-growing regions. There's an ethical imperative to support farmers in adapting to changing conditions, which might include introducing new varietals, changing cultivation practices, or even relocating production.

- Price Volatility and Farmer Livelihoods: The volatile nature of coffee prices can have devastating effects on farmers' livelihoods. There's ongoing debate about how to ensure a living income for coffee farmers, with proposed solutions ranging from price floors to diversification of income sources.

- Transparency and Traceability: Consumers are increasingly demanding to know where their coffee comes from and under what conditions it was produced. This has led to efforts to increase transparency and traceability in the supply chain, which can be technologically and logistically challenging.

- Cultural Preservation: Coffee production is deeply intertwined with the cultural identity of many producing regions. There's a growing recognition of the importance of preserving traditional coffee cultivation practices and the associated cultural heritage.

- Genetic Diversity: The focus on a few high-yielding varieties has led to a loss of genetic diversity in coffee. Preserving heirloom varieties is not just about maintaining flavor diversity, but also about ensuring the long-term resilience of coffee in the face of climate change and disease pressures.

These social and ethical considerations have reshaped the coffee industry in recent years. Many companies now view addressing these issues not just as a moral imperative, but as crucial for long-term business sustainability. Consumers, particularly in specialty coffee markets, often make purchasing decisions based on these ethical considerations.

However, addressing these issues is complex and often involves trade-offs. For example, paying higher prices to farmers might make coffee unaffordable for some consumers. Similarly, the costs of implementing sustainable practices or obtaining certifications can be burdensome for small producers.

Navigating these social and ethical considerations requires a nuanced understanding of the coffee industry's complexities and a commitment to continuous improvement. It also presents opportunities for differentiation and value creation for companies that can effectively address these issues. As the coffee industry continues to evolve, these social and ethical considerations will likely play an increasingly important role in shaping the future of coffee trade.

4. Coffee Trading Guide

4.1 Getting Started in Coffee Trading

Entering the world of coffee trading can be both exciting and daunting. Whether you're considering a career in coffee trading, looking to start a coffee-related business, or simply want to understand the market better, here are some key steps to get started:

- Educate Yourself: Start by building a strong foundation of knowledge about coffee. This includes understanding different coffee varieties, processing methods, grading systems, and cupping (tasting) techniques. Resources for learning include:

- Books: "The World Atlas of Coffee" by James Hoffmann and "Coffee: A Comprehensive Guide to the Bean, the Beverage, and the Industry" by Robert W. Thurston are excellent starting points.

- Online Courses: Platforms like Boot Coffee Campus and the Specialty Coffee Association offer comprehensive courses on various aspects of coffee.

- Industry Publications: Subscribe to publications like Perfect Daily Grind, Daily Coffee News, and Tea & Coffee Trade Journal for current industry insights.

- Understand the Market: Familiarize yourself with coffee market dynamics, including:

- Price trends and factors affecting them

- Major producing and consuming countries

- Different market segments (commodity, specialty, etc.)

- Key players in the industry

Websites like the International Coffee Organization (ICO) and the USDA Foreign Agricultural Service provide valuable market data and reports.

- Gain Practical Experience: Nothing beats hands-on experience. Consider:

- Working or interning with a coffee roaster, importer, or exporter

- Attending coffee trade shows and conferences like the SCA Expo or Producer & Roaster Forum

- Visiting coffee farms if possible to understand production firsthand

- Develop Your Palate: Coffee trading requires a refined palate. Practice cupping different coffees regularly to train your taste buds to discern quality differences.

- Network: Build relationships within the industry. Join professional associations like the Specialty Coffee Association (SCA) or the National Coffee Association (NCA). Attend industry events and engage with professionals on platforms like LinkedIn.

- Understand Regulations: Coffee trading involves navigating complex international trade regulations. Familiarize yourself with import/export procedures, food safety regulations, and any specific requirements for coffee in your target markets.

- Learn About Risk Management: Coffee prices can be highly volatile. Understand how futures markets work and learn about hedging strategies to manage price risk.

- Stay Informed About Sustainability: Given the increasing importance of sustainability in coffee, stay updated on certifications like Fair Trade, Rainforest Alliance, and organic standards.

- Consider Specialization: The coffee industry offers various niches. You might focus on specialty coffee, specific origins, or particular segments of the supply chain like green coffee trading or roasting.

- Start Small: If you're looking to trade coffee commercially, consider starting with small volumes to gain experience before scaling up.

- Leverage Technology: Familiarize yourself with software tools used in coffee trading, such as coffee trading platforms, supply chain management systems, and quality control applications.

- Understand Financial Aspects: Learn about financing options for coffee trading, including letters of credit, pre-shipment financing, and other trade finance instruments.

Remember, coffee trading is a complex field that requires continuous learning and adaptation. Start by building a strong foundation of knowledge and experience, and be prepared to invest time in developing your skills and network. With dedication and persistence, you can navigate the fascinating world of coffee trade successfully.

4.2 Understanding Price Fluctuations

Coffee prices are notoriously volatile, often experiencing significant fluctuations over short periods. Understanding the factors that drive these price movements is crucial for anyone involved in coffee trading. Let's delve into the key elements that contribute to coffee price volatility:

- Weather Conditions: Coffee plants are sensitive to weather, and extreme conditions can significantly impact yield and quality. Frost in Brazil, droughts in Vietnam, or excessive rainfall in Colombia can all lead to supply shortages and price spikes. Conversely, ideal growing conditions can lead to bumper crops and price drops.

- Climate Change: The long-term effects of climate change are altering traditional coffee-growing regions, potentially reducing suitable land for coffee cultivation. This ongoing shift adds an element of uncertainty to future supply, influencing prices.

- Crop Cycles: Coffee plants have biennial bearing cycles, typically producing a larger crop one year followed by a smaller crop the next. These natural cycles contribute to supply fluctuations.

- Pests and Diseases: Outbreaks of coffee leaf rust, coffee berry borer, or other pests can devastate crops, leading to reduced supply and higher prices. The spread of such diseases can be unpredictable and rapid.

- Political and Economic Factors: Changes in government policies in major producing countries, such as export quotas or subsidy programs, can impact global supply. Economic conditions in producing countries, such as currency fluctuations or changes in labor costs, also affect prices.

- Market Speculation: Coffee futures are traded on commodity exchanges like the Intercontinental Exchange (ICE). Speculative trading by investors who never intend to take physical delivery of coffee can amplify price movements.

- Global Demand Trends: While overall coffee demand tends to be relatively stable, shifts in consumption patterns can influence prices. For example, growing demand in emerging markets or increased preference for specialty coffee can drive prices up.

- Stock Levels: The amount of coffee held in storage by producing countries, importing countries, and roasters can influence prices. Low stock levels can lead to price spikes if there's an unexpected supply shortage.

- Currency Exchange Rates: As coffee is typically priced in US dollars, fluctuations in exchange rates between the dollar and currencies of major producing countries can impact prices.

- Oil Prices: Coffee production and transportation are energy-intensive. Changes in oil prices can affect production costs and shipping rates, influencing coffee prices.

- Geopolitical Events: Trade disputes, political instability in producing regions, or global economic crises can all impact coffee prices.

- Market Concentration: The coffee industry has seen significant consolidation, particularly among large roasters. The buying decisions of a few major players can have outsized impacts on the market.

To navigate these price fluctuations, coffee traders employ various strategies:

- Hedging: Using futures contracts to lock in prices and protect against adverse price movements.

- Diversification: Sourcing coffee from multiple origins to mitigate the risk of supply disruptions in any single region.

- Long-term Contracts: Establishing fixed-price contracts with suppliers or buyers to provide price stability.

- Market Analysis: Continuously monitoring market conditions and using technical and fundamental analysis to inform trading decisions.

- Vertical Integration: Some companies invest in their own farms or processing facilities to gain more control over their supply chain and costs.

Understanding coffee price fluctuations requires a holistic view of the global coffee market, considering both short-term factors like weather events and long-term trends like climate change. Successful coffee traders combine this market knowledge with risk management strategies to navigate the volatile world of coffee prices.

4.3 Trading Platforms and Instruments

Coffee trading has evolved significantly with the advent of digital technology and financial innovation. Today, traders have access to a variety of platforms and financial instruments to facilitate their trading activities. Understanding these tools is crucial for anyone looking to engage in coffee trading at a professional level.

- Trading Platforms:

a) Intercontinental Exchange (ICE): The primary platform for trading coffee futures and options. ICE offers contracts for both Arabica (traded in New York) and Robusta (traded in London) coffees.

b) Electronic Trading Platforms: Many brokers offer their own electronic platforms that allow traders to access futures markets, execute trades, and manage positions in real-time.

c) Over-the-Counter (OTC) Platforms: These facilitate direct trades between parties, often used for more customized contracts or larger volumes.

d) Specialty Coffee Platforms: Emerging platforms like Algrano or Cropster's Marketplace focus on connecting specialty coffee buyers directly with producers.

- Financial Instruments:

a) Futures Contracts: These are standardized contracts to buy or sell a specific quantity of coffee at a predetermined price at a specified time in the future. They're the most commonly used instrument for hedging and speculation in the coffee market.

b) Options: These give the holder the right, but not the obligation, to buy (call option) or sell (put option) coffee at a specific price within a set time frame. Options are used for both hedging and speculative purposes.

c) Forward Contracts: Similar to futures, but customized between buyer and seller and not traded on an exchange. These are often used in direct trade relationships.

d) Swaps: These allow traders to exchange a fixed price for a floating price (or vice versa) over a specified period. They're typically used by larger market participants for risk management.

- Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs): These investment vehicles track coffee prices or coffee-related indices, allowing investors to gain exposure to coffee prices without directly trading futures.

- Physical Trading Platforms: Some platforms facilitate the trade of physical green coffee beans. These often include quality control and logistics services.

- Risk Management Tools:

a) Stop-loss Orders: These automatically close a position when the price reaches a specified level, limiting potential losses.

b) Limit Orders: These execute trades only at a specified price or better, helping traders manage their entry and exit points.

- Market Analysis Tools:

a) Technical Analysis Software: These tools help traders analyze price charts and identify trends.

b) Fundamental Analysis Resources: Platforms that provide market reports, weather data, and other relevant information for coffee trading.

- Blockchain and Smart Contracts: Emerging technologies are being explored to increase transparency and efficiency in coffee trading, particularly in tracking coffee from farm to cup.

When using these platforms and instruments, it's crucial to understand:

- Contract Specifications: Each futures contract has specific terms regarding quantity, quality standards, delivery dates, and delivery locations.

- Margin Requirements: Futures trading typically requires maintaining a margin account with sufficient funds to cover potential losses.

- Regulatory Environment: Coffee trading is subject to regulations by bodies like the Commodity Futures Trading Commission (CFTC) in the US. Traders need to be aware of and comply with relevant regulations.

- Liquidity: Some instruments or contract months may be more liquid than others, affecting the ease of entering or exiting positions.

- Costs: Consider transaction costs, including brokerage fees and exchange fees, which can impact profitability, especially for high-frequency trading.

Effective use of these trading platforms and instruments requires a combination of market knowledge, technical skills, and risk management expertise. Traders should start with a thorough understanding of the basics and paper trading (simulated trading without real money) before engaging in live trading. Continuous education and staying updated with market developments are key to successful coffee trading in this dynamic environment.

5. Navigation Strategies for Coffee Market

5.1 Research and Analysis

Successful navigation of the coffee market hinges on thorough research and analysis. This process involves gathering, interpreting, and applying information from various sources to make informed trading decisions. Here's a comprehensive look at the research and analysis strategies crucial for coffee market participants:

- Fundamental Analysis:

a) Supply and Demand Dynamics:

- Monitor crop reports from major producing countries

- Analyze consumption trends in key markets

- Track changes in global coffee inventories

b) Weather Patterns:

- Use satellite imagery and weather forecasting tools to predict crop yields

- Understand the impact of phenomena like El Niño and La Niña on coffee-growing regions

c) Economic Indicators:

- Follow GDP growth in major consuming countries

- Monitor currency exchange rates, especially in producing countries

- Track inflation rates and their impact on production costs

d) Political Factors:

- Stay informed about trade policies, export quotas, and subsidy programs in producing countries

- Monitor geopolitical events that could disrupt coffee trade

- Technical Analysis:

a) Price Charts:

- Analyze historical price movements using various timeframes

- Identify trends, support and resistance levels, and chart patterns

b) Technical Indicators:

- Utilize tools like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence)

- Understand volume analysis to confirm price movements

c) Sentiment Analysis:

- Monitor the Commitment of Traders (COT) reports to understand market positioning

- Analyze market sentiment through social media and news sentiment tools

- Market Reports and Publications:

- Subscribe to reports from organizations like the International Coffee Organization (ICO), USDA Foreign Agricultural Service, and major coffee traders

- Read industry publications like Perfect Daily Grind, Daily Coffee News, and Tea & Coffee Trade Journal

- Follow research from agricultural universities and coffee research institutes

- Supply Chain Analysis:

- Understand the logistics of coffee movement from origin to destination

- Monitor shipping costs and potential disruptions in transportation

- Analyze processing and storage capacity in producing and consuming countries

- Competitive Intelligence:

- Track activities of major coffee companies, including mergers and acquisitions

- Monitor new product launches and marketing strategies of key industry players

- Analyze annual reports and investor presentations of publicly traded coffee companies

- Consumer Trends Research:

- Conduct or analyze consumer surveys to understand changing preferences

- Monitor social media trends related to coffee consumption

- Track sales data from different market segments (e.g., specialty vs. commodity coffee)

- Sustainability and Ethical Considerations:

- Research the impact of sustainability certifications on pricing and demand

- Analyze trends in ethical sourcing and its influence on consumer behavior

- Monitor environmental regulations that could impact coffee production

- Technological Developments:

- Stay informed about innovations in coffee production, processing, and brewing technologies

- Understand the potential impact of blockchain and other technologies on coffee trade

- Risk Assessment:

- Develop models to quantify potential risks, including price volatility, supply disruptions, and counterparty risks

- Conduct scenario analysis to prepare for various market conditions

- Networking and Field Research