How Coffee Prices are Determined A Look at Market Forces

Coffee is more than just a morning ritual; it fuels economies and connects cultures worldwide. Understanding how coffee prices are determined unveils the complex interplay of various market forces. From the laws of supply and demand to production costs, and the impact of climate change, each factor plays a pivotal role in shaping coffee's value. This article delves deep into the historical context, current trends, and future projections of coffee pricing. We also explore how international dynamics and domestic preferences shape consumer behavior and market trends. This comprehensive analysis is essential for anyone interested in the economics of one of the most traded commodities on Earth.

Introduction

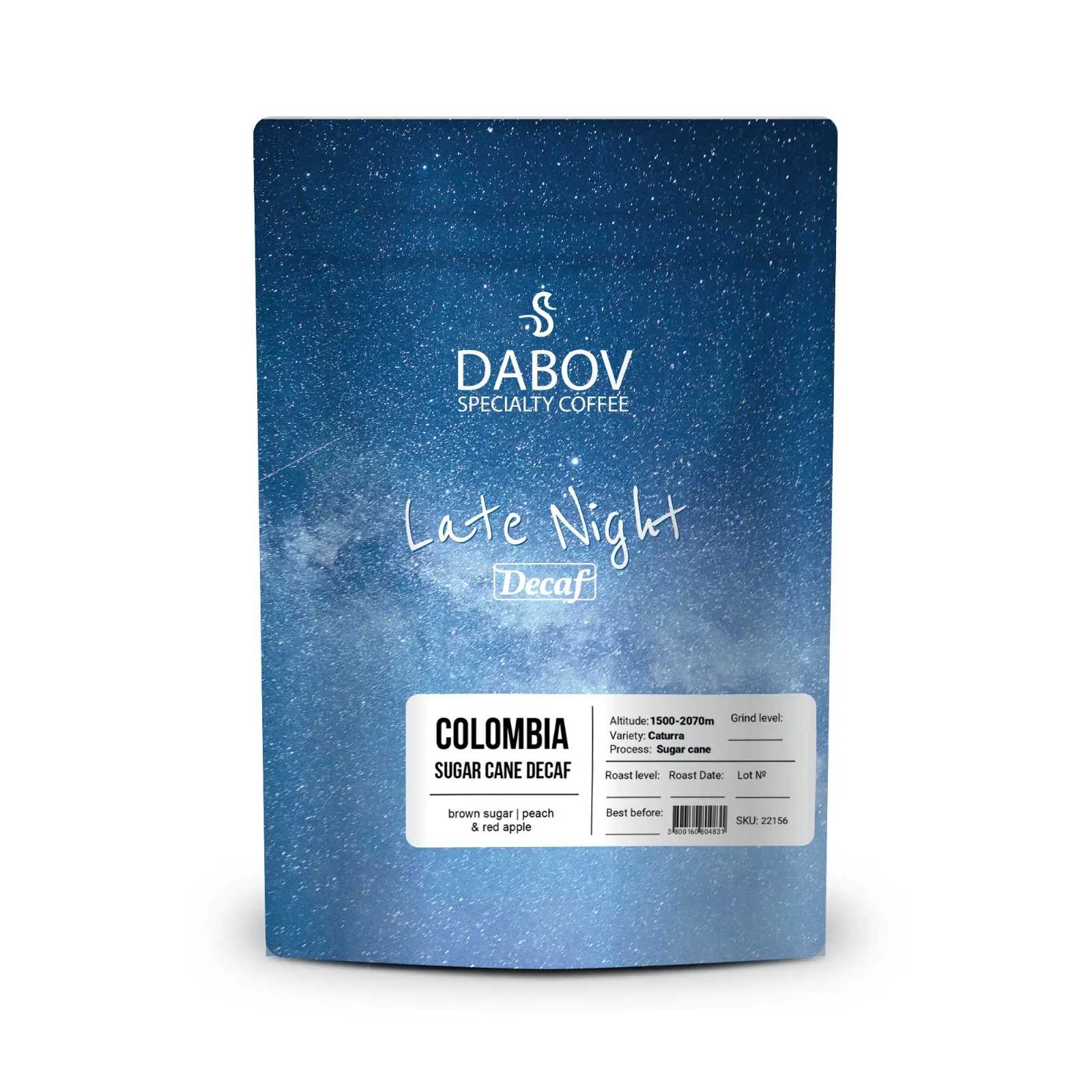

Coffee, the aromatic elixir that fuels millions of people worldwide, is more than just a beloved beverage. It's a global economic powerhouse, a cultural touchstone, and one of the most heavily traded commodities on the planet. From the misty mountains of Colombia to the bustling streets of New York, coffee's influence permeates societies and economies alike. Its importance extends far beyond the morning ritual, playing a crucial role in international trade, supporting countless livelihoods, and even shaping geopolitical relationships.

The purpose of this article is to delve deep into the intricate world of coffee economics, specifically focusing on how coffee prices are determined. We'll explore the myriad market forces that influence the cost of your daily brew, from the fundamental principles of supply and demand to the complex interplay of global events and environmental factors. By understanding these mechanisms, we can gain valuable insights into the broader economic landscape and appreciate the journey our coffee takes from crop to cup.

1. Understanding Coffee Price Determination

1.1 Definition of Coffee Price Determination

Coffee price determination is a complex process that involves a multitude of factors working in concert to establish the market value of coffee beans. At its core, it's an economic mechanism that balances the interests of producers, traders, roasters, and consumers. This process is not merely about setting a number; it's a dynamic interplay of global supply chains, agricultural conditions, market speculation, and consumer behavior.

The determination of coffee prices is intrinsically linked to broader economic concepts such as commodity pricing, futures markets, and international trade. It reflects the health of economies, the impact of climate change, and even geopolitical stability. Understanding coffee price determination requires a holistic view of these interconnected elements and how they fluctuate over time.

1.2 Historical Context of Coffee Pricing

The history of coffee pricing is as rich and varied as the beverage itself. Coffee's journey from a local crop to a global commodity has been marked by significant events that have shaped its economic landscape. In the 17th century, as coffee spread from its origins in Ethiopia to the Middle East and Europe, its value soared, making it a luxury item accessible only to the wealthy.

The 18th and 19th centuries saw the expansion of coffee cultivation to the Americas and Asia, leading to increased supply and more stable prices. However, the coffee market has always been prone to volatility. The Brazilian frost of 1975, which destroyed much of the country's coffee crop, sent global prices skyrocketing and highlighted the vulnerability of coffee supply to environmental factors.

In 1989, the collapse of the International Coffee Agreement, which had regulated coffee prices since 1962, led to a period of oversupply and plummeting prices. This event fundamentally changed the coffee market, shifting more power to large coffee roasters and retailers. Since then, the coffee market has experienced cycles of boom and bust, influenced by factors ranging from changing consumer preferences to the impact of climate change on coffee-growing regions.

2. Key Coffee Pricing Factors

2.1 Supply and Demand Dynamics

The fundamental economic principle of supply and demand plays a crucial role in coffee price determination. On the supply side, factors such as crop yields, weather conditions, and the number of coffee-producing countries influence the amount of coffee available in the market. Demand, on the other hand, is driven by consumer preferences, population growth, and economic conditions in coffee-consuming nations.

In recent years, we've seen a steady increase in global coffee consumption, particularly in emerging markets like China and India. This growing demand has put pressure on coffee producers to increase their output. However, coffee production is not something that can be ramped up quickly. Coffee trees take several years to mature and produce beans, creating a lag between increased demand and increased supply.

Moreover, the rise of specialty coffee has added another layer to the supply and demand equation. Consumers are increasingly willing to pay premium prices for high-quality, sustainably sourced coffee, creating niche markets within the broader coffee industry. This trend has incentivized some producers to focus on quality over quantity, further influencing the supply-demand balance.

2.2 Production Costs

The costs associated with coffee production have a significant impact on pricing. These costs can vary widely depending on the region, the type of coffee being grown, and the methods used in cultivation and processing. Labor is often the most substantial cost factor, particularly for high-quality Arabica coffees that require careful hand-picking of ripe cherries.

Land costs also play a role, with prime coffee-growing regions commanding higher prices. Climate conditions affect production costs as well. For instance, areas prone to frost or drought may require more investment in protective measures or irrigation systems. Additionally, the cost of inputs such as fertilizers and pest control measures can fluctuate based on global commodity prices and local regulations.

In recent years, there's been a growing emphasis on sustainable and ethical coffee production. While these practices often increase production costs in the short term, they can lead to higher quality beans and better long-term sustainability of coffee farms. Certifications such as Fair Trade, Organic, or Rainforest Alliance can command premium prices, helping to offset the higher production costs associated with these practices.

2.3 Coffee Market Forces

2.3.1 Global Coffee Supply Chains

The journey of coffee from farm to cup involves a complex global supply chain that significantly impacts pricing. This chain typically includes farmers, processors, exporters, importers, roasters, and retailers. Each step in this process adds value to the coffee but also introduces potential for price fluctuations.

At the farm level, coffee cherries are harvested and processed into green coffee beans. The method of processing (wet or dry) can affect both the quality and cost of the beans. From there, the beans are typically sold to exporters who handle the logistics of shipping the coffee to importing countries. Importers then sell the beans to roasters, who transform the green beans into the aromatic coffee we know and love.

The efficiency of this supply chain can significantly impact coffee prices. Disruptions at any stage, whether due to political instability, transportation issues, or changes in trade policies, can lead to price increases. Conversely, improvements in supply chain management, such as direct trade relationships between roasters and farmers, can sometimes lead to more stable and fair pricing.

2.3.2 Role of Coffee Producing Countries

Major coffee-producing countries wield considerable influence over global coffee prices. Brazil, Vietnam, and Colombia are the world's top three coffee producers, collectively accounting for over half of global coffee production. The policies and production levels of these countries can have far-reaching effects on the global coffee market.

Brazil, as the world's largest coffee producer, has a particularly significant impact. A frost or drought in Brazil's coffee-growing regions can send global prices soaring. Similarly, a bumper crop can lead to oversupply and price depression. Vietnam's entry into the coffee market in the 1990s as a major producer of Robusta coffee dramatically changed the global coffee landscape, leading to a period of low prices that had severe impacts on other coffee-producing nations.

Many coffee-producing countries have established coffee boards or similar organizations to manage their coffee sectors. These bodies can influence prices by setting minimum export prices, regulating quality standards, or implementing policies to support coffee farmers. However, the power of individual countries to control prices has diminished in recent decades due to market liberalization and the increasing influence of large multinational coffee companies.

2.4 Currency Fluctuations

Coffee is typically traded internationally in US dollars, making currency exchange rates a crucial factor in coffee pricing. Fluctuations in the value of the dollar relative to the currencies of coffee-producing countries can have significant impacts on coffee prices and the incomes of coffee farmers.

For example, if the US dollar strengthens against the Brazilian real, Brazilian coffee becomes cheaper for international buyers in dollar terms. This can lead to increased demand for Brazilian coffee and potentially drive up global prices. Conversely, a weaker dollar can make coffee more expensive for international buyers, potentially dampening demand.

Currency fluctuations can also affect the purchasing power of coffee farmers. In many cases, farmers' costs are in local currency, but their coffee is sold in dollars. A strong dollar can boost their income in local currency terms, while a weak dollar can reduce it. This currency risk adds another layer of complexity to coffee pricing and can contribute to price volatility.

2.5 Market Speculation and Futures Trading

The coffee market, like many commodity markets, is heavily influenced by speculation and futures trading. Coffee futures contracts are traded on exchanges such as the Intercontinental Exchange (ICE) in New York for Arabica coffee and the London International Financial Futures and Options Exchange (LIFFE) for Robusta coffee.

Futures trading allows buyers and sellers to lock in prices for future delivery, providing a degree of price certainty in a volatile market. However, it also opens the door to speculation. Traders who have no intention of taking delivery of coffee can buy and sell futures contracts based on their predictions of future price movements. This speculative activity can amplify price swings, leading to increased volatility in the coffee market.

The impact of speculation on coffee prices is a subject of ongoing debate. While some argue that it provides necessary liquidity to the market and helps in price discovery, others contend that excessive speculation can lead to price distortions that harm coffee producers and consumers alike. Understanding the role of futures markets and speculation is crucial for anyone seeking to comprehend the complexities of coffee price determination.

2.6 Climate Change and Environmental Factors

Climate change poses a significant threat to coffee production and, by extension, to coffee prices. Coffee plants, particularly the high-quality Arabica variety, are notoriously sensitive to temperature changes. Even small increases in average temperatures can affect yield and quality, while extreme weather events can devastate entire crops.

Rising temperatures are already impacting traditional coffee-growing regions. In some areas, farmers are being forced to move their plantations to higher altitudes to maintain suitable growing conditions. This shift not only increases production costs but also reduces the total land available for coffee cultivation, potentially leading to supply constraints and higher prices in the long term.

Climate change also exacerbates the spread of pests and diseases that affect coffee plants. For instance, the coffee berry borer, a major pest, has been able to spread to higher altitudes as temperatures have risen. The coffee leaf rust disease has also become more prevalent in some regions due to changing weather patterns. These threats can significantly reduce yields and increase production costs, putting upward pressure on coffee prices.

Moreover, unpredictable weather patterns associated with climate change can lead to greater volatility in coffee production from year to year. This inconsistency in supply can contribute to price instability in the coffee market. As climate change continues to impact coffee-growing regions, it's likely to become an increasingly important factor in coffee price determination.

3. Coffee Price Analysis

3.1 Historical Coffee Price Trends

Analyzing historical coffee price trends provides valuable insights into the factors that have shaped the coffee market over time. The coffee market has been characterized by significant price volatility, with periods of boom and bust that have had profound impacts on coffee-producing countries and the global coffee industry.

One of the most notable events in coffee price history was the coffee crisis of the late 1990s and early 2000s. Following the collapse of the International Coffee Agreement in 1989, which had helped stabilize prices through export quotas, the market entered a period of oversupply. This led to a dramatic fall in coffee prices, with the composite indicator price (a benchmark for coffee prices) falling from a high of $1.80 per pound in 1997 to a low of $0.42 per pound in 2001. This price crash had devastating effects on coffee-producing countries, leading to widespread poverty among coffee farmers and contributing to social unrest in some regions.

The market began to recover in the mid-2000s, driven by increasing global demand and supply constraints in some producing countries. Prices reached a peak in 2011, with the composite indicator price hitting $2.31 per pound, driven by a combination of strong demand, particularly from emerging markets, and concerns about supply shortages.

Since then, the market has experienced another downturn, with prices falling to around $1 per pound in 2019. This recent period of low prices has again raised concerns about the sustainability of coffee farming and the future of coffee supply.

3.2 Current Coffee Pricing Trends

As of 2023, the coffee market is experiencing a period of relative price strength compared to the lows of recent years. The COVID-19 pandemic initially caused a sharp drop in coffee prices in early 2020 due to concerns about reduced demand. However, prices rebounded strongly in the latter part of 2020 and throughout 2021, driven by a combination of factors including supply chain disruptions, increased at-home coffee consumption, and weather-related supply concerns in Brazil.

The composite indicator price reached a 10-year high of over $2 per pound in July 2021, before moderating somewhat. This price increase has provided some relief to coffee farmers who had been struggling with years of low prices. However, it has also put pressure on coffee roasters and retailers, some of whom have had to increase their prices to consumers.

Looking at the different coffee varieties, Arabica prices have generally been stronger than Robusta prices in recent years. This reflects the growing demand for high-quality specialty coffees, which are typically made from Arabica beans. However, Robusta prices have also seen significant increases, partly due to supply issues in Vietnam, the world's largest Robusta producer.

It's important to note that while these global benchmark prices provide a general indication of market trends, the prices received by individual coffee farmers can vary significantly based on factors such as quality, certifications, and local market conditions.

3.3 The Influence of Global Events

Global events can have profound impacts on coffee prices, often in ways that are difficult to predict. The COVID-19 pandemic provides a recent and dramatic example of how unforeseen events can shake up the coffee market. Initially, lockdowns and café closures led to fears of reduced demand, causing a sharp drop in coffee prices. However, as people adjusted to working from home, at-home coffee consumption increased, helping to support prices.

Political events can also significantly influence coffee prices. For instance, the election of Jair Bolsonaro as president of Brazil in 2018 led to a strengthening of the Brazilian real against the dollar, which put upward pressure on coffee prices. Trade disputes, such as the ongoing tensions between the U.S. and China, can impact global trade flows and currency values, indirectly affecting coffee prices.

Natural disasters in coffee-producing regions can have immediate and dramatic effects on coffee prices. The 2010 earthquake in Haiti, while not a major coffee producer, disrupted coffee exports and led to a spike in prices. More recently, hurricanes in Central America have damaged coffee crops and infrastructure, contributing to supply concerns and price increases.

Long-term global trends, such as urbanization and the growth of the middle class in emerging markets, also play a role in shaping coffee demand and, by extension, prices. The growing café culture in traditionally tea-drinking countries like China and India represents a significant potential source of demand growth, which could put upward pressure on prices in the coming years.

4. The Economics of Coffee Pricing

4.1 Microeconomic Factors

At the microeconomic level, coffee pricing is influenced by a variety of factors related to individual consumer behavior and market competition. Consumer preferences play a crucial role in shaping demand for different types of coffee. In recent years, there has been a growing trend towards specialty and premium coffees, with consumers willing to pay higher prices for unique flavor profiles, specific origins, or certifications such as Fair Trade or Organic.

This shift in consumer preferences has led to increased market segmentation, with a clear distinction between the commodity coffee market and the specialty coffee market. In the specialty market, factors such as bean quality, processing method, and even the story behind the coffee can significantly impact pricing. This has created opportunities for coffee producers to differentiate their products and potentially earn higher prices, but it also requires investment in quality improvement and marketing.

Market competition also plays a crucial role in coffee pricing at the retail level. The coffee industry is characterized by a mix of large multinational corporations and smaller independent roasters and cafés. Large companies like Starbucks, Nestlé, and JAB Holding Company have significant market power and can influence pricing trends. However, the rise of specialty coffee has also created space for smaller players to compete on quality and uniqueness rather than price alone.

The proliferation of coffee shops and the growth of the ready-to-drink coffee market have also influenced pricing dynamics. These trends have expanded the ways in which consumers engage with coffee, creating new pricing models and competitive landscapes. For instance, the success of premium-priced coffee drinks in cafés has demonstrated consumers' willingness to pay for convenience and experience, not just the coffee itself.

4.2 Macroeconomic Impacts

Coffee pricing is deeply intertwined with broader macroeconomic factors. As a globally traded commodity, coffee prices are influenced by overall economic conditions, including GDP growth, inflation rates, and employment levels in major consuming countries. During economic downturns, consumers may cut back on discretionary spending, potentially reducing demand for premium coffees or out-of-home coffee consumption.

Inflation can impact coffee prices in multiple ways. In coffee-producing countries, inflation can increase production costs, potentially leading to higher coffee prices. In consuming countries, inflation can affect consumers' purchasing power and their willingness to pay for coffee. Moreover, as coffee is often seen as an inflation hedge by investors, expectations of inflation can drive speculative activity in coffee futures markets.

Exchange rates, as mentioned earlier, play a significant role in coffee pricing. The strength or weakness of the US dollar relative to the currencies of major coffee-producing countries can have substantial impacts on the global coffee trade. A strong dollar can make coffee more expensive for non-US buyers, potentially dampening demand, while a weak dollar can have the opposite effect.

Interest rates also influence coffee pricing, particularly through their impact on inventory holding costs and futures market activity. Low interest rates can make it cheaper to hold coffee inventories, potentially increasing demand and prices. They can also encourage speculative activity in futures markets, potentially increasing price volatility.

4.3 The Role of International Organizations

Several international organizations play important roles in the coffee industry, influencing pricing dynamics and market structures. The International Coffee Organization (ICO), an intergovernmental organization representing both coffee-exporting and importing countries, is perhaps the most prominent. The ICO provides a forum for consultation on coffee matters, promotes market transparency through the collection and dissemination of coffee statistics, and works to promote a sustainable coffee economy.

While the ICO no longer directly intervenes in coffee markets as it did under the International Coffee Agreements of the 20th century, its activities can still influence coffee pricing. For instance, its efforts to promote sustainability and quality in the coffee sector can impact production practices and costs. The ICO's market reports and forecasts are also closely watched by industry participants and can influence market sentiment.

Other organizations, such as the Specialty Coffee Association (SCA) and various certification bodies like Fair Trade International and the Rainforest Alliance, also play important roles. These organizations set standards for coffee quality and sustainable production practices, which can impact production costs and the premiums that certified coffees can command in the market.

Development organizations and NGOs are also increasingly active in the coffee sector, often working to improve the livelihoods of coffee farmers and promote sustainable production practices. While these efforts may increase production costs in the short term, they aim to create a more sustainable and equitable coffee industry in the long run, which could help stabilize prices and ensure future coffee supply.

5. Future Projections in Coffee Pricing

5.1 Projected Market Trends

Looking to the future, several trends are likely to shape coffee pricing in the coming years. Climate change remains a significant concern, with the potential to reduce suitable land for coffee cultivation and increase production volatility. This could lead to upward pressure on prices, particularly for high-quality Arabica coffees grown in specific regions.

The continued growth of the specialty coffee market is likely to further segment the coffee industry, with increasing price differentiation between commodity and specialty coffees. This trend could provide opportunities for farmers to earn higher prices for high-quality beans, but may also increase price volatility in niche markets.

Demographic shifts in major consuming countries, including aging populations in some markets and the rise of millennial and Gen Z consumers with different consumption habits, are likely to impact demand patterns. The continued growth of coffee consumption in emerging markets, particularly in Asia, could also significantly influence global demand and pricing trends.

On the supply side, there's increasing focus on the need for substantial investment in coffee-producing regions to improve productivity and adapt to climate change. The success of these efforts will play a crucial role in determining future coffee supply and, by extension, prices.

5.2 Innovations in Coffee Production

Technological innovations in coffee production could have significant impacts on future coffee pricing. Advances in agricultural technology, including precision farming techniques and drought-resistant coffee varieties, have the potential to increase yields and reduce production costs. For instance, World Coffee Research, an industry-funded agricultural R\&D organization, is working on developing coffee varieties that are more resilient to climate change and diseases.

Blockchain technology is being explored as a way to increase transparency in the coffee supply chain, potentially allowing for better traceability and fairer pricing. Some companies are already implementing blockchain solutions to track coffee from farm to cup, providing consumers with detailed information about their coffee's origin and potentially justifying premium prices.

Innovations in processing techniques, such as anaerobic fermentation, are creating new flavor profiles and allowing producers to differentiate their coffees further. These novel processing methods often command higher prices, potentially offering a way for farmers to increase their income.

5.3 Consumer Trends and Preferences

Evolving consumer preferences will continue to play a crucial role in shaping coffee pricing. The trend towards premiumization in the coffee market shows no signs of slowing, with consumers increasingly willing to pay higher prices for high-quality, sustainably sourced coffees. This trend is likely to continue driving price differentiation in the market.

Sustainability is becoming an increasingly important factor for many coffee consumers. This focus on sustainability extends beyond environmental concerns to include social and economic sustainability for coffee-producing communities. As consumers become more aware of the challenges facing coffee farmers, there may be increased willingness to pay prices that ensure a living income for producers.

The rise of ready-to-drink and cold brew coffees represents another important trend. These products often command higher prices than traditional roasted coffee, potentially shifting value along the supply chain. The success of these products could influence broader coffee pricing trends and impact demand for different types of coffee beans.

Health and wellness trends are also influencing coffee consumption patterns. While coffee is increasingly recognized for its potential health benefits, there's also growing interest in low-caffeine options and coffee alternatives. These trends could impact demand for different types of coffee and influence pricing dynamics.

Conclusion

The determination of coffee prices is a complex and dynamic process, influenced by a myriad of interconnected factors. From the fundamental forces of supply and demand to the impacts of climate change and evolving consumer preferences, the coffee market is shaped by a diverse array of global forces.

Understanding these factors is crucial not just for those directly involved in the coffee industry, but for anyone interested in global economics and sustainable development. Coffee, as one of the world's most traded commodities, serves as a microcosm of broader economic trends and challenges.

As we look to the future, it's clear that the coffee industry faces significant challenges, particularly in terms of ensuring sustainable production in the face of climate change and providing fair livelihoods for coffee farmers. However, these challenges also present opportunities for innovation and positive change.

The coffee market of the future is likely to be characterized by greater differentiation, increased emphasis on quality and sustainability, and potentially higher prices to support necessary investments in producing regions. For consumers, this may mean higher prices for their daily cup, but also greater choice, quality, and the knowledge that their purchase is supporting a more sustainable and equitable coffee industry.

In conclusion, the story of coffee pricing is far more than a tale of numbers and market forces. It's a narrative that encompasses global trade, agricultural science, consumer culture, and sustainable development. As we sip our morning brew, we're participating in a global economic system that connects us to farmers, traders, and consumers around the world. Understanding how coffee prices are determined gives us valuable insights into this system and our place within it.

References

- International Coffee Organization. (2021). "Coffee Market Report – December 2021." Retrieved from https://www.ico.org/

- Specialty Coffee Association. (2022). "Coffee Market Size & Impact Report." Retrieved from https://sca.coffee/

- World Coffee Research. (2023). "Annual Report 2022." Retrieved from https://worldcoffeeresearch.org/

- Samper, L. F., Giovannucci, D., & Vieira, L. M. (2017). "The powerful role of intangibles in the coffee value chain." WIPO Economic Research Working Paper No. 39.

- Sachs, J., Cordes, K. Y., Rising, J., Toledano, P., & Maennling, N. (2019). "Ensuring Economic Viability and Sustainability of Coffee Production." Columbia Center on Sustainable Investment.

- Panhuysen, S. and Pierrot, J. (2022). "Coffee Barometer 2022." Conservation International, Ethos Agriculture, Hivos, Oxfam Belgium and Solidaridad.

- Hernandez-Aguilera, J. N., et al. (2018). "The impact of microlots on farmers' livelihood assets: Evidence from Colombia's coffee sector." World Development, 111, 152-166.

- Bacon, C. M., et al. (2014). "Explaining the 'hungry farmer paradox': Smallholders and fair trade cooperatives navigate seasonality and change in Nicaragua's corn and coffee markets." Global Environmental Change, 25, 133-149.

- Ponte, S. (2002). "The 'Latte Revolution'? Regulation, Markets and Consumption in the Global Coffee Chain." World Development, 30(7), 1099-1122.

- Daviron, B., & Ponte, S. (2005). "The Coffee Paradox: Global Markets, Commodity Trade and the Elusive Promise of Development." Zed Books.