How Coffee Prices Influence Global Supply Chains

Coffee is more than just a morning ritual; it's a global powerhouse that shapes economies and supply chains. Understanding how coffee prices fluctuate and what drives these changes is crucial for producers, exporters, and consumers alike. This article delves into the factors influencing coffee prices, examines historical trends, and explores how price variations impact the entire supply chain—from farmers in Brazil to consumers in coffee shops worldwide. We also look into major coffee-producing countries and the challenges they face, providing insights on how technology and sustainability trends are affecting the market. By the end, you'll gain a comprehensive understanding of coffee's influential role in the global economy and practical strategies to navigate price fluctuations.

Coffee, often referred to as "black gold," is more than just a morning ritual for millions around the world. It's a complex commodity that plays a crucial role in the global economy, influencing international trade, agricultural practices, and the livelihoods of millions of farmers and workers across the globe. The intricate web of coffee's global supply chain is profoundly affected by fluctuations in coffee prices, creating a ripple effect that touches every aspect of the industry from seed to cup. This article delves deep into the multifaceted relationship between coffee prices and global supply chains, exploring the economic, social, and environmental factors that shape this dynamic market.

1. Understanding Coffee Prices

1.1 What Determines Coffee Prices?

Coffee prices are influenced by a myriad of factors, creating a complex interplay of supply and demand dynamics. At the forefront are climatic conditions in major coffee-producing regions. Coffee plants are notoriously sensitive to weather patterns, and even slight deviations from ideal growing conditions can significantly impact crop yields. For instance, a frost in Brazil, the world's largest coffee producer, can send global prices soaring as supply tightens. Conversely, optimal weather conditions can lead to bumper crops and price drops.

Production costs also play a crucial role in determining coffee prices. These costs can vary widely depending on the region and farming methods employed. Labor costs, for example, are significantly higher in countries like Costa Rica compared to Ethiopia, which affects the final price of the beans. Additionally, the cost of inputs such as fertilizers and pesticides, as well as investments in machinery and processing equipment, all factor into the production costs that ultimately influence market prices.

Market demand is another critical determinant of coffee prices. Changes in consumer preferences, such as the growing popularity of specialty coffees or the rise of coffee culture in traditionally tea-drinking nations like China, can drive up demand and prices. Economic conditions in major consuming countries also play a role, as coffee consumption tends to be elastic – meaning it can be affected by changes in disposable income.

Geopolitical factors and currency fluctuations add another layer of complexity to coffee pricing. Many coffee-producing countries are in politically volatile regions, and instability can disrupt production and exports, leading to price spikes. Moreover, as coffee is typically traded in US dollars, changes in exchange rates can significantly impact the purchasing power of coffee-importing countries and the income of exporting nations.

1.2 Coffee Price Trends Over Time

Analyzing historical coffee price trends reveals a volatile market characterized by significant price spikes and drops. Over the past few decades, coffee prices have experienced several notable fluctuations that have had far-reaching consequences for the global supply chain.

One of the most significant events in coffee price history was the collapse of the International Coffee Agreement (ICA) in 1989. The ICA had regulated coffee supplies and kept prices relatively stable for decades. Its dissolution led to a period of oversupply and plummeting prices in the 1990s, known as the "coffee crisis." This crisis had devastating effects on coffee-producing countries, forcing many farmers to abandon their crops and seek alternative livelihoods.

In contrast, the mid-2010s saw a significant price spike due to a combination of factors including drought in Brazil, increased demand from emerging markets, and speculation in the futures market. Prices reached a 34-year high in 2011, with Arabica coffee trading at over $3 per pound. This spike led to increased planting and production, which, coupled with improved weather conditions, resulted in a subsequent price crash in 2013.

More recently, the coffee market has been grappling with the impacts of climate change, which has led to more frequent extreme weather events in coffee-growing regions. For example, severe frosts in Brazil in 2021 caused significant damage to coffee crops, leading to a sharp increase in prices. Simultaneously, the COVID-19 pandemic disrupted supply chains and altered consumption patterns, adding another layer of complexity to price trends.

1.3 The Role of Futures Markets

Futures markets play a pivotal role in the coffee industry, providing a mechanism for price discovery and risk management. Coffee futures are standardized contracts that obligate the buyer to purchase a specific quantity of coffee at a predetermined price on a future date. These contracts are traded on exchanges such as the Intercontinental Exchange (ICE) and serve as a benchmark for physical coffee trades worldwide.

The futures market allows coffee producers, roasters, and traders to hedge against price volatility. For instance, a coffee farmer can sell futures contracts to lock in a price for their upcoming harvest, protecting themselves against potential price drops. Conversely, a coffee roaster can buy futures to secure a stable price for their future coffee needs, shielding themselves from price increases.

However, the futures market is not without controversy. Speculation by non-commercial traders can exacerbate price volatility. These speculators, who have no intention of taking physical delivery of coffee, can influence prices based on market sentiment rather than fundamental supply and demand factors. This speculation can lead to price movements that may not reflect the realities of the physical coffee market, causing challenges for producers and consumers alike.

Moreover, the complexity of the futures market can create barriers for smaller producers who may lack the resources or knowledge to effectively use these financial instruments. This disparity can further widen the gap between large-scale producers with access to sophisticated risk management tools and smallholder farmers who are more vulnerable to price fluctuations.

2. The Global Coffee Supply

2.1 Major Coffee Producing Countries

The global coffee supply is dominated by a handful of key producing countries, each with its unique characteristics and challenges. Brazil stands at the forefront, accounting for approximately one-third of the world's coffee production. The country is known for its large-scale, mechanized coffee farms that primarily produce Arabica beans. Brazil's dominance in the market means that any changes in its production – whether due to weather events, policy changes, or economic factors – can have significant impacts on global coffee prices and supply chains.

Vietnam is the second-largest coffee producer globally and the leading supplier of Robusta beans. The country's coffee industry has experienced rapid growth since the 1990s, driven by government policies encouraging coffee cultivation. Vietnamese coffee production is characterized by small-scale farmers and a focus on quantity over quality, which has led to concerns about sustainability and environmental impact.

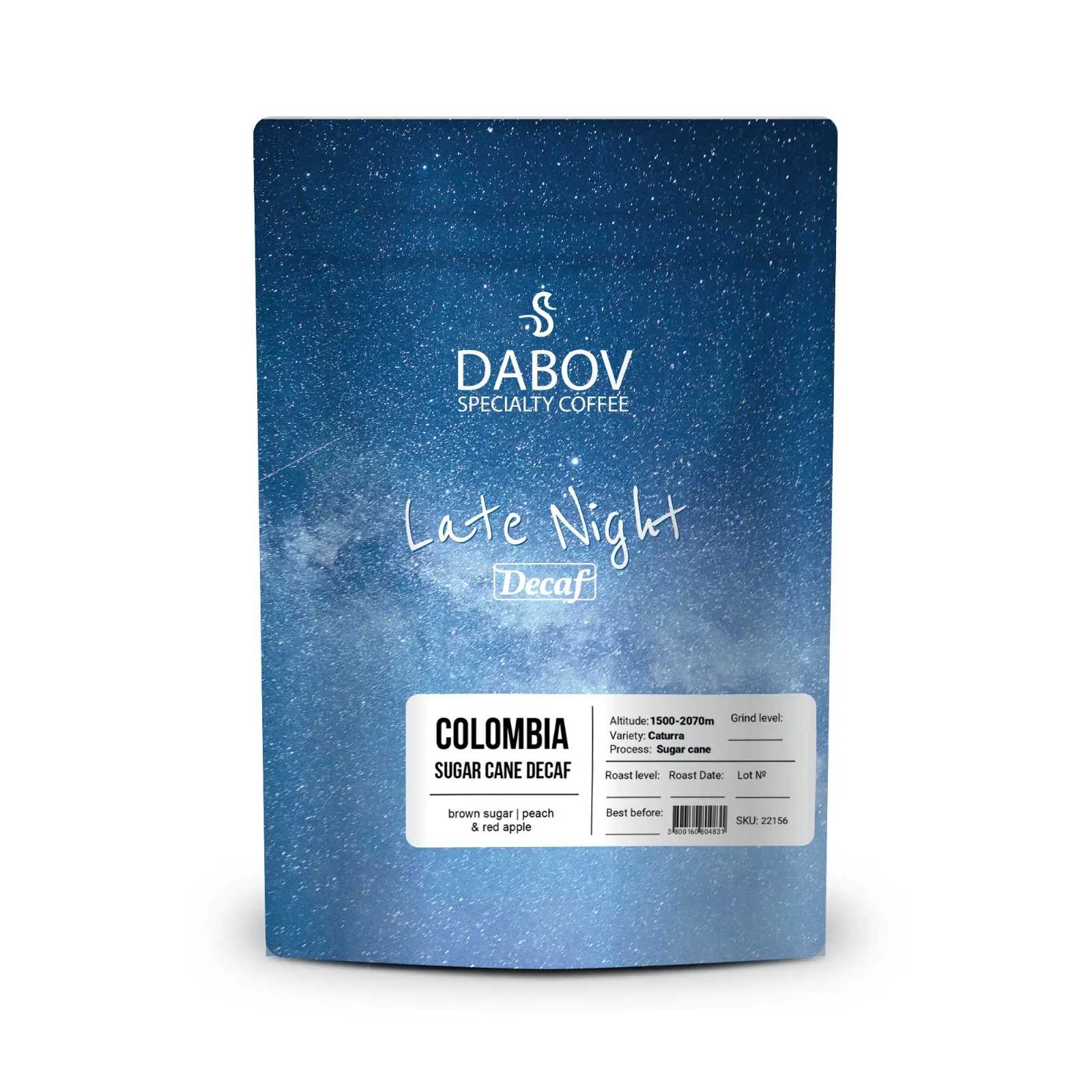

Colombia, renowned for its high-quality Arabica beans, is the third-largest coffee producer. The country's coffee sector is dominated by smallholder farmers, and its production is often affected by weather patterns and social unrest. The Colombian Coffee Growers Federation (FNC) plays a crucial role in supporting farmers and promoting Colombian coffee internationally.

Other significant producers include Indonesia, Ethiopia (the birthplace of coffee), Honduras, and India. Each of these countries has its unique coffee varieties, production methods, and challenges, contributing to the diversity and complexity of the global coffee supply.

2.2 Supply Chain Dynamics

The coffee supply chain is a complex network that spans continents and involves numerous stakeholders. It begins with the farmers who grow and harvest the coffee cherries. These farmers range from smallholders with less than a hectare of land to large commercial estates. After harvesting, the coffee cherries undergo processing, which can be done using wet (washed) or dry methods, depending on local traditions and available resources.

Once processed, the green coffee beans are typically sold to intermediaries or cooperatives. These entities aggregate coffee from multiple farmers and handle the crucial export process. Exporters play a vital role in quality control, packaging, and navigating the complex regulations governing international coffee trade.

From the exporting country, the coffee is shipped to importing nations, where it's received by importers or trading houses. These businesses often have long-standing relationships with producers and roasters, acting as a bridge between origin and consumption markets. They manage logistics, financing, and often provide market intelligence to their partners.

Roasters are the next link in the chain, transforming the green beans into the aromatic coffee consumers recognize. Roasters range from small artisanal operations to large multinational corporations. They often blend beans from different origins to create consistent flavor profiles and manage supply risks.

Finally, the roasted coffee reaches consumers through various channels, including retail stores, cafes, and increasingly, direct-to-consumer online sales. Each step in this supply chain adds value to the coffee, but also introduces potential points of vulnerability to price fluctuations and supply disruptions.

2.3 Challenges in the Coffee Supply Chain

The coffee supply chain faces numerous challenges that can impact both prices and the stability of supply. Climate change stands out as one of the most significant long-term threats to coffee production. Rising temperatures, changing rainfall patterns, and more frequent extreme weather events are altering the suitability of traditional coffee-growing regions. For example, studies suggest that by 2050, up to 50% of the land currently used for coffee production may become unsuitable for the crop.

Pests and diseases pose another significant challenge. The coffee berry borer, a small beetle that is the most serious pest in coffee plantations worldwide, causes an estimated $500 million in damages annually. Climate change is exacerbating this problem by allowing pests to survive in areas that were previously too cool for them.

Labor issues are also a growing concern in the coffee industry. Many coffee-producing regions face labor shortages as younger generations migrate to urban areas in search of better economic opportunities. This demographic shift is leading to increased labor costs and concerns about the long-term sustainability of coffee farming in some regions.

Moreover, the coffee industry grapples with issues of equity and fair compensation for farmers. Despite the high retail prices of specialty coffees, many coffee farmers struggle to make a living wage. This disparity has led to calls for more transparent and equitable supply chains, as well as initiatives like Fair Trade certification.

Lastly, the increasing consolidation of the coffee industry, particularly at the roaster and retail levels, poses challenges for smaller producers and can impact price negotiations. As large corporations gain more market power, there are concerns about their ability to influence prices and trading practices throughout the supply chain.

3. Coffee Prices and Their Impact on the Supply Chain

3.1 How Price Fluctuations Affect Producers

Coffee price fluctuations have a profound impact on producers, particularly smallholder farmers who make up the majority of coffee growers worldwide. When prices are low, many farmers struggle to cover their production costs, let alone make a profit. This financial strain can lead to a cycle of underinvestment in farms, reduced quality, and ultimately, lower yields. In extreme cases, sustained low prices can force farmers to abandon coffee cultivation altogether, leading to a loss of expertise and potential future supply shortages.

Conversely, when prices are high, producers may be incentivized to invest more in their farms, improving quality and yields. However, the cyclical nature of coffee prices means that these periods of prosperity are often followed by price crashes, which can leave farmers who have invested heavily in expansion particularly vulnerable.

Price volatility also affects producers' ability to plan for the future. Coffee trees take several years to reach full production, meaning that planting decisions made today will impact supply for years to come. Unpredictable prices make it challenging for farmers to make informed decisions about whether to expand, maintain, or reduce their coffee plantations.

Furthermore, price fluctuations can influence farming practices. During periods of low prices, farmers may be tempted to cut corners on sustainable practices or quality control measures to reduce costs. This can have long-term negative impacts on both the environment and the reputation of coffee from specific regions.

3.2 Consumer Behavior and Market Demand

Coffee prices have a complex relationship with consumer behavior and market demand. In general, coffee demand is relatively inelastic in the short term, meaning that small price changes don't significantly affect consumption patterns. Many consumers view coffee as a daily necessity and are willing to absorb moderate price increases.

However, sustained high prices can lead to changes in consumer behavior, particularly in price-sensitive markets. Consumers might switch to lower-quality beans, reduce their overall coffee consumption, or seek out alternative caffeinated beverages. In contrast, periods of low coffee prices can lead to increased consumption and potentially spark interest in higher-quality, specialty coffees as consumers feel they can afford to "trade up."

The impact of prices on consumer behavior also varies between different market segments. The specialty coffee market, which focuses on high-quality, often single-origin beans, tends to be less price-sensitive. Consumers in this segment are often willing to pay premium prices for unique flavor profiles and sustainable production practices. On the other hand, the mass market segment, which includes instant coffee and standard grocery store brands, is more susceptible to price fluctuations.

In recent years, there has been a growing trend towards ethical consumption in the coffee market. Many consumers are increasingly concerned about the environmental and social impacts of their coffee choices. This has led to a willingness among some consumers to pay higher prices for coffees that are certified Fair Trade, organic, or produced using sustainable methods. This trend has created new market opportunities but also adds complexity to pricing dynamics in the coffee supply chain.

3.3 Implications for Exporters and Importers

Coffee price fluctuations have significant implications for exporters and importers, who play a crucial role in bridging the gap between producing and consuming countries. For exporters, price volatility can make it challenging to maintain stable relationships with producers and secure consistent quality and quantity of coffee. When prices are low, exporters may struggle to source high-quality beans as producers cut costs or switch to other crops. Conversely, during price spikes, exporters may face intense competition to secure supplies, potentially straining long-standing business relationships.

Importers face similar challenges on the buying side of the equation. Price volatility can make it difficult to maintain stable pricing for roasters and retailers, potentially leading to frequent renegotiations of contracts. Importers also need to carefully manage their inventory in response to price trends. During periods of rising prices, there's an incentive to build up stocks, but this carries the risk of being left with high-priced inventory if the market suddenly turns.

Both exporters and importers use various strategies to manage price risks, including hedging through the futures market, diversifying their supplier base, and developing long-term contracts with fixed or minimum prices. However, these strategies can be complex and carry their own risks, particularly for smaller businesses that may lack the resources to implement sophisticated risk management techniques.

Moreover, price fluctuations can impact the financial stability of exporters and importers. Coffee trading often involves significant amounts of capital, and rapid price changes can lead to margin calls or liquidity issues. This financial pressure can sometimes force companies out of business, leading to further disruptions in the supply chain.

In response to these challenges, there's a growing trend towards more direct trade relationships between producers and roasters, bypassing traditional export-import channels. While this can lead to more stable prices and better returns for farmers, it also poses challenges for traditional exporters and importers, forcing them to adapt their business models and offer additional value-added services to remain competitive.

4. Coffee Market Impact on Global Supply Chains

4.1 Economic Implications of Coffee Prices

The economic implications of coffee prices extend far beyond the coffee industry itself, particularly in developing countries where coffee is a major export. In countries like Ethiopia, Uganda, and Honduras, coffee exports can account for a significant portion of foreign exchange earnings and GDP. Fluctuations in coffee prices can therefore have profound effects on these nations' overall economic stability and development prospects.

When coffee prices are high, coffee-exporting countries often see increased foreign investment, improved balance of payments, and greater government revenues. This can lead to increased spending on infrastructure, education, and other development priorities. Conversely, prolonged periods of low coffee prices can lead to economic hardship, increased rural poverty, and even political instability in coffee-dependent nations.

The impact of coffee prices on local economies can also create ripple effects throughout global supply chains. For example, when coffee farmers prosper, they tend to invest more in their local communities, creating demand for goods and services. This increased economic activity can stimulate growth in related industries, from agricultural suppliers to transportation and logistics providers.

However, the volatility of coffee prices can also create challenges for economic planning and development. The boom-and-bust cycles often associated with commodity-dependent economies can make it difficult for countries to implement long-term development strategies. This has led many coffee-producing countries to seek ways to diversify their economies and add value to their coffee exports, such as by developing domestic roasting and packaging industries.

4.2 Case Studies: Price Impact on Supply Chain Strategies

Several case studies illustrate the profound impact of coffee prices on supply chain strategies. One notable example is the response of major coffee companies to the coffee price crisis of the late 1990s and early 2000s. During this period of sustained low prices, many farmers abandoned coffee production or cut corners on quality to reduce costs. In response, companies like Starbucks and Nestlé implemented programs to support farmers and secure their supply chains.

Starbucks, for instance, developed its C.A.F.E. (Coffee and Farmer Equity) Practices program, which sets economic, social, and environmental standards for its suppliers. The company also committed to paying premium prices for high-quality beans. This strategy not only helped secure Starbucks' supply chain but also positioned the company as a leader in sustainable sourcing, enhancing its brand image.

Another illustrative case is the Colombian Coffee Growers Federation's response to price volatility. The Federation has implemented a price stabilization fund that helps protect farmers from sharp price drops. When market prices are high, a portion of the earnings is set aside, which is then used to supplement farmers' incomes when prices fall. This strategy has helped maintain a more stable supply of Colombian coffee and supported the livelihoods of smallholder farmers.

In contrast, the Vietnamese coffee industry provides an example of how rapid expansion in response to high prices can lead to challenges. Vietnam's coffee production grew exponentially in the 1990s and early 2000s, driven by government policies and high global prices. However, this rapid growth led to oversupply issues and environmental concerns, illustrating the need for more sustainable, long-term approaches to coffee production.

4.3 Sustainability and Ethical Sourcing Trends

The increasing consumer demand for sustainably and ethically sourced coffee has had a significant impact on global coffee supply chains. This trend has led to the proliferation of certification schemes such as Fair Trade, Rainforest Alliance, and organic certifications. These programs often guarantee minimum prices to farmers, helping to buffer them against market volatility.

Many major coffee companies have responded to this trend by developing their own sustainability programs and setting ambitious targets for ethical sourcing. For example, Lavazza has committed to sourcing 100% of its coffee sustainably by 2025, while JDE Peet's aims to source 100% responsibly by 2025. These commitments are driving changes throughout the supply chain, from farming practices to processing and transportation methods.

The focus on sustainability is also leading to innovations in the coffee supply chain. Blockchain technology, for instance, is being explored as a way to increase transparency and traceability in coffee sourcing. This could allow consumers to track their coffee from farm to cup, verifying sustainability claims and potentially commanding premium prices for truly sustainable products.

However, the trend towards sustainability also presents challenges. The proliferation of certification schemes can be confusing for consumers and burdensome for producers. There are also concerns about the true impact of some certification programs and whether they provide sufficient benefits to farmers to justify their costs.

Moreover, the push for sustainability is influencing coffee prices and supply chain dynamics. Sustainably produced coffees often command higher prices, but this can create a two-tiered market where only certain producers can access these premium prices. This has led to debates about how to make sustainable production more accessible to all coffee farmers, particularly smallholders in the poorest regions.

5. Coffee Economics: Key Concepts and Considerations

5.1 Supply and Demand Dynamics

The coffee market, like any commodity market, is fundamentally driven by the forces of supply and demand. However, several unique factors make coffee economics particularly complex. On the supply side, coffee production is characterized by a significant time lag between planting decisions and harvest. Coffee trees typically take 3-5 years to reach full production, meaning that supply cannot quickly adjust to changes in demand or price signals.

This inelasticity of supply in the short term can lead to pronounced price swings. For example, if adverse weather conditions in a major producing country like Brazil lead to a poor harvest, supply cannot be quickly increased from other sources to meet demand, resulting in price spikes. Conversely, when prices are high, farmers may plant more coffee trees, but the impact of this increased production won't be felt for several years, potentially leading to oversupply and price crashes in the future.

On the demand side, coffee consumption is relatively stable in mature markets like the United States and Europe, with growth primarily driven by emerging markets and the specialty coffee segment. However, demand can be influenced by factors such as changing consumer preferences, health trends, and economic conditions.

The interaction between these supply and demand factors creates the cyclical nature of coffee prices, often referred to as the "coffee cycle." This cycle typically lasts several years and is characterized by periods of oversupply and low prices followed by shortages and high prices. Understanding this cycle is crucial for all participants in the coffee supply chain, from farmers making planting decisions to roasters planning their purchasing strategies.

5.2 Economic Theories Relevant to Coffee Pricing

Several economic theories are particularly relevant to understanding coffee pricing and its impact on global supply chains. One key concept is price elasticity of demand, which measures how sensitive demand is to changes in price. Coffee demand is generally considered to be relatively inelastic, meaning that consumption doesn't change dramatically with small price changes. This inelasticity can contribute to price volatility, as significant changes in supply or demand can lead to large price movements.

The cobweb model is another economic theory that helps explain the cyclical nature of coffee prices. This model describes how a time lag between production decisions and output can lead to cyclical fluctuations in price and quantity. In the coffee market, the long lead time between planting and harvesting can result in farmers over- or under-producing in response to current prices, leading to future price swings.

Game theory also plays a role in understanding coffee market dynamics, particularly in the context of international agreements and producer behavior. For example, the breakdown of the International Coffee Agreement in 1989 can be analyzed through the lens of game theory, with producing countries ultimately deciding that the potential benefits of increasing their market share outweighed the advantages of coordinated production limits.

Lastly, the concept of asymmetric information is relevant to coffee pricing, particularly in the relationship between farmers and buyers. Farmers often have less information about global market conditions than large buyers or traders, which can put them at a disadvantage in price negotiations. This information asymmetry has led to calls for greater market transparency and efforts to improve farmers' access to market information.

6. Coffee Supply Chain Guide: Best Practices and Strategies

6.1 Optimizing the Coffee Supply Chain

Optimizing the coffee supply chain in the face of price volatility requires a multifaceted approach. One key strategy is vertical integration, where companies control multiple stages of the supply chain. This can provide greater control over quality and costs, as well as reduce exposure to market volatility. For example, some large roasters have invested in their own farms or processing facilities in producing countries.

Another important strategy is diversification of supply sources. By sourcing coffee from multiple origins, companies can mitigate the risk of supply disruptions or price spikes in any single producing region. This approach requires building relationships with producers in different countries and potentially adapting blending recipes to maintain consistent flavor profiles.

Risk management through financial instruments is also crucial. This can include using futures contracts to hedge against price fluctuations, as well as employing more sophisticated financial products like options and swaps. However, effective use of these tools requires expertise and careful management to avoid introducing new risks.

Implementing sustainable practices throughout the supply chain can also help optimize operations. This can include initiatives to improve crop yields and quality at the farm level, more efficient processing and transportation methods, and waste reduction strategies. While these practices may require upfront investment, they can lead to long-term cost savings and help secure a more stable supply of high-quality coffee.

6.2 Technology and Innovation in the Coffee Supply Chain

Technology is playing an increasingly important role in optimizing coffee supply chains and managing price risks. Blockchain technology, for instance, is being explored as a way to increase transparency and traceability in the coffee supply chain. This could help verify sustainability claims, reduce fraud, and potentially allow for more direct trading relationships between producers and roasters.

Big data and artificial intelligence are also being leveraged to improve supply chain management. These technologies can help predict supply and demand trends, optimize inventory management, and even forecast potential disruptions due to factors like weather events or political instability in producing regions.

At the farm level, precision agriculture techniques are being adapted for coffee production. This includes the use of drones for crop monitoring, soil sensors to optimize irrigation and fertilizer use, and mobile apps that provide farmers with real-time market information and agronomic advice.

In processing and quality control, new technologies like near-infrared spectroscopy are being used to rapidly assess coffee bean quality, allowing for more efficient sorting and grading. This can help producers and buyers more accurately determine the value of coffee lots, potentially leading to fairer pricing.

6.3 Emerging Market Trends to Watch

Several emerging trends are likely to shape the future of coffee prices and global supply chains. One significant trend is the growing importance of specialty and single-origin coffees. As consumers become more discerning, there's increasing demand for high-quality, traceable coffees with unique flavor profiles. This trend could lead to more direct trading relationships and potentially higher, more stable prices for producers of premium coffees.

Climate change adaptation is another crucial trend. As traditional coffee-growing regions become less suitable due to rising temperatures, there's increasing interest in developing new varietals that can withstand higher temperatures and resist pests and diseases. There's also exploration of new growing regions at higher altitudes or latitudes.

The rise of coffee consumption in producing countries is another trend to watch. As middle classes grow in countries like Brazil, Vietnam, and Indonesia, domestic consumption is increasing. This could potentially reduce the amount of coffee available for export, impacting global supply and prices.

Lastly, there's a growing trend towards greater equity in the coffee supply chain. This includes efforts to ensure living incomes for farmers, increase gender equality in coffee production, and support youth engagement in coffee farming. While these initiatives may lead to higher production costs in the short term, they're crucial for the long-term sustainability of the coffee industry.

Conclusion

The intricate relationship between coffee prices and global supply chains underscores the complexity of the coffee industry. From the farmers tending to their crops in the highlands of Ethiopia to the baristas serving lattes in New York City cafes, every participant in this vast network is affected by the ebb and flow of coffee prices.

As we've explored, these price fluctuations are driven by a myriad of factors, from weather patterns and geopolitical events to changes in consumer preferences and speculative trading. The impacts ripple through the entire supply chain, influencing farming practices, trading strategies, and even national economies.

Looking to the future, the coffee industry faces significant challenges, particularly from climate change and the need for greater sustainability and equity. However, these challenges also present opportunities for innovation and positive change. New technologies, more direct trading relationships, and a growing consumer interest in the story behind their coffee all have the potential to create a more resilient and equitable coffee supply chain.

Ultimately, the key to navigating the complex world of coffee prices and supply chains lies in adaptability, collaboration, and a long-term perspective. By working together to address challenges and embrace opportunities, stakeholders throughout the coffee supply chain can help ensure a sustainable and prosperous future for this beloved beverage. As we move forward, it will be crucial to balance the need for stable prices and reliable supply with the imperative of environmental sustainability and social responsibility. Only by addressing these interconnected issues can we hope to secure a future where coffee continues to play its vital role in global culture and commerce.