From Auction to Market How Coffee is Traded Worldwide

Coffee trading is more than just a transaction; it's a global phenomenon that affects millions of livelihoods worldwide. From farmers in Brazil to roasters in Italy, every cup of coffee traded represents a complex journey through various market dynamics. Understanding this journey means exploring the nuances of the global coffee market, from the classification of coffee beans like Arabica and Robusta to the auction systems that influence pricing. This article offers a comprehensive guide to coffee trading - detailing everything from cultivation techniques and processing methods to trading platforms and sustainability issues. Discover how price volatility can impact the industry and gain insights into best practices for aspiring coffee traders. Join us as we navigate the rich world of coffee trading and uncover what lies ahead for this beloved beverage.

Coffee, a beverage cherished by millions worldwide, undergoes a complex journey from farm to cup. This intricate process involves a multitude of stakeholders, sophisticated trading mechanisms, and a global market that spans continents. In this comprehensive guide, we'll delve deep into the world of coffee trading, exploring its nuances, challenges, and the innovative practices shaping its future.

Introduction

The global coffee trade is a multi-billion dollar industry that impacts the livelihoods of over 25 million farmers worldwide. From the misty highlands of Ethiopia to the bustling ports of Brazil, coffee's journey is a testament to human ingenuity and the power of global commerce. The coffee trading process has evolved significantly since its inception in the 15th century, adapting to technological advancements, changing consumer preferences, and global economic shifts.

Today, coffee stands as the second most traded commodity after oil, highlighting its immense economic significance. The intricate web of relationships between farmers, exporters, importers, roasters, and retailers forms the backbone of this industry, each playing a crucial role in bringing this beloved beverage to consumers worldwide. As we embark on this exploration of coffee trading, we'll uncover the mechanisms that drive this global market and the factors that influence its dynamics.

Section 1: The Global Coffee Market

1.1 Understanding Coffee as a Commodity

Coffee, in its raw form, is classified as a soft commodity – a term used for agricultural products that are grown rather than mined. This classification places coffee alongside other tradable agricultural goods like cocoa, sugar, and cotton. However, coffee's unique characteristics set it apart in the commodity market.

The two primary species of coffee traded globally are Arabica and Robusta. Arabica, known for its smooth, complex flavor profile, accounts for about 60-70% of global production. It's typically grown at higher altitudes and commands a premium price in the market. Robusta, on the other hand, is hardier, contains more caffeine, and is often used in espresso blends and instant coffee. The distinct characteristics of these species significantly influence their market value and trading patterns.

Coffee's position in the global market is unique due to its widespread consumption and cultural significance. Unlike many commodities that are primarily industrial inputs, coffee is a consumer product with direct emotional and social connections. This dual nature as both a commodity and a consumer good adds layers of complexity to its trading process, influenced not just by supply and demand but also by factors like consumer trends, lifestyle changes, and even geopolitical events.

1.2 Market Size and Scope

The global coffee market is a behemoth, with an estimated value of over $465 billion as of 2020, and projections suggest it could reach $645 billion by 2027. This growth is driven by increasing coffee consumption worldwide, particularly in emerging markets like China and India, where coffee culture is rapidly gaining popularity.

In terms of production, Brazil leads the pack, producing approximately 50-60 million bags (60 kg each) annually, followed by Vietnam and Colombia. These three countries account for over 50% of global coffee production. On the consumption side, the European Union, United States, and Brazil are the top consumers, with the average EU citizen drinking about 5 kg of coffee per year.

Interestingly, while production is concentrated in the "Coffee Belt" – regions between the Tropics of Cancer and Capricorn – consumption is highest in developed countries outside this zone. This geographical disparity forms the basis of the global coffee trade, necessitating complex logistics and trading mechanisms to bridge the gap between producers and consumers.

Recent trends show a growing preference for specialty and premium coffees, particularly among younger consumers. This shift has led to the emergence of micro-lots and direct trade relationships, adding new dimensions to the traditional coffee trading landscape.

1.3 Market Participants

The coffee trade involves a diverse array of participants, each playing a crucial role in the journey from seed to cup. At the foundation are the farmers, numbering in the millions, who cultivate and harvest coffee cherries. These farmers range from small-scale producers managing a few hectares to large estates spanning hundreds of acres.

Exporters play a pivotal role in aggregating coffee from various farmers, processing it, and preparing it for international shipment. They often act as a bridge between local producers and the global market, handling quality control, packaging, and export documentation.

Importers, typically based in consuming countries, purchase coffee from exporters and distribute it to roasters. They often specialize in sourcing specific types or origins of coffee and may provide financing and risk management services to their suppliers.

Roasters transform the green coffee beans into the aromatic product consumers recognize. They range from small artisanal operations to multinational corporations. Roasters often blend different coffees to create consistent flavor profiles and are increasingly engaging in direct trade relationships with producers.

Retailers, including cafes, supermarkets, and online platforms, represent the final link in the chain, bringing coffee to consumers. The rise of specialty coffee shops has created a new category of market participants who often have direct relationships with roasters and sometimes even producers.

Additionally, there are numerous supporting players in the coffee trade ecosystem. These include quality graders (or Q-graders) who assess coffee quality, logistics providers specializing in coffee transportation, financial institutions providing trade finance, and various associations and NGOs working to improve sustainability and fairness in the coffee trade.

Understanding the roles and interactions of these diverse participants is crucial for anyone looking to engage in or understand the coffee trade process. Each plays a part in shaping the market dynamics, influencing prices, and ultimately determining the quality and variety of coffee available to consumers worldwide.

Section 2: Coffee Trade Process

2.1 Cultivation to Harvesting

The journey of coffee from seed to cup begins with cultivation, a process that requires patience, expertise, and favorable environmental conditions. Coffee plants are typically grown from seeds in nurseries for about 6-12 months before being transplanted to fields. The plants take 3-4 years to bear fruit, known as coffee cherries.

The cultivation process is labor-intensive and highly dependent on climate conditions. Coffee thrives in tropical and subtropical regions with well-defined rainy and dry seasons. Altitude plays a crucial role, particularly for Arabica coffee, which is typically grown at elevations between 600-2000 meters above sea level. This high-altitude cultivation contributes to the development of complex flavors and higher acidity in the beans.

Soil quality is another critical factor. Coffee plants prefer slightly acidic soil rich in organic matter. Many coffee farms practice intercropping, growing coffee alongside other plants like bananas or macadamia trees, which provide shade and help maintain soil health.

The harvesting process is equally crucial and labor-intensive. In most regions, coffee cherries are hand-picked to ensure only ripe cherries are harvested. This selective picking is essential for quality but adds significantly to production costs. Some large-scale farms, particularly those producing Robusta coffee, may use mechanical harvesting methods.

The timing of the harvest is critical and varies by region. In countries straddling the equator, like Kenya and Colombia, there may be two harvesting seasons per year. In contrast, countries further from the equator typically have one main harvest season.

The quality of the harvest significantly impacts the final product. Factors such as the ripeness of cherries at picking, the speed at which they are processed after harvesting, and the care taken to prevent damage all play crucial roles in determining the coffee's potential quality and, consequently, its market value.

2.2 Processing Methods

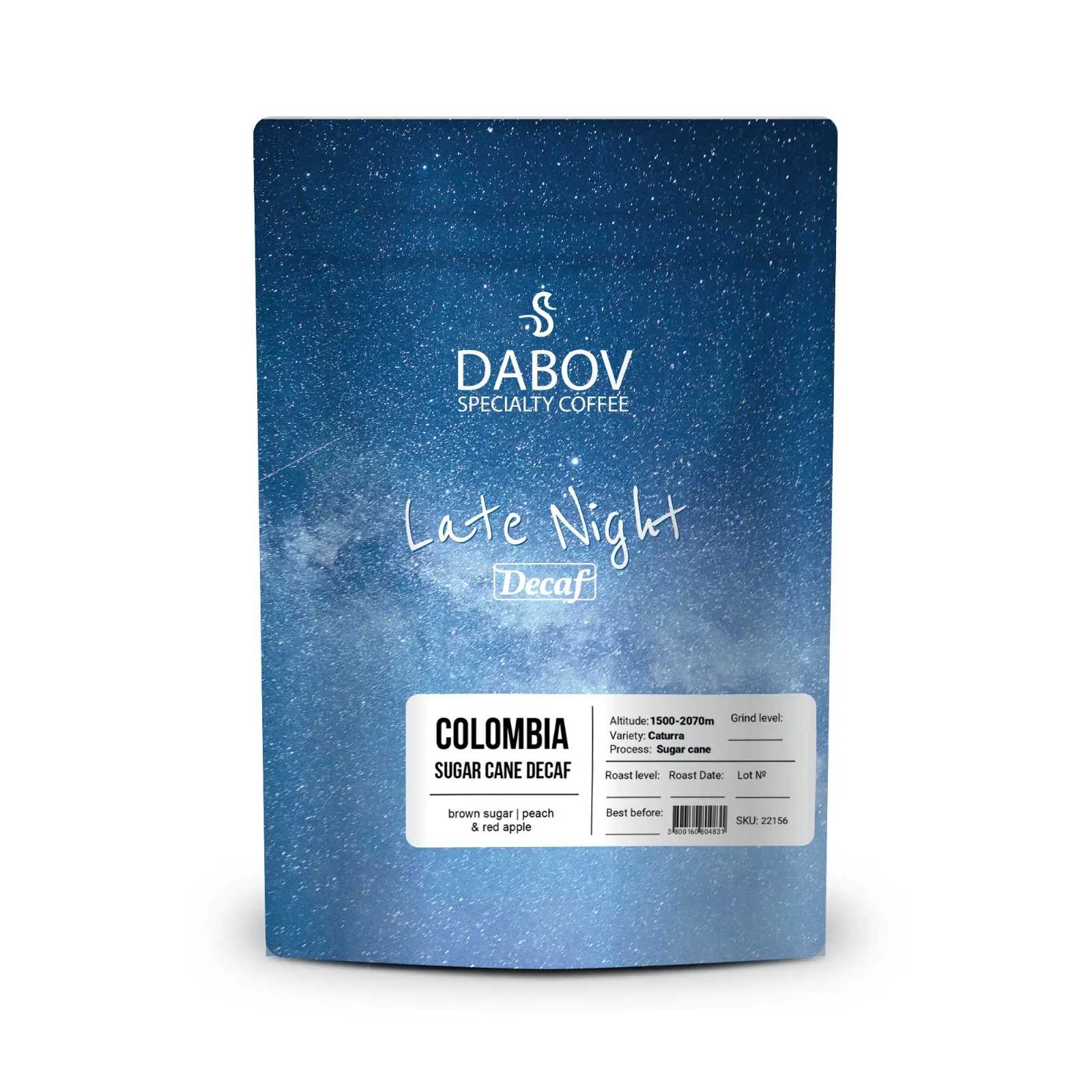

After harvesting, coffee cherries undergo processing to extract the beans. The method of processing significantly influences the flavor profile of the coffee and its market value. There are three primary processing methods: washed (or wet), natural (or dry), and honey-processed.

The washed process involves removing the cherry's outer skin and pulp before fermentation. The beans, still covered in a thin layer of mucilage, are then fermented in water tanks for 12-36 hours. After fermentation, the mucilage is washed off, and the beans are dried. This method typically results in coffee with higher acidity, cleaner flavors, and a lighter body. It's the most common method for high-quality Arabica coffees and is preferred in regions with reliable water sources.

The natural process, the oldest method, involves drying the whole coffee cherry with the bean inside. The cherries are spread out on patios or raised beds and regularly turned to ensure even drying. This process can take up to four weeks, depending on climate conditions. Natural processed coffees often have a fuller body, lower acidity, and more complex, fruity flavors. This method is common in regions with water scarcity and is often used for Robusta coffees.

The honey process is a hybrid method where the cherry's skin is removed, but some or all of the mucilage is left on the bean during drying. The amount of mucilage left on determines whether it's a white, yellow, red, or black honey process. This method results in coffees with a balance of acidity and body, often with heightened sweetness.

The choice of processing method depends on various factors, including local climate, water availability, tradition, and market demand. Each method requires specific expertise and infrastructure, influencing the overall cost of production. The processing method is a key factor in determining the coffee's flavor profile and, consequently, its market positioning and price.

2.3 Auctions: The Gateway to Global Trade

Coffee auctions play a pivotal role in the global coffee trade, serving as a crucial link between producers and the international market. These auctions, which can be physical or increasingly digital, provide a platform for buyers to assess and bid on coffee lots from various producers.

One of the most renowned coffee auctions is the Kenya Coffee Auction, held weekly in Nairobi. This auction sets the benchmark for East African coffee prices and is known for its transparent and competitive bidding process. Similarly, the Cup of Excellence auctions, held in several producing countries, have gained prominence for showcasing and selling some of the world's highest-quality coffees.

The auction process typically begins with the submission of coffee samples by producers or cooperatives. These samples are cupped (tasted) and graded by expert panels. The grading process considers factors such as bean size, density, moisture content, and cup quality. Once graded, the coffees are cataloged and made available for potential buyers to sample before the auction.

During the auction, lots are sold to the highest bidder. The auction price is influenced by various factors, including the coffee's quality score, origin, processing method, and current market conditions. For specialty coffees, particularly those sold through programs like the Cup of Excellence, prices can reach extraordinary levels, sometimes exceeding $100 per pound.

Auctions serve multiple purposes in the coffee trade ecosystem. They provide a mechanism for price discovery, helping to establish fair market values for different coffee qualities and origins. They also offer smaller producers an opportunity to showcase their coffees to a global audience, potentially commanding premium prices for exceptional lots.

Moreover, auctions contribute to transparency in the coffee supply chain. The open bidding process and published results provide valuable market information to all stakeholders, from farmers to roasters. This transparency can help in building trust and fostering long-term relationships between producers and buyers.

2.4 Transition from Auction to Market

The journey of coffee from auction to the broader market involves several crucial steps and considerations. Once a lot is sold at auction, the buyer (often an importer or large roaster) must arrange for its transportation, storage, and eventual distribution or use.

The logistics of moving coffee from origin to destination markets is a complex process. Coffee is typically shipped in jute or sisal bags, each containing 60-70 kg of green beans. These bags are loaded into shipping containers, with each container holding about 250-300 bags. The coffee must be kept dry and protected from temperature fluctuations during transit to maintain its quality.

The price paid at auction forms the basis for the coffee's market price, but several factors can influence its final cost to roasters and consumers. These include transportation costs, import duties, storage fees, and any additional certifications or verifications required by buyers or regulatory bodies.

Currency exchange rates play a significant role in this transition, as coffee is typically traded in US dollars. Fluctuations in exchange rates can impact the final cost of coffee and influence trading decisions.

As the coffee moves through the supply chain, each intermediary adds their margin, contributing to the final market price. Importers, for instance, take on the risk and cost of storing and financing large quantities of coffee, which is reflected in their selling price to roasters.

The transition from auction to market also involves quality control measures. Samples from each lot are often re-cupped at various stages to ensure the coffee maintains its expected quality. Any discrepancies can lead to price adjustments or even rejection of the shipment.

For specialty coffees, particularly those purchased through direct trade relationships or exclusive auctions, the transition may be more streamlined. These coffees often command a premium price and may be marketed with specific information about their origin, producer, and unique characteristics.

Understanding this transition is crucial for all participants in the coffee trade. It highlights the complexities involved in bringing coffee from producing regions to consuming markets and underscores the importance of efficient supply chain management in maintaining coffee quality and managing costs.

Section 3: Trading Platforms and Market Transactions

3.1 Types of Coffee Trading

Coffee trading occurs through two primary mechanisms: spot trading and futures trading. Each serves different purposes and caters to different market participants.

Spot trading involves the immediate purchase and sale of physical coffee. In these transactions, the coffee is available for immediate delivery, or within a very short timeframe. Spot trading is common among roasters purchasing coffee for immediate use, and it allows for greater flexibility in terms of quantity and specific coffee characteristics. Prices in spot markets can be more volatile, reflecting immediate supply and demand conditions.

Futures trading, on the other hand, involves contracts for the delivery of a standard quantity and quality of coffee at a specified future date. The two main futures contracts for coffee are traded on the Intercontinental Exchange (ICE): the "C" contract for Arabica coffee and the "RC" contract for Robusta. These futures contracts serve several purposes in the coffee market.

Firstly, futures provide a mechanism for price discovery, helping to establish benchmark prices for coffee. Secondly, they offer a tool for hedging against price volatility. Producers can sell futures contracts to lock in prices for their future production, while buyers can purchase futures to secure prices for their future needs. This helps both parties manage their risk exposure to price fluctuations.

Futures trading also attracts speculators who aim to profit from price movements without any intention of taking physical delivery of coffee. While speculation can increase market liquidity, it can also contribute to price volatility.

The interplay between spot and futures markets is complex. Futures prices influence spot prices and vice versa. For instance, if futures prices are significantly higher than current spot prices, it may incentivize producers to hold onto their stocks, expecting higher prices in the future. Conversely, if futures prices are lower, it might encourage increased selling in the spot market.

Understanding the dynamics of both spot and futures trading is crucial for anyone involved in the coffee trade. It requires a keen understanding of market fundamentals, technical analysis skills, and often, access to real-time market information.

3.2 Role of Exchanges

Coffee exchanges play a central role in facilitating global coffee trade. The most prominent of these is the Intercontinental Exchange (ICE), which operates the New York and London coffee futures markets. These exchanges provide standardized contracts, clearing services, and a centralized platform for price discovery.

The ICE Coffee "C" contract, traded in New York, is the benchmark for Arabica coffee worldwide. Each contract represents 37,500 pounds of washed Arabica coffee from one of several approved origins. The London market, trading Robusta futures, plays a similar role for that variety of coffee.

Exchanges contribute to market efficiency in several ways. They provide transparency by publishing prices and trading volumes in real-time. This information is crucial for all market participants in making informed decisions. Exchanges also ensure the integrity of trades through their clearing houses, which act as intermediaries between buyers and sellers, guaranteeing the performance of contracts.

Moreover, exchanges set and enforce standards for the coffee traded through their contracts. This includes specifications for quality, delivery procedures, and contract terms. These standards help to create a level playing field and reduce the risk of disputes.

For smaller producers or buyers who may not have direct access to these exchanges, local exchanges or auction systems often serve as intermediaries. These local platforms may have linkages to international exchanges, helping to integrate local markets with global price trends.

Understanding how exchanges operate and interpreting the information they provide is crucial for anyone involved in coffee trading. Prices on these exchanges serve as reference points for many coffee transactions, even those conducted outside the exchange.

3.3 Digital Transformation of Coffee Trade

The coffee industry, like many others, is undergoing a digital transformation that is reshaping how coffee is traded. This transformation is driven by advancements in technology, changing consumer preferences, and a growing demand for transparency in the supply chain.

One of the most significant developments is the emergence of online trading platforms. These platforms connect buyers and sellers directly, often bypassing traditional intermediaries. They can range from simple marketplaces to sophisticated systems that integrate quality control, logistics, and financial services. For example, platforms like Algrano and Cropster allow roasters to source coffee directly from producers, providing detailed information about the coffee's origin, processing method, and cupping scores.

Blockchain technology is another innovation making waves in coffee trading. By creating an immutable record of each transaction in the supply chain, blockchain can enhance traceability and transparency. This is particularly valuable in the specialty coffee market, where consumers are increasingly interested in the story behind their coffee. Companies like Bext360 are using blockchain in combination with AI and IoT devices to create verifiable records of coffee transactions from farm to cup.

Mobile apps are also playing an increasingly important role, particularly in producing countries. Apps can provide farmers with real-time market information, weather forecasts, and agronomic advice. Some apps even facilitate mobile payments, addressing the challenge of financial inclusion in rural coffee-growing regions.

The rise of data analytics is another aspect of this digital transformation. Advanced analytics tools can help traders make more informed decisions by analyzing vast amounts of data on weather patterns, crop yields, market trends, and consumer preferences.

These technological advancements are not without challenges. Issues of digital literacy, internet connectivity in rural areas, and the cost of implementing new systems are significant hurdles. However, the potential benefits in terms of efficiency, transparency, and market access are driving continued innovation and adoption of digital tools in coffee trading.

As the coffee industry continues to embrace digital transformation, it's likely to see further disintermediation, increased price transparency, and more direct relationships between producers and consumers. This evolution presents both opportunities and challenges for traditional players in the coffee trade, necessitating adaptation to remain competitive in an increasingly digital marketplace.

Section 4: Challenges in the Coffee Trade Process

4.1 Price Volatility

Price volatility is one of the most significant challenges in the coffee trade. Coffee prices can fluctuate dramatically due to a variety of factors, creating uncertainty for all participants in the supply chain.

One of the primary drivers of price volatility is weather conditions in major producing regions. Coffee plants are sensitive to temperature and rainfall, and extreme weather events can significantly impact crop yields. For instance, a frost in Brazil, the world's largest coffee producer, can send global prices soaring as supply tightens.

Global economic conditions also play a crucial role in coffee price volatility. As coffee is traded in US dollars, fluctuations in currency exchange rates can have a significant impact on prices. Economic downturns can affect consumer demand, particularly for higher-priced specialty coffees, influencing prices throughout the supply chain.

Political instability in producing countries can disrupt coffee production and exports, leading to supply shortages and price spikes. Similarly, changes in trade policies, such as the imposition or removal of tariffs, can quickly alter the dynamics of the global coffee market.

Speculation in the futures market can amplify price movements. While futures trading provides necessary liquidity and risk management tools, excessive speculation can lead to price swings that don't reflect fundamental supply and demand conditions.

The impact of price volatility is felt differently across the supply chain. For farmers, who often have the least capacity to absorb market shocks, extreme price fluctuations can be devastating. In some cases, the market price may fall below the cost of production, threatening livelihoods and the sustainability of coffee farming.

Roasters and retailers face challenges in maintaining consistent pricing for consumers while dealing with fluctuating input costs. This often leads to a lag between changes in green coffee prices and retail prices, compressing margins during periods of rising costs.

Various strategies are employed to manage price volatility. Futures contracts and other financial instruments are used for hedging. Diversification, both in terms of coffee origins and business activities, can help spread risk. Some companies engage in long-term contracts or price guarantees with producers to provide more stability.

Efforts are also being made at an industry level to address price volatility. These include initiatives to improve market information systems, develop more resilient coffee varieties, and create alternative pricing models that better reflect the cost of sustainable production.

Understanding and managing price volatility is crucial for anyone involved in coffee trading. It requires a combination of market knowledge, risk management skills, and often, a long-term perspective on the coffee business.

4.2 Sustainability Issues

Sustainability has become a critical issue in the coffee trade, encompassing environmental, social, and economic concerns. As consumers become more conscious of the impact of their purchasing decisions, the coffee industry is under increasing pressure to address sustainability challenges throughout the supply chain.

Environmental sustainability is a major concern. Coffee cultivation, particularly sun-grown coffee, can contribute to deforestation and loss of biodiversity. Climate change poses an existential threat to coffee production, with some estimates suggesting that up to 50% of the land currently used for coffee cultivation may become unsuitable by 2050. Water usage in coffee processing is another environmental concern, particularly in regions facing water scarcity.

Social sustainability issues include labor conditions on coffee farms, gender inequality, and the economic vulnerability of small-scale farmers. Many coffee farmers live below the poverty line, and younger generations are increasingly abandoning coffee farming for more lucrative opportunities, threatening the long-term viability of coffee production in some regions.

Economic sustainability is closely tied to these social issues. The volatility of coffee prices, combined with increasing production costs and the impacts of climate change, makes it difficult for many farmers to earn a stable, living income from coffee production.

In response to these challenges, various sustainability initiatives have emerged. Certification schemes like Fairtrade, Rainforest Alliance, and Organic aim to ensure that coffee is produced according to certain environmental and social standards. These certifications often provide price premiums to farmers, although the impact and effectiveness of such schemes are subjects of ongoing debate.

Direct trade relationships, where roasters work directly with producers, have gained popularity as a way to ensure fair prices and promote sustainable practices. These relationships often involve long-term commitments and investments in improving farm productivity and quality.

Industry-wide initiatives are also addressing sustainability issues. The Sustainable Coffee Challenge, launched in 2015, brings together companies, governments, and NGOs to make coffee the world's first sustainable agricultural product. Similarly, World Coffee Research is working on developing more resilient coffee varieties and improving farming practices to address the challenges posed by climate change.

Technology is playing an increasing role in promoting sustainability. Blockchain and other traceability solutions are being used to verify sustainable practices and provide transparency to consumers. Precision agriculture techniques, using data from satellites and sensors, are helping farmers optimize resource use and improve yields.

Despite these efforts, significant challenges remain. The cost of implementing sustainable practices often falls disproportionately on farmers, many of whom lack the resources to make necessary investments. There's also a need for greater coordination among various sustainability initiatives to avoid duplication and maximize impact.

Addressing sustainability issues in the coffee trade requires a holistic approach, considering the entire supply chain and involving all stakeholders. It necessitates long-term thinking and often, a reconsideration of traditional business models. As sustainability becomes increasingly central to consumer choices and corporate strategies, it's likely to be a key driver of innovation and change in the coffee industry in the coming years.

Section 5: A Comprehensive Coffee Market Guide

5.1 Tips for Coffee Traders

Navigating the complex world of coffee trading requires a combination of market knowledge, relationship-building skills, and strategic thinking. Here are some key tips for those looking to engage in coffee trading:

- Develop a deep understanding of coffee: Beyond market dynamics, it's crucial to understand the product itself. This includes knowledge of different coffee varieties, processing methods, and how these factors influence quality and price. Developing cupping skills can be invaluable in assessing coffee quality.

- Stay informed about market conditions: Keep abreast of factors that can influence coffee prices, including weather conditions in major producing regions, political developments, and global economic trends. Subscribe to industry publications and market reports to stay updated.

- Build strong relationships: The coffee industry is built on relationships. Cultivate connections with producers, exporters, importers, and roasters. Attend industry events and trade shows to network and stay current on industry trends.

- Understand risk management: Given the volatility of coffee prices, understanding and utilizing risk management tools is crucial. This includes knowledge of futures and options markets, hedging strategies, and contract negotiations.

- Embrace technology: Utilize digital platforms for trading, market analysis, and supply chain management. Stay informed about technological developments that could impact the industry, such as blockchain for traceability or AI for price prediction.

- Focus on quality control: Implement rigorous quality control measures. This includes proper sampling techniques, cupping protocols, and understanding how to interpret coffee grading systems from different origins.

- Consider sustainability: With increasing focus on sustainable and ethical sourcing, consider how to incorporate sustainability into your trading practices. This could involve working with certified coffees or developing direct trade relationships.

- Understand logistics: Coffee trading involves complex logistics. Familiarize yourself with shipping terms, import/export regulations, and best practices for coffee storage and transportation.

- Develop a niche: The coffee market is diverse, ranging from commodity-grade to ultra-premium specialty coffees. Consider specializing in a particular segment or origin to differentiate yourself in the market.

- Continual learning: The coffee industry is constantly evolving. Commit to ongoing education, whether through formal courses, industry certifications, or self-study.

- Practice patience: Building a successful coffee trading business takes time. Be prepared for a learning curve and don't be discouraged by initial setbacks.

- Understand cultural nuances: Coffee is produced and consumed globally. Understanding cultural differences can be crucial in building relationships and negotiating deals across different countries.

By following these tips and continuously adapting to market changes, coffee traders can position themselves for success in this dynamic and rewarding industry.

5.2 Resources and Information

For those looking to deepen their knowledge of coffee trading or stay updated on market developments, there are numerous valuable resources available:

- Industry Associations:

- International Coffee Organization (ICO): Provides statistics, market reports, and information on coffee policies.

- Specialty Coffee Association (SCA): Offers education, research, and events focused on specialty coffee.

- National Coffee Associations: Many countries have their own associations providing country-specific information.

- Market Information Services:

- CoffeeNetwork: Offers real-time news and analysis on the coffee market.

- Intercontinental Exchange (ICE): Provides data on coffee futures trading.

- USDA Foreign Agricultural Service: Publishes regular reports on global coffee production and trade.

- Trade Publications:

- Perfect Daily Grind: Online magazine covering various aspects of the coffee industry.

- Global Coffee Report: Magazine focusing on the business of coffee.

- Tea & Coffee Trade Journal: Covers both tea and coffee industries.

- Books:

- "The World Atlas of Coffee" by James Hoffmann

- "Coffee: A Comprehensive Guide to the Bean, the Beverage, and the Industry" edited by Robert W. Thurston, et al.

- "The Coffee Trader's Handbook" by Nigel Rolfe

- Online Courses:

- Coffee Quality Institute (CQI): Offers Q Grader certification courses.

- SCA Coffee Skills Program: Provides various modules on coffee from beginner to professional level.

- edX and Coursera: Occasionally offer courses related to commodities trading and agricultural economics.

- Websites and Blogs:

- Daily Coffee News: Provides news and analysis on the coffee industry.

- Sprudge: Covers coffee culture, including industry news and trends.

- Coffee Research: Offers scientific information about coffee production and processing.

- Trade Shows and Conferences:

- SCA Expo: Annual event featuring exhibitions, workshops, and networking opportunities.

- World of Coffee: European coffee event organized by SCA.

- Producer & Roaster Forum: Focuses on fostering direct relationships between producers and roasters.

- Mobile Apps:

- ICO Coffee Statistics: Provides access to ICO's statistical database.

- Coffee Taster's Flavor Wheel: Useful tool for describing coffee flavors.

- Bean Conqueror: Helps track and analyze coffee tastings.

- Research Institutions:

- World Coffee Research: Conducts scientific research to improve coffee quality and sustainability.

- Coffee Center at UC Davis: Academic research center focused on coffee science.

- Social Media:

- Follow key industry figures, companies, and organizations on platforms like Twitter, LinkedIn, and Instagram for real-time updates and discussions.

These resources provide a wealth of information for anyone involved in or interested in coffee trading. Regular engagement with these sources can help traders stay informed about market trends, improve their technical knowledge, and connect with others in the industry.

Conclusion

The journey of coffee from seed to cup, facilitated by the complex mechanisms of global trade, is a testament to the interconnectedness of our world. As we've explored in this comprehensive guide, coffee trading is a multifaceted process involving numerous stakeholders, sophisticated market mechanisms, and a delicate balance of economic, environmental, and social factors.

Looking to the future, several trends are likely to shape the evolution of coffee trading:

- Increased emphasis on sustainability: As climate change threatens coffee production and consumers demand more ethical products, sustainability will become even more central to coffee trading. This may lead to new pricing models that better account for the true cost of sustainable production.

- Technological innovation: The continued integration of technologies like blockchain, AI, and IoT in coffee trading will likely increase transparency, efficiency, and traceability in the supply chain.

- Direct trade relationships: The trend towards more direct relationships between producers and roasters is likely to continue, potentially reshaping traditional supply chain structures.

- Changing consumption patterns: Emerging markets, particularly in Asia, are likely to play an increasingly important role in global coffee demand, potentially shifting trade flows and influencing price dynamics.

- Climate adaptation: As climate change impacts coffee-growing regions, there will likely be increased investment in developing climate-resilient coffee varieties and adaptation strategies.

- Market consolidation: The coffee industry may see further consolidation, with larger players acquiring smaller ones to secure supply chains and expand market share.

- Premiumization: The trend towards higher-quality, specialty coffees is likely to continue, potentially widening the price gap between commodity and specialty markets.

These trends present both challenges and opportunities for those involved in coffee trading. Success in this evolving landscape will require adaptability, a commitment to sustainability, and a willingness to embrace innovation.

In conclusion, coffee trading is more than just a commercial activity; it's a global phenomenon that connects millions of people across continents. Understanding its intricacies is crucial not only for those directly involved in the trade but for anyone interested in the complexities of global commerce and agricultural sustainability. As we sip our daily brew, we participate in this vast, intricate network – a reminder of the global stories behind one of the world's most beloved beverages.

FAQs About Coffee Trading

- Q: What determines coffee prices?A: Coffee prices are influenced by a complex interplay of factors including supply and demand, weather conditions in major producing countries, global economic trends, currency exchange rates, and speculative activity in futures markets. Quality, origin, and certifications (like organic or Fair Trade) also play a role in pricing specific lots of coffee.

- Q: How can I start trading coffee?A: Starting in coffee trading typically involves several steps: educating yourself about the coffee market, building relationships with producers or exporters, understanding quality assessment and grading systems, familiarizing yourself with import/export regulations, and developing a business plan. Many start by working for established trading companies to gain experience before venturing out on their own.

- Q: What's the difference between Arabica and Robusta coffee in terms of trading?A: Arabica and Robusta are traded in separate markets due to their different characteristics and uses. Arabica, which accounts for about 60-70% of global production, is generally considered higher quality and commands higher prices. It's traded on the New York market. Robusta, which is hardier and contains more caffeine, is traded on the London market and is typically cheaper.

- Q: How does coffee futures trading work?A: Coffee futures are standardized contracts for the delivery of a specific quantity and quality of coffee at a future date. They're primarily used for price hedging and speculation. The main futures contracts are the "C" contract for Arabica coffee traded on the Intercontinental Exchange (ICE) in New York, and the Robusta contract traded on ICE Europe in London.

- Q: What impact does climate change have on coffee trading?A: Climate change poses significant challenges to coffee production, potentially reducing suitable growing areas and increasing the prevalence of pests and diseases. This can lead to supply volatility and price increases. It's driving efforts to develop more resilient coffee varieties and sustainable farming practices, which in turn affects trading dynamics.

- Q: How do certifications like Fair Trade affect coffee trading?A: Certifications like Fair Trade, Organic, or Rainforest Alliance aim to ensure certain social, economic, or environmental standards in coffee production. They often provide price premiums and can open access to specific market segments. For traders, dealing in certified coffees requires adherence to specific standards and may involve additional documentation and auditing processes.

- Q: What role do coffee auctions play in the global market?A: Coffee auctions, such as the Kenya Coffee Auction or Cup of Excellence auctions, play a crucial role in price discovery, especially for high-quality coffees. They provide a platform for producers to showcase their coffees to a global audience and can result in significantly higher prices for exceptional lots. Auction prices often serve as benchmarks for similar coffees in private sales.

- Q: How has technology changed coffee trading?A: Technology has significantly impacted coffee trading in recent years. Online trading platforms have made it easier for buyers and sellers to connect directly. Blockchain technology is being used to enhance traceability and transparency. Data analytics tools help traders make more informed decisions, while mobile apps provide real-time market information to producers.

- Q: What are some common challenges in coffee trading?A: Common challenges include price volatility, currency fluctuations, quality inconsistencies, logistical complexities, and changing regulations. Climate change and sustainability concerns are also increasingly significant challenges. For smaller traders, access to finance and competing with larger, more established companies can be difficult.

- Q: How can I assess the quality of coffee for trading purposes?A: Coffee quality assessment typically involves both physical and sensory evaluation. Physical evaluation looks at factors like bean size, density, and defect count. Sensory evaluation, or cupping, involves brewing the coffee under standardized conditions and assessing its aroma, flavor, acidity, body, and aftertaste. Professional certifications, like the Q Grader certification, are available for those wanting to develop expert cupping skills.

These FAQs provide a starting point for understanding some of the key aspects of coffee trading. However, given the complexity and ever-changing nature of the coffee market, continuous learning and staying updated with current trends and developments is crucial for anyone involved in coffee trading.

Case Studies in Coffee Trading

To illustrate effective strategies and practices within the coffee trade process, let's examine two case studies of successful approaches in the industry: